Arthur Hayes envisioned a stablecoin independent of the fiat banking system. Ethena, inspired by his ideas, still relies on centralized systems like USDT, falling short of full decentralization.

Alexander Mardar

Trump's nominee may end Gensler's war on digital assets, but legacy Democratic appointments and banking hesitancy could challenge the pro-crypto agenda.

Mathilde Adam

Polygon investors face uncertainty as Lido exits due to adoption struggles and increased competition, while Aave considers following suit amid governance disputes.

Alexander Mardar

Nihilism and laughter rule for a generation dogged by financial inequality.

Eva Senzaj Pauram

TON's strategy of onboarding new users leverages the boom in Mini Apps, which are now trying to integrate DeFi projects.

Sasha Markevich

Arthur Hayes envisioned a stablecoin independent of the fiat banking system. Ethena, inspired by his ideas, still relies on centralized systems like USDT, falling short of full decentralization.

Alexander Mardar

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

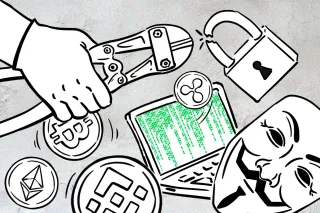

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

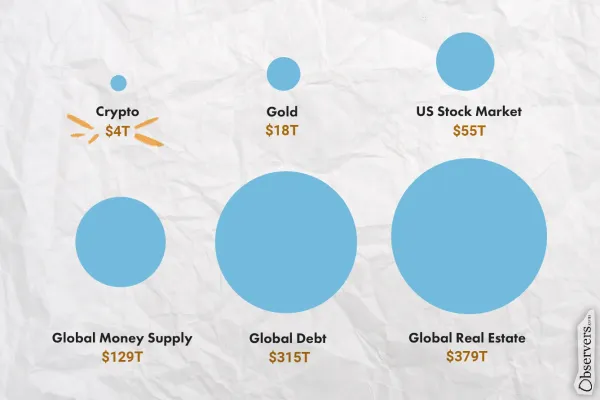

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.

Jito is about to release tokens that will more than double the project's circulating supply, a move which has investors worried about the $JTO token price.

Meme-stocks are at the root of the “move to T+1” reform in the U.S. securities market, forcing financial markets worldwide to readjust how they do business.

Eva Senzaj Pauram

As Mark Twain once quipped, “Reports of my death have been greatly exaggerated.”

Eva Senzaj Pauram

The financial giant has announced that its Tokenized Collateral Network is now live, with the first transaction taking place between BlackRock and Barclays.

Jack Martin

Forbidden in Kenya, mindlessly adopted in Chile, soon be replaced in Argentina. Local setbacks point to existential problems for the biometrical data collection project of Sam Altman.

Eva Senzaj Pauram

Offering high-speed trading, sniper bots play a vital role in the meme-coin trading game. However, they come with higher costs and security risks that users should consider.

Alexander Mardar

Kraken and other major exchanges are shifting focus to the European market as the new MiCA framework promises greatly enhanced regulatory clarity.

Sasha Markevich

Frax Finance is ready to deploy the v3 upgrade. The upgrade integrates the Federal Reserve's IORB rate and abandons the stablecoin's algorithmic component for enhanced stability.

Alexander Mardar

So much for Bitcoin being the currency of the internet. A recent report suggested that cash is accepted at more than twice as many online retailers as crypto, and the number is still growing.

Jack Martin

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.