A year-end overview of decentralized stablecoins with market caps between $50 and $500 million.

Eva Senzaj Pauram

Tether should be on the verge of delisting due to new regulations, but major exchanges are still not communicating clearly with users.

Rebecca Denton

The new update is a response to the Chainalysis leak, in which the company revealed a method for tracing some of Monero’s transactions.

Alexander Mardar

Analytics suggest that sophisticated market makers on Aerodrome DEX are behind the high trading volumes on Base.

Sasha Markevich

Polygon investors face uncertainty as Lido exits due to adoption struggles and increased competition, while Aave considers following suit amid governance disputes.

Alexander Mardar

A year-end overview of decentralized stablecoins with market caps between $50 and $500 million.

Eva Senzaj Pauram

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.

Jito is about to release tokens that will more than double the project's circulating supply, a move which has investors worried about the $JTO token price.

The CEO of Bitcoin Magazine has published documents on X (formerly Twitter) suggesting that DCG borrowed approximately $500 million from the now-bankrupt lender, Genesis. Bailey asserts that these funds were used to “manipulate and prop up the price of GBTC.”

Alexander Mardar

The recent surge in the SaaS market has led to the emergence of numerous staking providers. This article highlights the top five SaaS providers based on Assets under Management.

Alexander Mardar

The Prime Minister of Thailand was sworn in on Tuesday along with his cabinet. During the election his Pheu Thai party’s signature policy was a 10,000 baht payout to citizens via a new blockchain platform. So now comes the logistical challenge of actually keeping that promise.

Jack Martin

The Ripple vs SEC case is sadly still far from being settled. In mid-August the judge granted the SEC's request to file an interlocutory appeal, although Ripple now claims the regulator has failed to satisfy all the prerequisites necessary to justify this.

Mathilde Adam

MakerDAO, the largest decentralized stablecoin project, plans to launch its own stand-alone blockchain by potentially forking Solana. This decision, however, is meeting a mixed response from the crypto community.

Observers

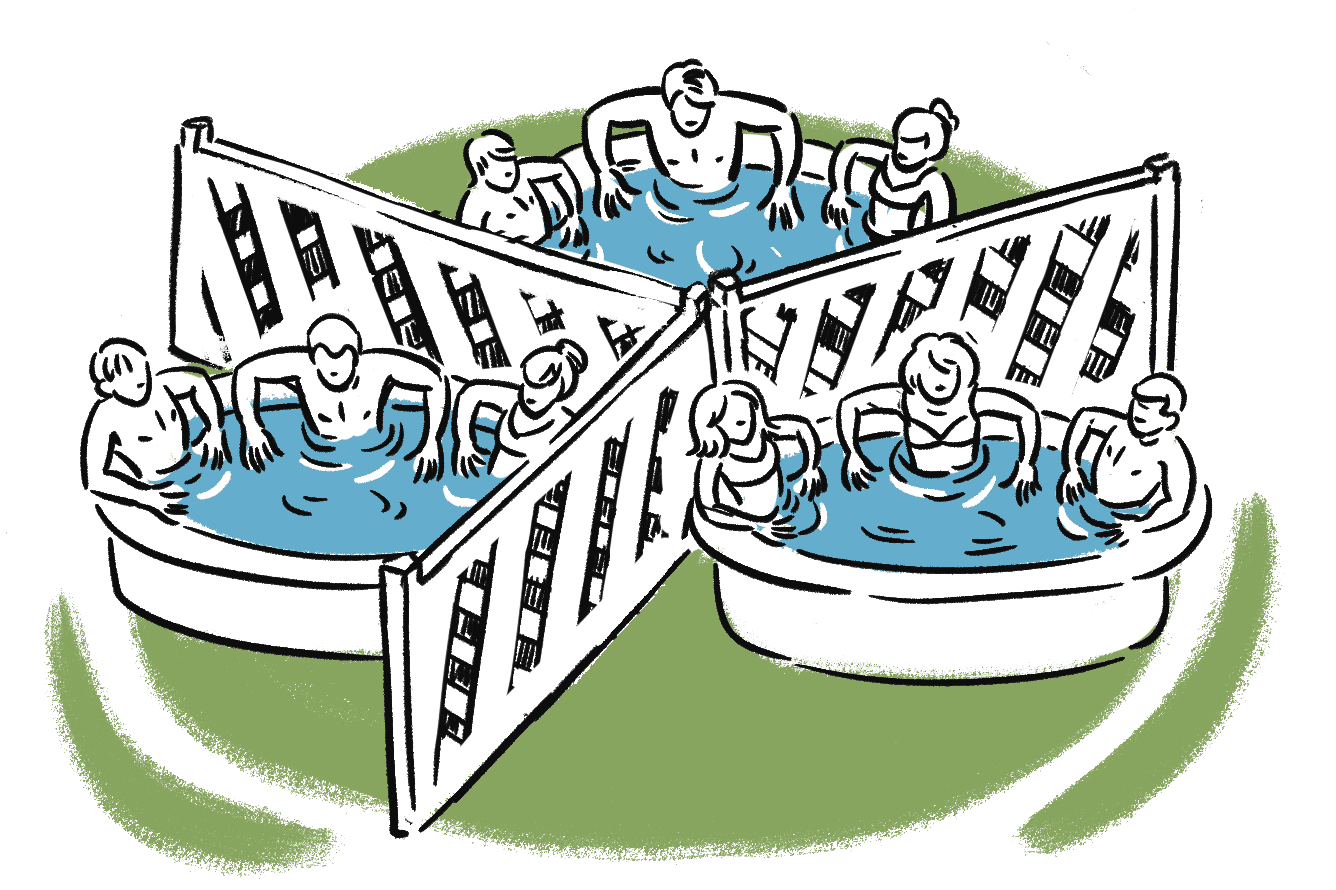

Ethereum’s founder unveils the Privacy Pools concept in a new paper. These allow users to achieve greater privacy around their financial transactions while minimising the chance of abuse by bad actors.

Alexander Mardar

The payments giant has been accepting USDC payments on Ethereum from card-issuer Crypto.com in Australia since 2021, and will now use the cheaper Solana network to settle cross-border transactions with Merchant Acquirers, Worldpay and Nuvei, which collect payments on behalf of global retailers.

Jack Martin

A new report by Henley & Partners shines a light on how cryptocurrency wealth is distributed and how to keep it safe with a Plan B in case of future regulation or prohibition.

Eva Senzaj Pauram

It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while. The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached

Happy Sunday Observers! It has been almost a year since Bitcoin spot BTFs were approved, but still, nothing excites the crypto community more than seeing the big sharks from traditional finance and international politics validate their industry. The market surged on Thursday following World Liberty Financial's crypto Christmas

Every day now, hundreds of crypto users are falling victim to scams and rug pulls that either derive from cyber attacks on unsuspecting influencers or from influencers themselves.

The National Center for Public Policy Research told Amazon: "Put 5% of Your Cash in Bitcoin". If you're expecting Amazon's board to read this and have some sort of Damascene conversion, think again.

Another U.S. state pushes for CBDCs to be banned — as a tokenization platform secures a crucial license for rolling out in the EU. Also in this issue: an overview of developments in China, Russia, and the EU central bank digital currencies.

Happy Sunday, Observers! This has been a major week for crypto, with Bitcoin finally surpassing the $100k mark following Donald Trump’s nomination of Paul Atkins as the next Chair of the Securities and Exchange Commission. The market was further energized on the day following Atkins’ appointment when Trump announced

The man who promised to "unbank" millions and created one of the worlds largest crypto lending platforms now faces up to three decades in prison after admitting to extensive market manipulation and fraud.

The imposition of martial law in South Korea on December 3rd led to an erratic market.