Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

From Polymarket’s stripped-down design to Kalshi’s regulatory breakthrough, prediction markets are turning collective opinion into a financial asset class — and a new battleground over who defines truth

Alex Harutunian

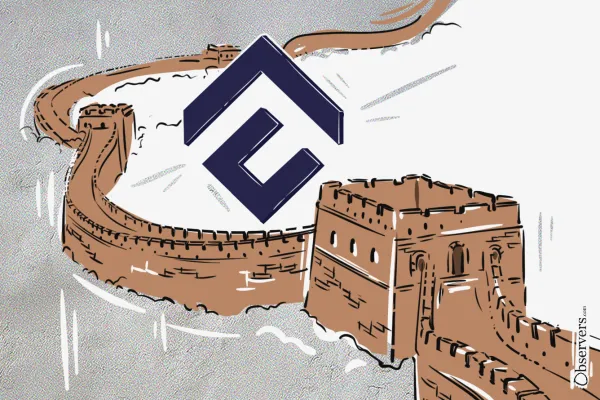

While crypto remains banned, China’s state-backed blockchain ecosystem — led by Conflux — is expanding across Asia and into global finance. Conflux Network bridges China’s academic research, state strategy, and open blockchain innovation.

Alex Harutunian

Monero, the leading privacy coin, suffered an 18-block reorg after Qubic consolidated large mining power. Debate rages: Qubic claims 51% control; Monero devs deny widescale damage. Exchanges raised confirmations. The episode shows PoW chains can be threatened by economic incentives

Alex Harutunian

Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

30.01.2026 Nubank receives conditional approval from US regulators to open a US branch. 30.01.2026 Hong Kong’s 15th Five-Year Plan highlights stablecoins as a core FinTech priority. 30.01.2026 Binance to convert its $1B SAFU fund reserves from stablecoins into Bitcoin. 30.01.2026 Andre

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

TON Strategy Company, formerly Verb Technology, has rebranded as a Toncoin treasury, holding $713M in TON and targeting over 5% of supply. By staking its holdings and adopting financial engineering akin to Strategy’s playbook, it aims to turn crypto reserves into shareholder returns

The leading marketplace for Solana NFTs is adopting an optional creator royalty model. The protocol lets creators of new NFT collections block marketplaces that refuse to grant royalties.

Alex Harutunian

The NFTs were created by the artist GMUNK in partnership with Crypto.com and Coca-Cola and are based on the heat maps FIFA World Cup Qatar 2022 matches.

Alex Harutunian

Tether announced the launch of Euro Tether (EURT) and Tether Gold (XAUT) on Huobi Global. As well as a stablecoin tied to the offshore Chinese yuan (CNHT) which will be available to users on the Tron blockchain, although previously it worked only on Ethereum.

Alex Harutunian

Recently the internet has been bursting with pictures of a statue of a goat on a rocket with Elon Musk’s head. Who is behind it and what do they want?

Alex Harutunian

The Digital Operational Resilience Act (DORA), a landmark legislation focused on the Information and Communication Technology (ICT) operational resiliency for financial entities was adopted on 28th of November

Alex Harutunian

The call for participants in Australian CBDC project pilot has received significant interest. At almost the same time, Australian Securities Exchange (ASX) cancelled its plans for its settlement system upgrade that utilized blockchain technology.

Alex Harutunian

The discussion on Crypto has reignited in Brazil once more as worldwide markets react to the FTX collapse. The authorities seek regulation, while fully expanding their roots in the sector.

Sasha Markevich

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

30.01.2026 Nubank receives conditional approval from US regulators to open a US branch. 30.01.2026 Hong Kong’s 15th Five-Year Plan highlights stablecoins as a core FinTech priority. 30.01.2026 Binance to convert its $1B SAFU fund reserves from stablecoins into Bitcoin. 30.01.2026 Andre

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.