Once a promising Layer 1 blockchain, HECO failed to sustain growth, facing declining user interest and security and liquidity issues.

Sasha Markevich

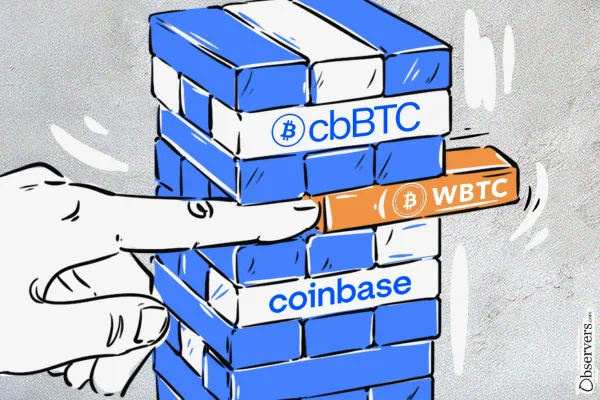

Coinbase and Circle joined forces to offer 4.75% APY for USDC holders. This partnership is expected to attract users to Coinbase’s products, while also boosting the usage of USDC.

Alexander Mardar

WalletConnect - more like traditional web2 infrastructure than a blockchain. Season 1 of the airdrop will distribute 50 million $WCT tokens, but the tokens won't be transferable until 2025 due to ongoing tests for the WalletConnect network.

Alexander Mardar

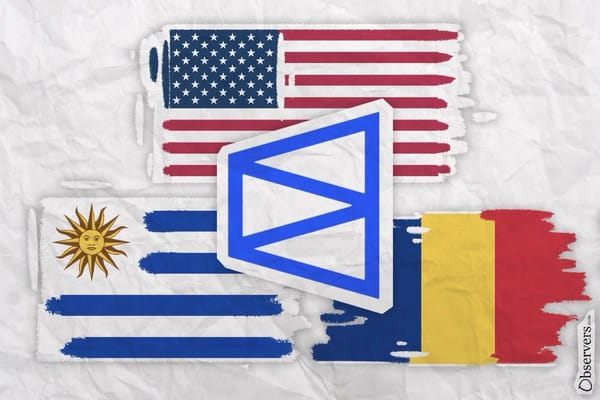

Polymarket correctly predicted the results of the United States elections. Can the blockchain information market be as accurate in predicting other presidential elections around the globe?

Eva Senzaj Pauram

The blockchain gaming leader boasts over 400 titles, driven by new partnerships, publisher adoption, and seamless in-game blockchain integrations.

Mathilde Adam

Once a promising Layer 1 blockchain, HECO failed to sustain growth, facing declining user interest and security and liquidity issues.

Sasha Markevich

With Solana’s staking market booming, centralized exchanges like Binance and Coinbase are reaping the rewards, leveraging their position to maximize staking and trading revenues.

Gensler declared war on "fraudsters" and "hucklers" — and took celebrities to task when they promoted little-known coins to their millions of followers, without disclosing they had been paid to do so.

Bill to establish strategic Bitcoin reserve introduced in Brazil's Chamber of Deputies. Trump administration considers CFTC to lead digital asset regulation. Uniswap launches $15M bug bounty for V4 core contract vulnerabilities. Kraken to close NFT marketplace. US court rules Tornado Cash sanctions unlawful. Morocco to lift 2017 crypto

Shanghai Judge Sun Jie drew a line between personal crypto holdings and banned activities as the underground market thrives.

Riding the memecoin wave to scam inexperienced and busy users, hackers have built “poisoned” repositories of trading bots, from which ChatGTP eventually trained.

For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' weekly has you covered. CBDC Updates 'Urgency' Required in Digital Euro Rollout

Happy Sunday, Observers! Good things come to those who wait, and we waited. Bitcoin was $500 short from $100,000 after the news that the world’s leading anti-crypto crusader, SEC’s chair Gary Gensler, is leaving its post. Now that we are throwing precautions out the window, wild things

The two-hour downtime was due to a bug in the transaction scheduling logic, which led to validators crashing. The incident resulted in a drop in SUI's price and raised doubts about the network’s ability to compete with Solana.

The zero-knowledge privacy application is gaining momentum on Farcaster, which has been grappling with a 96% decline in monthly revenue since February.

Solv Protocol emerges as a major player in DeFi. The recent partnership with Ethena allows Bitcoin owners to earn between 10-15% APY by using Ethena’s strategies through Solv’s new yield vault.

Alexander Mardar

Despite pushback, the decentralized exchange introduced Sushi Labs, its new council-based governance system, and a multi-token system.

Mathilde AdamMultiBank.io, the cryptocurrency division of the renowned TradFi broker MultiBank Group, is set to revolutionize the financial landscape with the launch of Real-World Assets (RWAs). This innovative initiative simplifies the integration between cryptocurrency and traditional markets, eliminating the need for complex transactions. Soon, users will be able to effortlessly

Sponsored Content

The settlement includes a permanent ban on Terraform and Kwon from participating in crypto securities activities, leaving the future of Terraform's products open to community-led initiatives.

Mathilde Adam

Prompted by high interest rates and competition, stablecoins that earn yield are on the rise. Are they a fad or the new normal of the largest crypto-asset class?

Eva Senzaj Pauram

Despite this, the founder managed to salvage nearly $100 million from his $140 million in $CRV collateral.

Alexander Mardar

The new law complements a series of measures introduced by the government over the past two years to protect Australians from risky gambling behaviors.

Mathilde Adam

The blockchain giant is bogged down in a legal case with the SEC, the outcome of which could have ramifications for the entire industry. At the same time, Ripple's new roadmap fosters compliant tools and services.

Mathilde Adam

With Solana’s staking market booming, centralized exchanges like Binance and Coinbase are reaping the rewards, leveraging their position to maximize staking and trading revenues.

Gensler declared war on "fraudsters" and "hucklers" — and took celebrities to task when they promoted little-known coins to their millions of followers, without disclosing they had been paid to do so.

Bill to establish strategic Bitcoin reserve introduced in Brazil's Chamber of Deputies. Trump administration considers CFTC to lead digital asset regulation. Uniswap launches $15M bug bounty for V4 core contract vulnerabilities. Kraken to close NFT marketplace. US court rules Tornado Cash sanctions unlawful. Morocco to lift 2017 crypto

Shanghai Judge Sun Jie drew a line between personal crypto holdings and banned activities as the underground market thrives.

Riding the memecoin wave to scam inexperienced and busy users, hackers have built “poisoned” repositories of trading bots, from which ChatGTP eventually trained.

For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' weekly has you covered. CBDC Updates 'Urgency' Required in Digital Euro Rollout

Happy Sunday, Observers! Good things come to those who wait, and we waited. Bitcoin was $500 short from $100,000 after the news that the world’s leading anti-crypto crusader, SEC’s chair Gary Gensler, is leaving its post. Now that we are throwing precautions out the window, wild things

The two-hour downtime was due to a bug in the transaction scheduling logic, which led to validators crashing. The incident resulted in a drop in SUI's price and raised doubts about the network’s ability to compete with Solana.