Ethereum has reclaimed its position as the primary blockchain for hosting USDT for the first time since 2022. Tether is minting new stablecoins on Ethereum as it expects higher demand.

Sasha Markevich

Currently, only whitelisted parties can deploy EVM smart contracts on the mainnet. However, anyone can interact with the already deployed smart contracts.

Alexander Mardar

Once a promising Layer 1 blockchain, HECO failed to sustain growth, facing declining user interest and security and liquidity issues.

Sasha Markevich

Coinbase and Circle joined forces to offer 4.75% APY for USDC holders. This partnership is expected to attract users to Coinbase’s products, while also boosting the usage of USDC.

Alexander Mardar

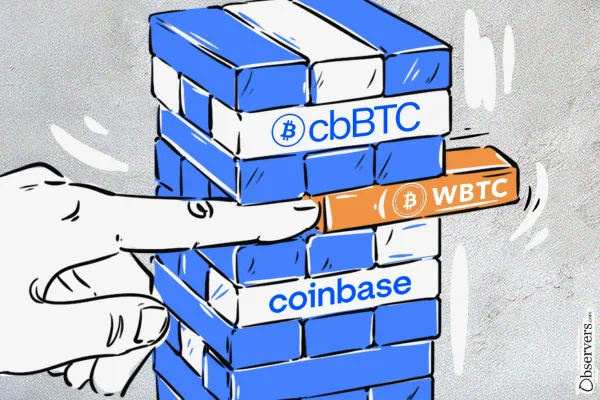

Coinbase delisting of wrapped Bitcoin comes as a surprise and leaves many questions unanswered.

Eva Senzaj Pauram

Ethereum has reclaimed its position as the primary blockchain for hosting USDT for the first time since 2022. Tether is minting new stablecoins on Ethereum as it expects higher demand.

Sasha Markevich

With Solana’s staking market booming, centralized exchanges like Binance and Coinbase are reaping the rewards, leveraging their position to maximize staking and trading revenues.

Gensler declared war on "fraudsters" and "hucklers" — and took celebrities to task when they promoted little-known coins to their millions of followers, without disclosing they had been paid to do so.

Tether discontinues EURT stablecoin. Tron is the only profitable L1 in 2024. Bitwise files S-1 for ETF holding both Bitcoin and Ether. Japanese firm Remixpoint invests $3,2M in Bitcoin. Brazil introduces bill for national Bitcoin reserve in Chamber of Deputies. Trump administration considers CFTC to lead digital asset regulation.

Shanghai Judge Sun Jie drew a line between personal crypto holdings and banned activities as the underground market thrives.

Riding the memecoin wave to scam inexperienced and busy users, hackers have built “poisoned” repositories of trading bots, from which ChatGTP eventually trained.

For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' weekly has you covered. CBDC Updates 'Urgency' Required in Digital Euro Rollout

Happy Sunday, Observers! Good things come to those who wait, and we waited. Bitcoin was $500 short from $100,000 after the news that the world’s leading anti-crypto crusader, SEC’s chair Gary Gensler, is leaving its post. Now that we are throwing precautions out the window, wild things

The two-hour downtime was due to a bug in the transaction scheduling logic, which led to validators crashing. The incident resulted in a drop in SUI's price and raised doubts about the network’s ability to compete with Solana.

The zero-knowledge privacy application is gaining momentum on Farcaster, which has been grappling with a 96% decline in monthly revenue since February.

It looks unlikely that a digital pound will launch in the U.K. any time soon as an election beckons. The digital shekel challenge, updates on India CBDC progress and other news in this week's roundup

Observers

The SEC's recent apparent approval of Ethereum ETFs raised some questions about the decentralized betting platform. Those who lost money betting against the approval this month insist that the resolution made by Oracle was premature.

Sasha Markevich

A hotel developer in El Salvador is offering a 10% yield on tokens backed by real estate.

Observers

On May 31, all unlicensed crypto exchanges had to leave the country. So far, only two local exchanges have secured licenses, and 18 more are waiting for the regulator's decision.

Sasha Markevich

As the AI-generated token price peaked, $TURBO entered the top-10 meme coins by trading volume, and its capitalization grew by over 2,000%, reaching $600 million.

Sasha Markevich

Helium Network is dominating the DePIN sector, fueled by rapid mobile adoption and growing IoT applications. This has resulted in over $1.5 million in HNT token burns and many new partnerships across the world.

Mathilde Adam

There is a potential solution for those impacted by the ZKasino debacle. The founder has taken to X to explain how investors can recover their full ETH investment.

Alexander Mardar

Despite Bitcoin's impressive performance over the past five years, few publicly listed companies have opted to add this cryptocurrency to their balance sheet.

Observers

With Solana’s staking market booming, centralized exchanges like Binance and Coinbase are reaping the rewards, leveraging their position to maximize staking and trading revenues.

Gensler declared war on "fraudsters" and "hucklers" — and took celebrities to task when they promoted little-known coins to their millions of followers, without disclosing they had been paid to do so.

Tether discontinues EURT stablecoin. Tron is the only profitable L1 in 2024. Bitwise files S-1 for ETF holding both Bitcoin and Ether. Japanese firm Remixpoint invests $3,2M in Bitcoin. Brazil introduces bill for national Bitcoin reserve in Chamber of Deputies. Trump administration considers CFTC to lead digital asset regulation.

Shanghai Judge Sun Jie drew a line between personal crypto holdings and banned activities as the underground market thrives.

Riding the memecoin wave to scam inexperienced and busy users, hackers have built “poisoned” repositories of trading bots, from which ChatGTP eventually trained.

For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' weekly has you covered. CBDC Updates 'Urgency' Required in Digital Euro Rollout

Happy Sunday, Observers! Good things come to those who wait, and we waited. Bitcoin was $500 short from $100,000 after the news that the world’s leading anti-crypto crusader, SEC’s chair Gary Gensler, is leaving its post. Now that we are throwing precautions out the window, wild things

The two-hour downtime was due to a bug in the transaction scheduling logic, which led to validators crashing. The incident resulted in a drop in SUI's price and raised doubts about the network’s ability to compete with Solana.