Ethereum has reclaimed its position as the primary blockchain for hosting USDT for the first time since 2022. Tether is minting new stablecoins on Ethereum as it expects higher demand.

Sasha Markevich

Currently, only whitelisted parties can deploy EVM smart contracts on the mainnet. However, anyone can interact with the already deployed smart contracts.

Alexander Mardar

Once a promising Layer 1 blockchain, HECO failed to sustain growth, facing declining user interest and security and liquidity issues.

Sasha Markevich

Coinbase and Circle joined forces to offer 4.75% APY for USDC holders. This partnership is expected to attract users to Coinbase’s products, while also boosting the usage of USDC.

Alexander Mardar

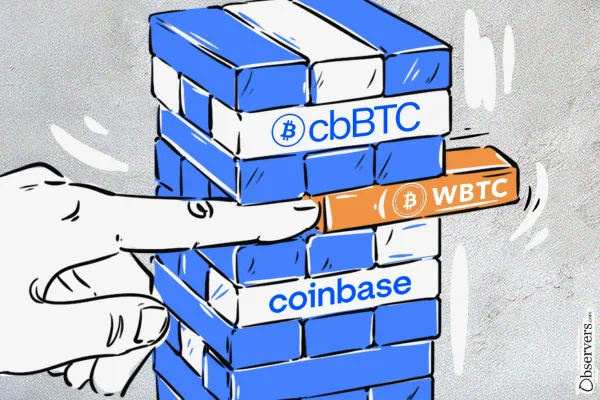

Coinbase delisting of wrapped Bitcoin comes as a surprise and leaves many questions unanswered.

Eva Senzaj Pauram

Ethereum has reclaimed its position as the primary blockchain for hosting USDT for the first time since 2022. Tether is minting new stablecoins on Ethereum as it expects higher demand.

Sasha Markevich

With Solana’s staking market booming, centralized exchanges like Binance and Coinbase are reaping the rewards, leveraging their position to maximize staking and trading revenues.

Gensler declared war on "fraudsters" and "hucklers" — and took celebrities to task when they promoted little-known coins to their millions of followers, without disclosing they had been paid to do so.

Tether discontinues EURT stablecoin. Tron is the only profitable L1 in 2024. Bitwise files S-1 for ETF holding both Bitcoin and Ether. Japanese firm Remixpoint invests $3,2M in Bitcoin. Brazil introduces bill for national Bitcoin reserve in Chamber of Deputies. Trump administration considers CFTC to lead digital asset regulation.

Shanghai Judge Sun Jie drew a line between personal crypto holdings and banned activities as the underground market thrives.

Riding the memecoin wave to scam inexperienced and busy users, hackers have built “poisoned” repositories of trading bots, from which ChatGTP eventually trained.

For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' weekly has you covered. CBDC Updates 'Urgency' Required in Digital Euro Rollout

Happy Sunday, Observers! Good things come to those who wait, and we waited. Bitcoin was $500 short from $100,000 after the news that the world’s leading anti-crypto crusader, SEC’s chair Gary Gensler, is leaving its post. Now that we are throwing precautions out the window, wild things

The two-hour downtime was due to a bug in the transaction scheduling logic, which led to validators crashing. The incident resulted in a drop in SUI's price and raised doubts about the network’s ability to compete with Solana.

The zero-knowledge privacy application is gaining momentum on Farcaster, which has been grappling with a 96% decline in monthly revenue since February.

Luxembourg-based platform STOKR launched tokenized CMSTR Notes, each backed by 100 MicroStrategy Inc. shares. The new product has multiple implicit advantages but is out of reach for the majority of investors.

Sasha Markevich

The forthcoming Dragon8 hard fork by Chiliz will optimize the CHZ token’s economy by adjusting inflation rates and burning transaction fees, paving the way for a balanced ecosystem.

Alexander Mardar

On the rise once more: is GameStop set for a repeat of 2021?

Rebecca Denton

By April, the network boasted 650,000 monthly active accounts, marking a record high since the integration of parachains.

Alexander Mardar

While the crypto sector will rightly argue this is a move in the right direction, there are no guarantees that FIT21 will ever be enshrined into law.

Observers

With so many floods and heavy rains happening all over the world in recent times, weather service agencies haven't been the carriers of good news. This week, however, there were some exceptions in the northern hemisphere countries. A geomagnetic storm has made it possible for people in several

Eva Senzaj Pauram

The Open Network community is still gaining momentum. The excitement surrounding Notcoin's launch on major exchanges has pushed up the price of Toncoin.

Sasha Markevich

Are European Central Banks too slow on the CBDC track? Let's hear what the governors say. Also, in this roundup, the U.S. commercial banks fighting actively for their share of the crypto custody markets and even developing their own digital asset network.

Observers

With Solana’s staking market booming, centralized exchanges like Binance and Coinbase are reaping the rewards, leveraging their position to maximize staking and trading revenues.

Gensler declared war on "fraudsters" and "hucklers" — and took celebrities to task when they promoted little-known coins to their millions of followers, without disclosing they had been paid to do so.

Tether discontinues EURT stablecoin. Tron is the only profitable L1 in 2024. Bitwise files S-1 for ETF holding both Bitcoin and Ether. Japanese firm Remixpoint invests $3,2M in Bitcoin. Brazil introduces bill for national Bitcoin reserve in Chamber of Deputies. Trump administration considers CFTC to lead digital asset regulation.

Shanghai Judge Sun Jie drew a line between personal crypto holdings and banned activities as the underground market thrives.

Riding the memecoin wave to scam inexperienced and busy users, hackers have built “poisoned” repositories of trading bots, from which ChatGTP eventually trained.

For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' weekly has you covered. CBDC Updates 'Urgency' Required in Digital Euro Rollout

Happy Sunday, Observers! Good things come to those who wait, and we waited. Bitcoin was $500 short from $100,000 after the news that the world’s leading anti-crypto crusader, SEC’s chair Gary Gensler, is leaving its post. Now that we are throwing precautions out the window, wild things

The two-hour downtime was due to a bug in the transaction scheduling logic, which led to validators crashing. The incident resulted in a drop in SUI's price and raised doubts about the network’s ability to compete with Solana.