Ethos turns credibility into an on-chain market. By blending XP-based participation, capital-backed vouching, and invite-bonded trust graphs, it attempts to price reputation itself. One year in, the experiment reveals both the promise—and the fragility—of financializing trust in crypto

Alex Harutunian

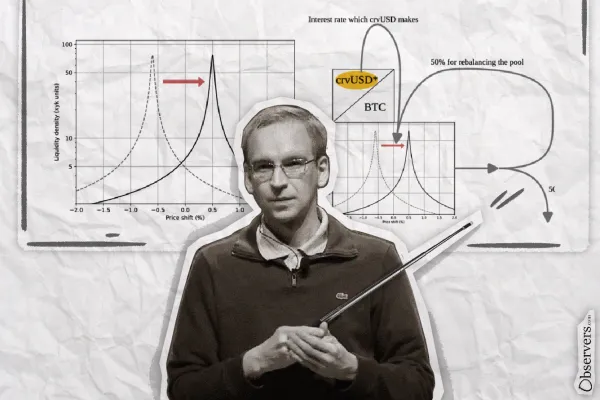

Vitalik Buterin’s recent posts reflect a shift from idealistic decentralization toward pragmatic system design. Rather than rejecting Ethereum’s core principles, he questions where complexity, governance, and the current development path fail under real-world constraints.

Alex Harutunian

Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

DeFi is moving from standalone apps into the backend of exchanges, with Coinbase and Crypto.com leading by embedding Morpho’s lending vaults. This “embedded DeFi” model raises a key question: are exchanges becoming banks, or just UIs? The answer will define DeFi’s role in future banking.

Alex Harutunian

Ethos turns credibility into an on-chain market. By blending XP-based participation, capital-backed vouching, and invite-bonded trust graphs, it attempts to price reputation itself. One year in, the experiment reveals both the promise—and the fragility—of financializing trust in crypto

Alex Harutunian

After years of legal uncertainty, U.S. regulators have opened the door for on-chain shareholder records. From Galaxy and Securitize to DTC’s pilot, equity is moving into the blockchain mesh—reshaping settlement, trading, and the future architecture of capital markets.

NASHVILLE, Tenn. Nakamoto Inc. (NASDAQ: NAKA) (“Nakamoto” or the “Company”) today announced that it has entered into merger agreements to acquire BTC Inc, the leading provider of Bitcoin-related media and events, and UTXO Management GP, LLC (“UTXO”), an investment firm focused on private and public Bitcoin companies (collectively, the “Transaction”

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• Ethereum Foundation begins staking its ETH treasury. • Circle reports Q4 revenue and reserve income of $770M (+77% YoY). • Tether invests in online marketplace Whop.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

The U.S. Senate has passed the GENIUS Act, a sweeping bill to regulate dollar-backed stablecoins while promoting private-sector leadership in digital finance. Backed by the Trump administration, the bill now heads to the House—marking a pivotal moment in the future of digital dollars.

Alex Harutunian

The spike in activity is primarily attributed to the rapid growth of Avalanche’s Coqnet subnet, which has seen an unusual surge in volume. However, other subnets, including the main Avalanche C-Chain, have also experienced significant increases in activity.

Alexander Mardar

A controversial change in Bitcoin Core will remove relay limits on the OP_RETURN field, allowing larger data payloads to spread across the network. Critics fear spam and bloat; supporters say it's already happening—and making it visible will improve fee markets and mempool consistency.

Alexander Mardar

A new blockchain, Plasma, is positioning itself as purpose-built for stablecoins. The chain will be fully EVM-compatible and promises zero fees on USDT transfers. But beyond marketing appeal, what core features do stablecoins truly need from the underlying blockchain?

Alexander Mardar

The Ethereum Foundation is entering a new phase with a structured treasury policy, shifting from passive ETH holdings to strategic deployment. Guided by “Defipunk” values, EF plans to support privacy-first, trust-minimized DeFi while improving financial transparency and counter-cyclical engagement

Alexander Mardar

Switzerland will adopt the OECD's Crypto-Asset Reporting Framework in 2026, automatically sharing crypto data with 74 partner countries. While tough on foreign tax evasion, Swiss residents continue to enjoy tax-free capital gains and a clear, favorable crypto policy.

Sasha Markevich

After years of legal uncertainty, U.S. regulators have opened the door for on-chain shareholder records. From Galaxy and Securitize to DTC’s pilot, equity is moving into the blockchain mesh—reshaping settlement, trading, and the future architecture of capital markets.

NASHVILLE, Tenn. Nakamoto Inc. (NASDAQ: NAKA) (“Nakamoto” or the “Company”) today announced that it has entered into merger agreements to acquire BTC Inc, the leading provider of Bitcoin-related media and events, and UTXO Management GP, LLC (“UTXO”), an investment firm focused on private and public Bitcoin companies (collectively, the “Transaction”

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• Ethereum Foundation begins staking its ETH treasury. • Circle reports Q4 revenue and reserve income of $770M (+77% YoY). • Tether invests in online marketplace Whop.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland