Online payments processor PayPal launched its dollar-pegged PayPal USD (PYUSD) token in August 2023 in partnership with Paxos, becoming the first major FinTech player to launch a stablecoin. The stablecoin hasn’t gained much popularity, but we are still following its development. Here are our latest observations.

Partnerships & Integrations

Xoom, PayPal’s cross-border money transfer service, recently allowed customers to use stablecoin to make transfers to approximately 160 countries. PayPal announcement claims that with this option users can save up to 6% in transfer fees.

Another payments firm, Singapore-based [and licensed] Triple-A, will reportedly add PYUSD to its available payment methods. The company allows merchants to accept digital currencies and receive fiat without ‘touching’ crypto. The platform is growing fast and is one of the few allowed to operate in Singapore, so the partnership can legitimately push PYUSD. At the same time, Triple-A has only around 20,000 customers, which is a drop in the ocean compared to PayPal’s user base, so we do not think that this partnership will significantly affect the PYUSD position.

Markets

Right now, PYUSВ is the number 11th largest stablecoin by market capitalization. Its market cap has been steadily growing since its launch but dropped significantly in the first part of March from $304 million to $190 million. According to Paxos’ latest PayPal USD transparency report, its circulation in March was 39% less than in February. PYUSD slightly gained market capitalization in April, reaching $203 million at the time of writing. Meanwhile, USDC and USDT issuance continue to increase.

Crypto.com teamed up with the issuers to become a preferred PYUSD exchange back in 2023, but the coin is also listed on all the major exchanges apart from Binance and OKX. The world’s biggest exchange, Binance, allegedly doesn’t list the stablecoin due to Paxos’ legal problems and the now-defunct BUSD incident. Interestingly, the Australian exchange Hotcoin Global is one of the largest markets for PYUSD.

Authorities

The stablecoin’s main advantage is that its issuer is a trust company regulated by the New York Department of Financial Services. Thus, PYUSD is better regulated, and its holders are allegedly better protected than Tether and Circle clients. Compared to its major rivals, PYUSD has fewer legal - and consequently trust - issues. As always, the SEC couldn’t pass up the opportunity to start a new investigation, but so far, no charges have been brought. Three months after the PYUSD launch, PayPal was summoned by the SEC’s Enforcement Division and asked to provide extra documentation. PayPal promised to cooperate with the regulator, and since then, no more details have been revealed.

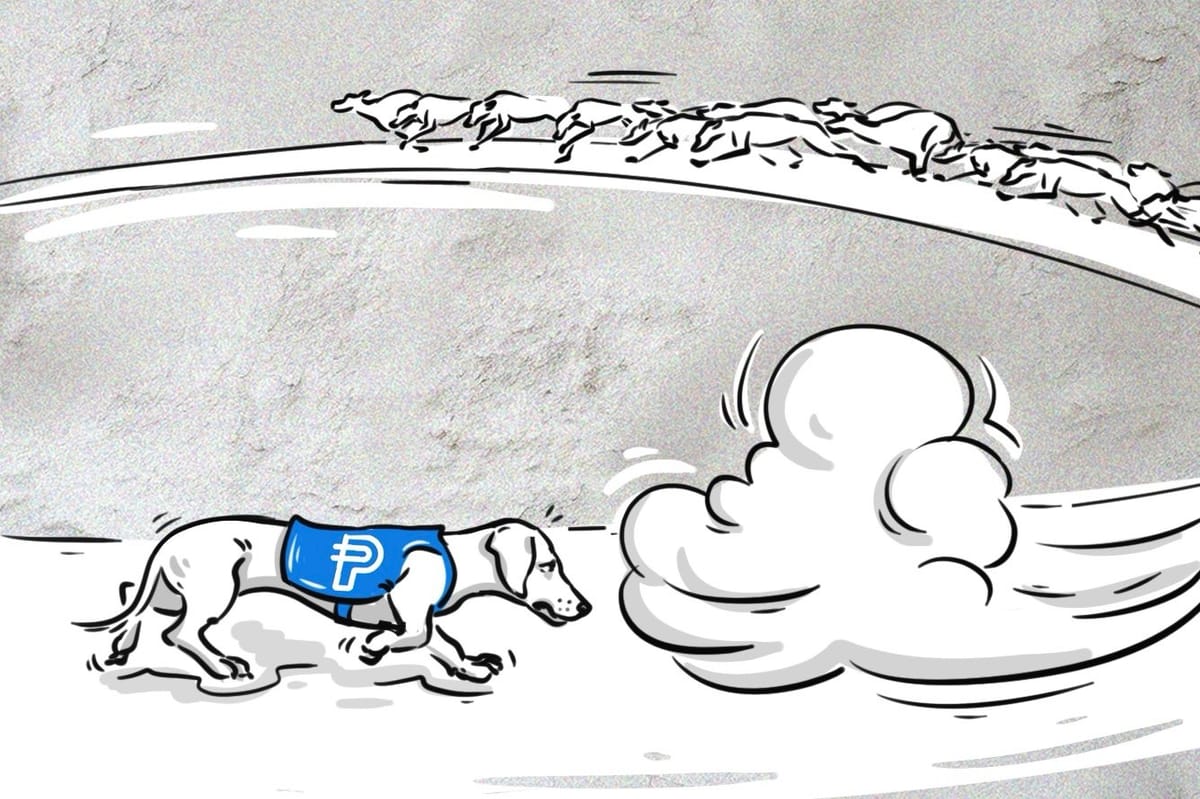

The fact that one of the largest payment companies embraces blockchain and ‘confirms’ the credibility of stablecoins raised hopes that it might serve as a catalyst for faster adoption and wider crypto acceptance, but we would say that PYUSD, currently ranked #298 on CoinMarketCap, has a long way to go before it can influence the game rules.