The crypto betting platform Polymarket seems to be unstoppable right now.

With under nine weeks to go before the U.S. election, hundreds of millions of dollars have been wagered on the result.

But more than that, Polymarket is quickly becoming a barometer of who is likeliest to win: Kamala Harris or Donald Trump.

The 24/7 nature of this platform means odds rapidly respond to real-world events—from Joe Biden abruptly pulling out of the campaign, to the assassination attempt Trump faced in July.

Beyond the prospect of winning money, this is a powerful use case—especially considering opinion polls are resource intensive and time consuming, meaning the views of American voters may only emerge days or weeks after a significant event unfolds.

Because of all this, perhaps it's little surprise that Polymarket data surrounding the U.S. election is now being added to Bloomberg Terminal, meaning it can now be accessed by more than 350,000 influential subscribers around the world.

We are in the process of adding @Polymarket data to WSL ELECTION<Go>! pic.twitter.com/aNM087bcwS

— Michael McDonough (@M_McDonough) August 29, 2024

It's a significant boost for Polymarket—not least because the collaboration will introduce its concept to deep-pocketed, market-moving executives who remain deeply dubious about cryptocurrencies.

The site's CEO, Shayne Coplan, declared that the company was "entering mainstream news and finance before our eyes," writing:

"What once was a fringe, sci-fi idea for transforming the flow of information is now becoming the new normal, as 10s of millions of people build habit around relying on Polymarket forecasts as a source of truth, to make sense of what’s going on in the world. And it’s still early."

All of this has been coupled with aggressive fundraising this year, which Ethereum co-founder Vitalik Buterin has participated in. A total of $70 million was raised across two rounds earlier this year.

Buterin has described prediction markets, as well as the Community Notes feature seen on X, as "the two flagship social epistemic technologies of the 2020s."

It seems the public agrees. Data from Dune Analytics shows Polymarket broke monthly trading volumes in August, generating an attractive $472.8 million. The number of active traders over this period also hit a new all-time high of 63,616.

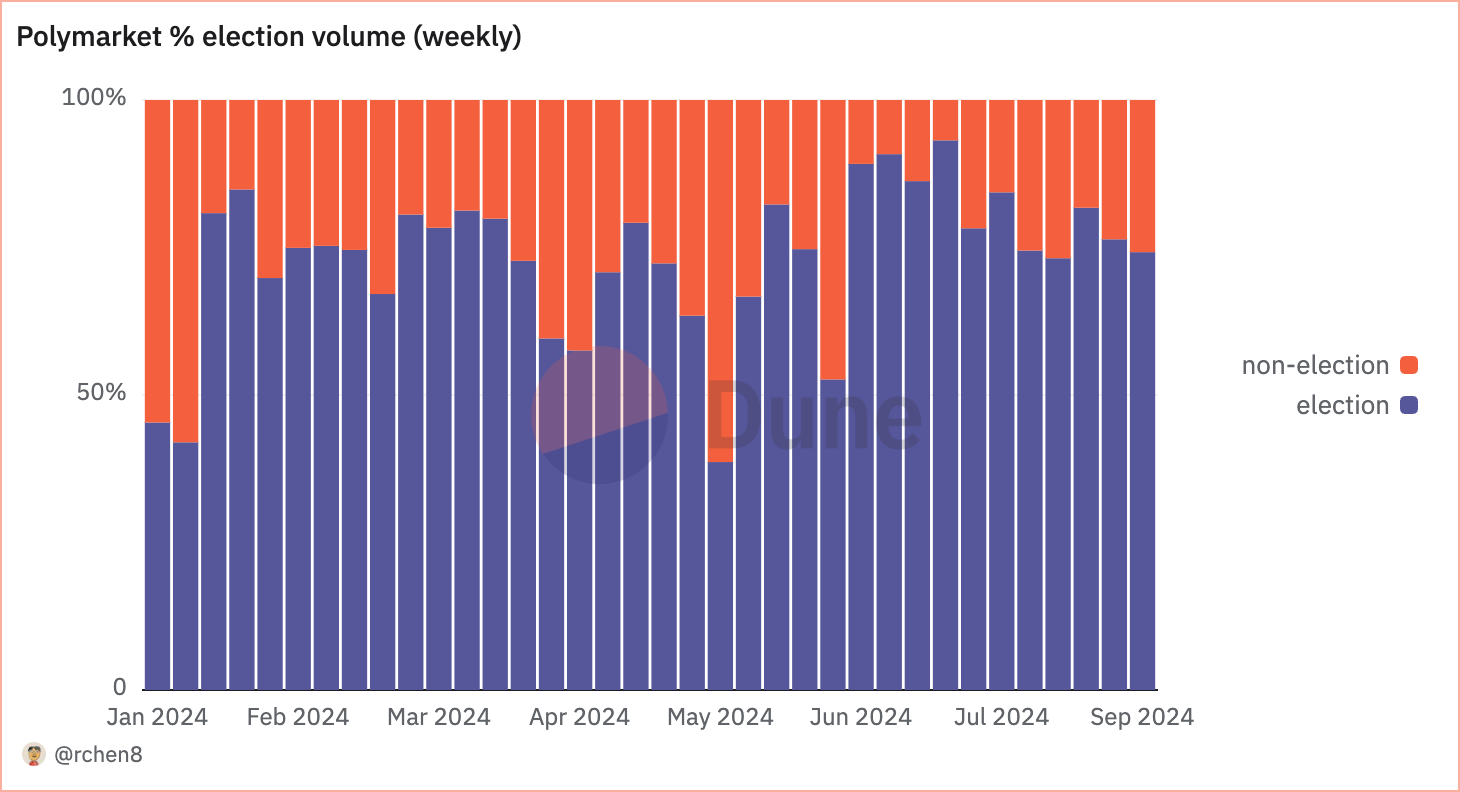

But there's one graph in particular that should be giving Polymarket investors, and its executives, sleepless nights. Here it is:

In the week leading to September 2, a whopping 74.2% of Polymarket's trading volume was directly linked to the U.S. election. That's coincided with a dramatic reversal of fortunes in Harris v Trump bet, with the Republican nominee now given a 53% chance of returning to power.

But here's the question: after November 5, are we going to see Polymarket's trading volume fall off a cliff? Will users, profitability and enthusiasm die down? Can this site maintain its undeniable momentum and uncover new use cases, or will popularity wane just like it did with NFTs?

That would be an interesting prediction market to bet on.