The New York-based company, backed by Bank of America and Intel, has held discussions with several potential buyers, including Ava Labs, the Solana Foundation, and Adhara, over the past six months, according to Bloomberg. The talks encompass various scenarios, from a complete sale to a minority stake investment or joint venture arrangement.

These talks come as traditional financial institutions increasingly choose public blockchain infrastructure over private solutions.

In recent months, major financial players have opted for established public networks. PayPal launched its PYUSD stablecoin on Solana and Ethereum, while Visa announced plans to deploy its new tokenization platform VTAP on the Ethereum blockchain in 2025. Spanish banking giant BBVA is set to pilot Visa's platform.

Founded in 2014 during the initial wave of enterprise blockchain enthusiasm, R3 emerged as one of the most prominent startups focused on developing blockchain solutions for the banking sector. The company initially led a consortium of nine major banks aimed at implementing blockchain technology for complex financial processes. At its peak, R3 counted over 200 partners.

Key members, including JPMorgan Chase, Goldman Sachs, and Morgan Stanley, departed as R3 began seeking external funding in 2016. In 2019, JPMorgan Chase developed its own private blockchain Quorum for its JPM Coin.

While R3's Corda technology achieved some success with implementations like the Swiss stock exchange's digital assets venue, many projects stalled in the testing phase. The company's recent challenges led to a workforce reduction of approximately 20% last year, leaving its current headcount between 200 and 250 employees, according to Bloomberg.

In 2018, R3 raised $122 million from over 40 institutions, including Barclays, UBS, and Wells Fargo. At the time, this represented one of the largest blockchain-focused fundraising efforts, and the company had contemplated going public as early as that year.

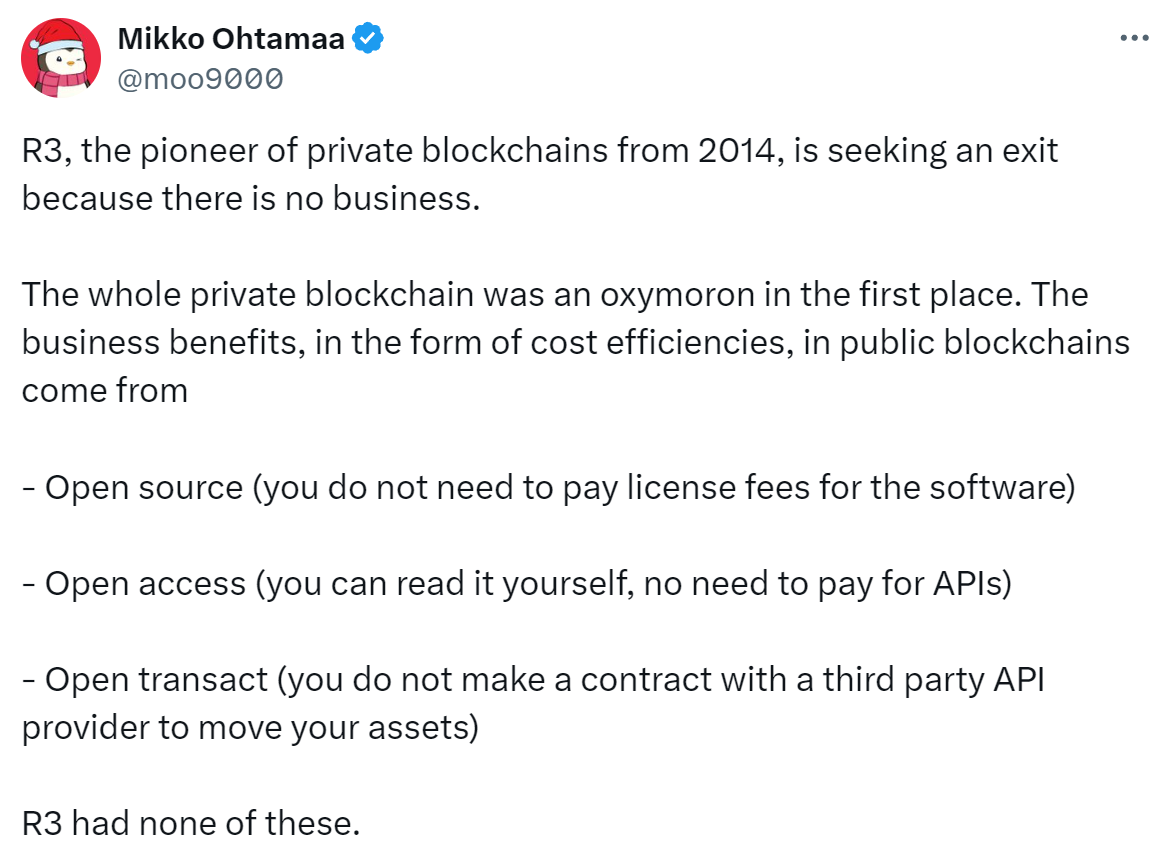

Early concerns about privacy and control that drove interest in private blockchains appear to be giving way to the efficiency offered by public infrastructure. Industry analysts, such as Trading Strategy co-founder Mikko Ohtamaa, point to the fundamental advantages of public over private blockchains. These include reduced licensing costs through open-source code, transparent access to data, and the elimination of third-party transaction fees—benefits that have proven more compelling than the controlled access offered by private networks.

Harrison Comfort, a former Business Development Director at R3, said on X that enterprise blockchain projects face significant hurdles. He cites limited ongoing funding, regulatory limitations that hinder real-time payments, and complex IT demands such as on-premises node management. These factors, Comfort notes, reduce blockchain's potential by restricting its use to information exchange—nonetheless, Comfort points to the rising market in professional services for blockchain initiatives.

While R3's search for strategic options continues, many view the pioneer blockchain startup as a relic of an outdated approach with limited growth potential in a market that has decisively moved toward public blockchains.

"It's a dying blockchain vendor in a world of thousands of blockchains where an L2 can be spun up in a matter of hours." @nullpackets