The Central Bank Digital Currency (CBDC) is an impending trend over recent years, followed by more and more countries.

Some facts: now 105 countries (together representing 95% of world GDP) are working on CBDC. 10 countries have fully implemented CBDC projects. 19 of the G20 countries are exploring CBDC, with 16 including India, South Korea, Japan and Russia, already in the development or pilot stage. The Chinese e-CNY project is considered to be the most advanced among other leading economies testing this concept. China plans to launch a pilot project in early 2023.

Over the years, Indonesia has built the necessary framework and methodically developed a digital society and economy. In Indonesia, about 98% of retailers use digital payments, 59% of them use digital funding. Cryptocurrency adoption in the country is in line with world trends. According to the Commodity Futures Trading Authority (Bappebti) in 2021, cryptocurrency transactions in Indonesia amounted to 859.4 trillion rupees (USD 55 billion), compared to 64.9 trillion rupees (USD 4 billion) in 2020. According to a recent announcement by the Indonesian government. Indonesia also plans to establish a cryptocurrency “stock exchange”.

Since 2019, Indonesia has been developing its digital payment strategy Indonesia Payment Systems Blueprint 2025 (IPSB 2025). Among its elements, already deployed, are: QRIS - the national standard for payments QR code, launched in August 2019, SNAP - the National Standard for Open API for payments launched in July 2022.

So, there is some groundwork already prepared, and all of these elements have found their place in the CBDC project design. Yet, judging by the name selected for the project, CBDC has still an air of mystery for the authors.

“Garuda Project”: the specifics of its building

According to the Central Bank’s plan, the project will be implemented in stages:

Development will begin with wholesale CBDC, w-Digital Rupiah at the initial stage and will serve as a common basis for the Digital Rupiah. At this stage the issuance and redemption use case will be tested between reserve accounts and w-Digital Rupiah. The transacting parties will need to connect to a single node maintained by BI.

At the next stage, w-Digital Rupiah the above use case will be expanded to support other transactions such as interbank money market and monetary operations, Central Counterparties (CCP) fund settlements and, also, tokenized securities. The parties will need to prepare their own nodes.

At the final stage, an integrated w-Digital Rupiah and retail, r-Digital Rupiah, will be tested. Use cases here will include distribution, collection, conversion between w-Digital Rupiah and r-Digital, peer-to-peer transfers, payments r-Digital Rupiah, etc. Parties who assumed a wholesaler role would need to develop a distribution mechanism.

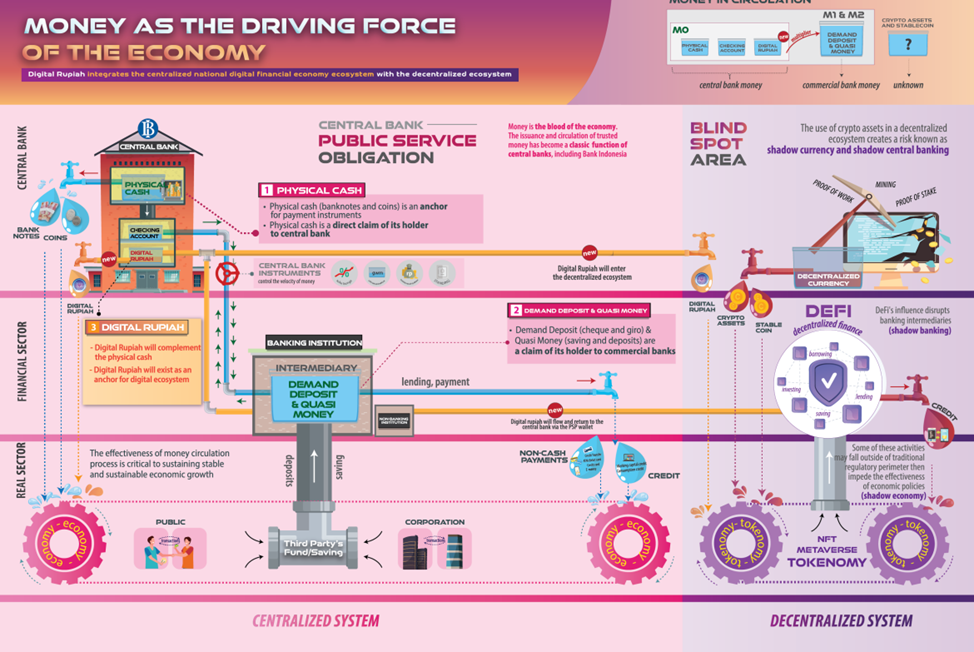

Overall, the project authors have tried to draw a holistic view of the financial system of Indonesia and the future role of CBDC in it.

Technological Foundation of “Garuda Project”

As with our other reviews, we summarized the main design choices of Indonesian CBDC as follows:

- Model of Issuance: Direct (by BI) or Indirect (by Banks)? W-CBDC will be issued directly by BI, and R-CBDC indirectly, by Banks and other intermediaries

- Form: Token (like Bitcoin) or Account based (like Ethereum)? Token-based W-CBDC, and Token and Account-based R-CBDC

- Economic type: Interest bearing or not? Non-interest bearing

- Privacy: Anonymous or AML/CF compliant AML compliant, granular data

- Denominations: minimum value or Fixed denominations? Fixed denominations as existing paper money

- Ledger: DLT or non-DLT? Permissioned DLT for W-CBDC, and Centralized for R-CBDC

Furthermore, the document talks about offline functionality for r-Digital Rupiah to facilitate inclusion.

Cyber security and monetary policy risks

Potential risks and uncertainties in the implementation of the CBDC in Indonesia are not different from other countries.

The risk of cyber-attacks persists in Digital Rupiah due to its reliance on digital solutions. The use of consensus mechanisms, smart contracts, cryptographic key management, account security, data protection and privacy, among other features, can put the entire system at risk. The Bank of Indonesia foresees extensive risk assessment and identification procedures related to people, processes and technologies.

Socio-economic, regulatory and policy issues will be reviewed before a country launches a CBDC. As mentioned in the document, the existing laws and regulations have not yet provided the legal basis for Digital Rupiah to earn the status of legal tender. From the monetary policy perspective, Digital Rupiah is planned to be as neutral as possible. Still, the risk of a bank run during crisis periods, when people move their bank deposits to r-Digital Rupiah at once and on a massive scale, is a scenario that Indonesian specialists need to consider.

Conclusion: what are the prospects for CBDC in Indonesia?

The Bank of Indonesia’s Governor, Perry Warjiyo, said that issuing CBDC is not an easy task, as central banks need to “intelligently consider the design features of CBDC, weighing the benefits against the risks involved”.

The paper issued by the Bank of Indonesia is largely a concept vision and discussion rather than a technical plan. Many details are left to be answered during the actual implementation. The colourful and visually rich style of the paper as well as its timing show that the authors paid much attention to the PR aspect of the project. The most difficult work is ahead and we will continue to observe its progress.