Pump Drops More Fun

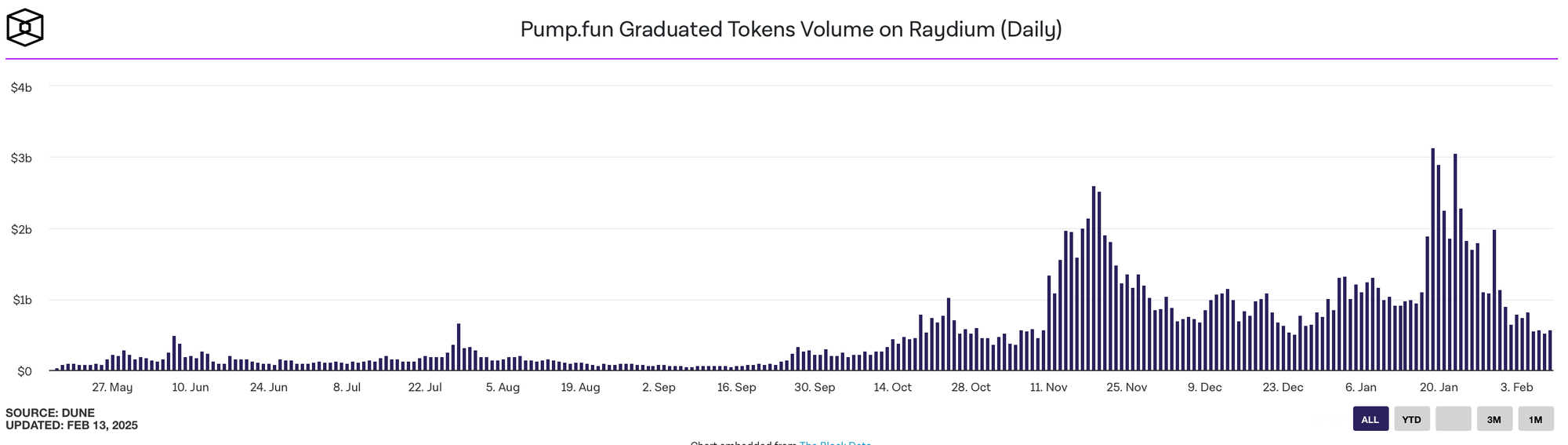

Pump.Fun token launchpad released its mobile versions moving closer to its goal of becoming a social app. The powerhouse of meme coins is as busy as ever, but mounting criticism is taking a toll on the chances of long-term success.