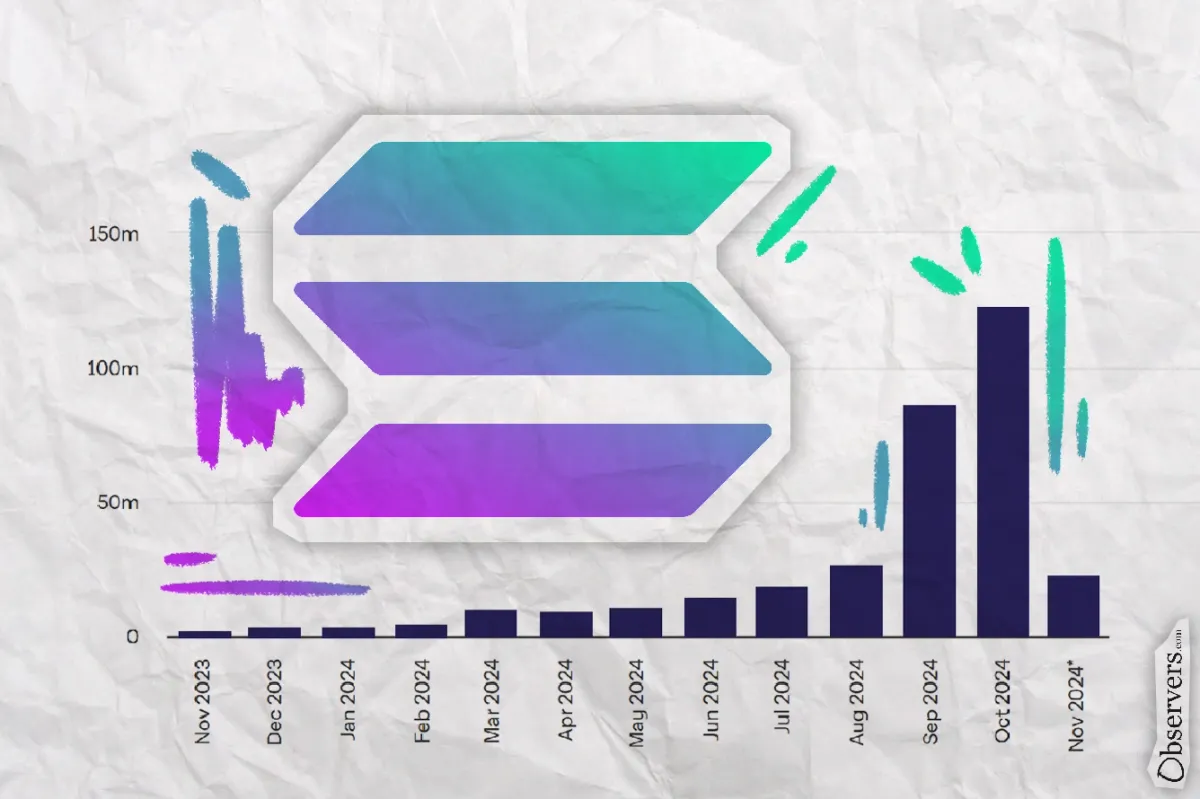

Solana's largest decentralized exchange, Raydium, reached $124.6 billion in trading volume this November, surpassing Uniswap by 30%. The exchange has now topped Uniswap for two straight months after first taking the lead with a 10% advantage in October.

According to Messari research, the turning point for Raydium came on March 6, when it surpassed its rival Orca in trading volumes. By the third quarter, Raydium secured its first quarterly majority of Solana's daily DEX volume since 2022. By November, Raydium had consistently captured over 60% of all DEX trades on Solana.

The platform's V3 upgrade in March introduced faster, more efficient trading through new market maker pools and a vastly improved user experience. These pools connect buyers and sellers automatically while monitoring prices through built-in feeds, making trades more accurate and cost-effective.

Meme-coin Trading Continues to Drive Growth

The meme-coin surge, fueled by venture capital funding and political speculation, has pushed total meme-coin market capitalization to approximately $135 billion, according to CoinGecko. This momentum exploded after the U.S. presidential election, with Raydium's daily meme-coin trades hitting $2 billion—triple October's average. Memecoins now represent 65% of Raydium's monthly volume, up from just 2% in November 2023.

Much of this growth stems from Pump.fun's integration with Raydium. The platform's automated system deposits $12,000 into Raydium trading pools whenever a token reaches $69,000 in market cap, creating a constant stream of new trading activity. This mechanism has propelled Pump.fun to become Web3's fifth-highest earning protocol, ranking just below USDC issuer Circle. Building on this success, Pump.fun announced plans in October for a token release and a new trading terminal called Pump Advance.

In recent weeks, Pumpdotfun has subtly evolved from a pure memecoin launchpad to a general-purpose fair launch platform.

— Ryan Watkins (@RyanWatkins_) November 24, 2024

While 99% of tokens minted are degenerate junk, a small few have legit technical roadmaps, evoking shades of the 2018 ICO boom as much as the 2021 NFT mania.

The Solana Ecosystem Benefits

Solana's overall DEX activity shows similar gains. The network now handles about 50% of global DEX volume, up from first challenging Ethereum's weekly volumes in December 2023 following major airdrops that brought millions in liquidity. This wealth effect triggered massive network activity increases.

By Q3 2024, Solana surpassed Ethereum's weekly volumes three times and maintained second place in all other weeks. Ethereum's current 18% share represents a dramatic shift in the DEX hierarchy.

According to DefiLlama data, the total value locked in Solana increased approximately fivefold in 2024, though it still trails Ethereum's $70 billion TVL. The growth stems largely from Solana's technical advantages—high throughput and low transaction costs attract users seeking faster, cheaper DeFi alternatives.

On October 10, Uniswap launched Unichain, its own layer-2 network, while maintaining a presence across 18 different chains. In contrast, Raydium focuses solely on Solana, leveraging its speed and cost benefits to attract traders. This single-chain strategy has proven effective as Solana emerged as 2024's primary hub for memecoin trading.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar