The global banking industry is barely fit for purpose… and due to a lack of viable alternatives, has been getting away with this inadequacy for far too long. International (and even national) banking systems basically consist of a bunch of individual proprietary bookkeeping databases, which can just about interact with each other via a decidedly low-tech 1970s messaging protocol.

Cryptocurrency’s relatively recent arrival on the global financial stage, eventually, gave the commercial banks a well-needed kick in the collective pants, as they realized that a bunch of tech startups could pretty much do their jobs better than they could… or at least better than they’d ever previously had to.

After having ignored crypto for so long, the banking dinosaurs finally had to accept that maybe there was something to this young upstart. Of course, being unable to compete with the ever-evolving and unregulated world of the more innovative crypto offerings, they were forced to do the next best thing.

They would, often begrudgingly, need to evolve in a desperate attempt to stay relevant in the crypto age.

For some forward-thinking banks, this has meant incorporating new services and functionality, to provide customers with secure and regulated access to cryptocurrencies and digital assets. Despite its current market-related woes, Deutsche Bank has been more proactive than many in embracing digital assets, having recently completed a digital fund management concept, as Observers reported last month.

Alongside this, an ever-increasing number of central banks, from countries spread across the entire planet, have undertaken feasibility studies to decide whether they ought to create their own blockchain-based digital currency to maintain sovereign control over monetary supply. This has led to a wave of central bank digital currency (CBDC) projects in various stages of consideration, development, pilot, or in some cases which have already launched.

The more shall we say ‘conservative’ commercial banks have been watching these developments and have realized a few home truths:

1/ A retail CBDC enabling easy digital payments could essentially make bank accounts obsolete overnight.

2/ If a significant proportion of customers close accounts and withdraw their money from the bank, it collapses.

3/ They are currently quite happy with their huge profits and don’t particularly want to collapse, thank you very much.

In the face of such an existential threat, some banks chose not to evolve at all. Instead, they have reverted to their usual underhand methods of lobbying central banks and regulatory authorities to either cripple the functionality of potential CBDCs before launch or litigate the competition out of all existence.

Others have accepted that they can’t realistically beat the FinTechs in a fair fight, so have decided to finally join them. This has involved belatedly upgrading the infrastructure they have been relying on for decades longer than its shelf-life, often with a sprinkling of that magical blockchain technology stuff which made crypto such a success in the first place. A recent example of this is the Deposit Token proposed by a Swiss banking group as reported earlier this month.

Which brings us to the Regulated Liability Network (RLN), a white paper published in November last year, whose contributors all work for organizations which have a vested interest in banking’s current status quo.

This weighty tome stretches to nearly 50 pages including appendices, disclaimers and notes, which may be a deliberate ploy to discourage anybody from actually reading it all the way through. Luckily we did, so you don’t have to. There is a lot of jargon and needless repetition, so we’ll paraphrase:

Current money is a liability. It is the liability of the central banks and commercial banks, it is sovereign, regulated and (it is claimed) has a “maximize(d) […] probability of redemption.” Private money is a liability of the company issuing it. In the case of cryptocurrencies and stablecoins, this is non-sovereign, non-regulated and non-liability which is scary and bad.

However, everyone agrees that the current banking system of proprietary and remote ‘island’ databases isn’t particularly efficient, whereas the shared ledger technology used by cryptocurrencies is both vastly more efficient AND programmable.

So the RLN proposes a rebuild of the current international banking system using shared ledger technology so that both the messaging and settlement of regulated liabilities can be carried out quickly and efficiently through the same system. Essentially it is the existing system with an 'upgraded' 24/7 SWIFT. Which is fine, and would clearly be an improvement over the current system, but why stop there?

Basically, because it keeps the bankers in a job. The recipe for the success of the RLN is easy and coded in the name of the concept: regulatory protection of the legacy system and preservation of the status quo for the bankers.

The white paper stresses how essential it is to have a two-tiered banking system, whereby commercial banks can make huge profits by lending out money that doesn’t belong to them while passing none of this profit back to the people who own it. This aspect of fractional reserve banking is what creates the ‘easy credit’ that fuels business and home loans, it claims.

No mention that this ‘easy credit’ also fuels the inevitable boom and bust cycles of the modern financial system and its regular flaws such as hyperinflation and sector bubbles. Let’s not forget the global banking crash of 2008, when public tax money was used to bail out these self-same banks, and which inspired the creation of cryptocurrency in the first place.

In truth ‘easy credit’ is anything but easy with the commercial banks and DeFi does better loans with programmable conditions and non-negotiable purely commercial terms.

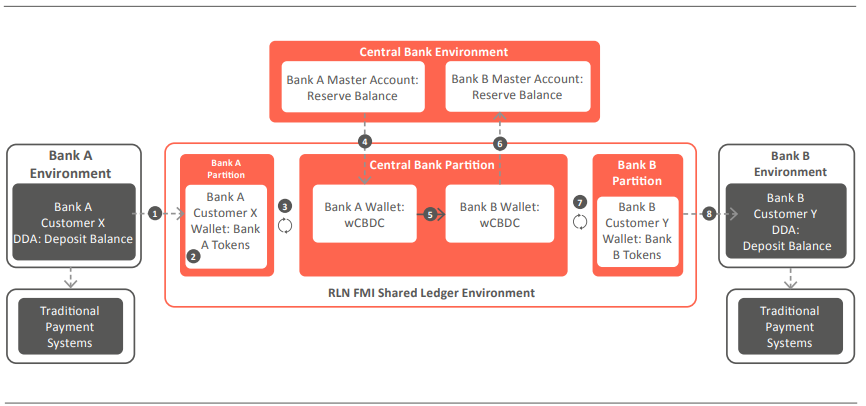

As a result, these proposals to improve the banking system using blockchain technology are all well and good, but they are invariably designed to retain the unnecessary layers of complexity that keep bankers rich. Take, for example, the RLN proposal for a transfer of funds from a customer of bank A to a customer of bank B.

This is shown as an 8-step process, rather than just, you know, the one blockchain transaction that it would take an ordinary person.

If the commercial banks want to stay in business then they should make themselves relevant by offering a compelling service and/or product, not just peddling the same broken system in a new suit and hoping the customers and central banks buy into that.

Because these days, the general public does have an alternative, and its name… is crypto.