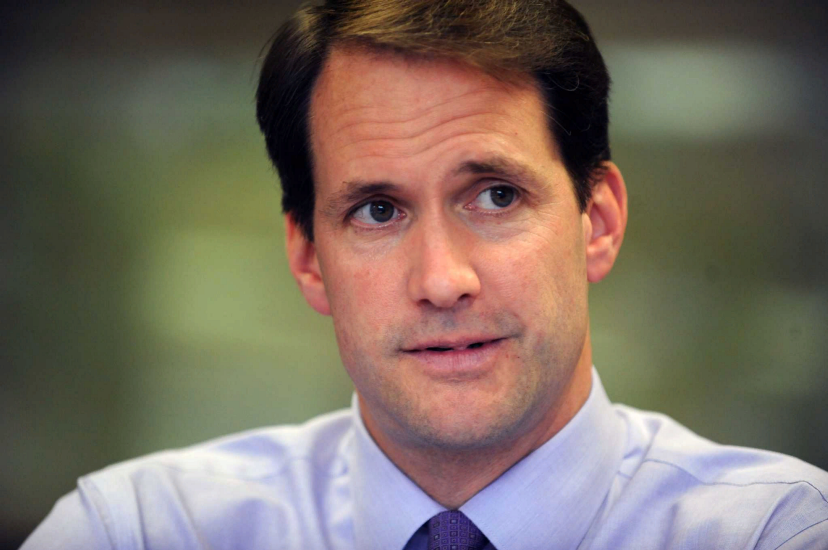

On June 22, Rep. Jim Himes published a paper titled “Winning the Future of Money: A Proposal for a US Central Bank Digital Currency” urging to establish a U.S. CBDC. The white paper embraces many aspects of digital currency: from architecture to risks and privacy issues.

Himes draws attention to the fact that many countries are running pilot projects of digital currencies or even have already launched their own CBDC, getting ahead of the United States in this matter. Among G20 countries only the U.S., Mexico, and the United Kingdom are still in the research phase.

The dollar’s dominance is also a matter of great concern for the lawmaker. We already looked into some de-dollarization trends amid shifts in Israel’s reserves, and Himes also noted in his paper that over time other global currencies had offered alternatives to the dollar as a reserve currency. The lag in the development of a U.S. CBDC threatens the dollar’s premier position. Notably, many southeast Asian countries prioritized developing their CBDCs just because of foreign digital currency expansion, namely the yuan (we briefly touched upon this topic when describing Soramitsu projects in the region).

As for the architecture, Himes suggests a CBDC should use a semi-distributed base, rather than a true blockchain. Intermediaries could access this network if they had a specific reason to and if it complied with their functional role. They also will be responsible for validating the authenticity of transactions. It appears that what he is describing looks more like a classic centralized database with different access levels.

It should be mentioned that the Republican politician is urging the Federal Reserve to authorize and issue a CBDC, just like a physical dollar. He highlights that the latter has gained trust all over the world, and a digital alternative will follow in its predecessor’s footsteps.

As to the matter of risks, he details some standard technical issues like privacy and security. Apart from that, he emphasizes the danger of a reduction in deposits, especially in times of financial stress, when a U.S. CBDC might be regarded as a safe refuge. To avoid that, the author suggests paying no interest on CBDC deposits.

Richard Turrin, the author of the book “Cashless: China’s Digital Currency Revolution” praised the politician for “one of the most thoughtful documents on the US CBDC” from the US government. He regrets, however, that the U.S. undermines the role of the new technology and lags behind other countries in a CBDC race.

Himes is the most recent politician to enter the debate over digital currency. Recently, Stephen Lynch, a member of the Financial Services Committee and the head of the FinTech Task Force, also a Republican, presented a proposal for E-Cash that would use a private wallet system that is not based on a blockchain.