Ripple Labs will pay $125 million to settle charges with the U.S. Securities and Exchange Commission (SEC) but secured a crucial legal victory when a federal judge ruled that its sales of XRP tokens on digital asset exchanges did not constitute securities offerings. The SEC is expected to appeal the ruling.

The SEC sued Ripple in 2020, alleging the company raised $1.3 billion through an unregistered securities offering. The regulator sought nearly $2 billion in penalties. Last July, U.S. District Judge Analisa Torres in Manhattan ruled Ripple's direct sales of XRP to institutional buyers were unregistered securities offerings but concluded that programmatic sales on exchanges did not violate federal securities laws.

On April 7, Judge Torres found that the company's 1,278 institutional XRP sales violated securities laws and issued a $125.035 million fine.

"There is no question that the recurrent, highly lucrative violation of [SEC rules] is a serious offense. However, this case does not involve allegations of fraud, misappropriation, or other more culpable conduct."

Ripple CEO Brad Garlinghouse hailed the settlement decision as a "win," noting the amount was a fraction of what the agency initially sought. "The SEC asked for $2 billion, and the Court reduced their demand by ~94%," he said on X.

A final judgment. The Court rejects the SEC’s suggestion that Ripple acted recklessly and she reminds the SEC that this case did not involve any allegations of fraud or intentional wrongdoing, and no one suffered any financial harm. She rejects the SEC’s absurd demand for $2B in… https://t.co/RbwpBnoXJG

— Stuart Alderoty (@s_alderoty) August 7, 2024

This ruling dealt a blow to the SEC's regulation approach regarding cryptocurrencies. Critics have long argued that the agency's "regulation by enforcement" approach has hindered innovation and failed to provide clear guidelines for digital asset firms. James Seyffart, a senior analyst at Bloomberg, commented on X:

"I'm sure the SEC will refer to this as a win for getting a $125 million penalty. But that's really a win for Ripple as far as i'm concerned. And an L for the SEC's "regulation via enforcement" stance."

While the court has ordered Ripple to refrain from any future unregistered offerings of XRP to institutional investors, the company is permitted to continue its automated, programmatic sales of the token to retail customers through exchanges. This landmark decision will significantly impact similar cases between the SEC and crypto firms.

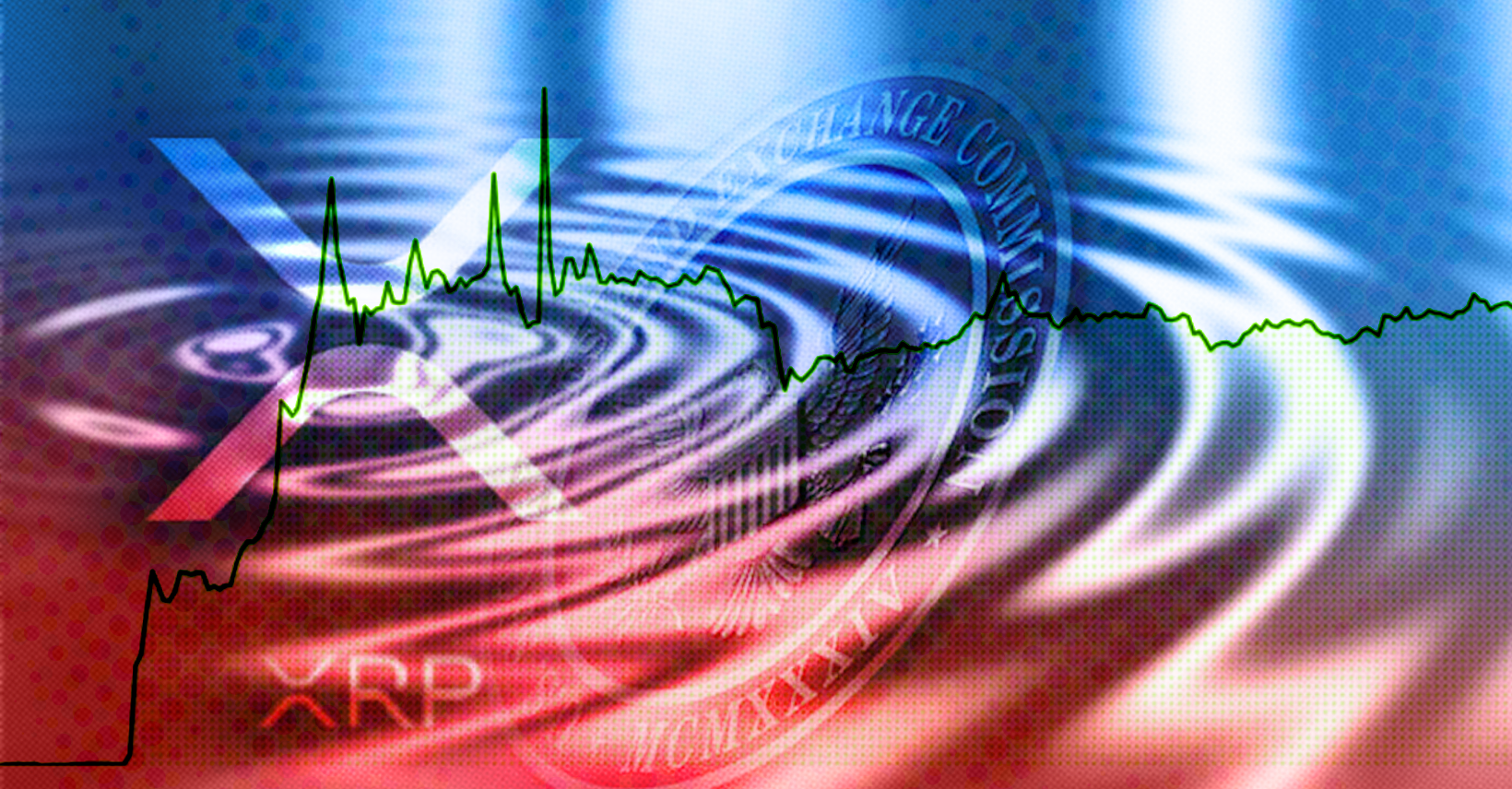

According to Coingecko data, XRP prices jumped from $0.50 to over $0.630 following the settlement news and have since stabilized at around $0.60.

The Timeline

- August 7, 2024: Judge Torres ordered Ripple to pay $125 million in civil penalty. An appeal by the SEC seems expected.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- May 6, 2024: SEC filed its remedies reply brief under seal, addressing Ripple's motion to strike the Fox Declaration.

- May 2, 2024: Ripple filed its reply brief, challenging the SEC's classification of Andrea Fox's testimony.

- April 29, 2024: SEC countered Ripple's objections, asserting the Fox Declaration as summary evidence for calculating disgorgement.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- March 22 to May 20, 2024: Proposed timeframe for submissions and redactions for the SEC and Ripple.

- April 22, 2024: Ripple filed its opposition against the SEC's fine request and a motion to strike expert testimonies due to "sandbagging."

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- March 25, 2024: The SEC filed a proposal for judgment, demanding nearly $2 billion in penalties against Ripple.

- October 23, 2023: The SEC voluntarily dismissed charges against the individual defendants (Garlinghouse & Larsen) with Judge Torres' approval.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- October 4, 2023: Ripple's Singapore subsidiary obtained its license to operate in the country. The trading volume of XRP nearly doubled.

- October 3, 2023: Judge Torres dismissed the SEC's request for an interlocutory appeal, as it does not meet the exceptional circumstances necessary.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- September 8, 2023: The SEC's deadline to file its response.

- September 1, 2023: Ripple filed its response to the appeal and stated that the SEC lacked any legal grounds for the appeal's success or relevance.

- August 18, 2023: Court deadline for the SEC to file its appeal.

- August 15, 2023: Judge Torres granted the SEC's request to file an interlocutory appeal. She also filed a notice of appearance for an investment banker declarant.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- July 13, 2023: Judge Torres ruled that XRP is not a security in the case of programmatic sales but that the token does meet the definition of security for sales made to institutional investors.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- June 13, 2023: The Hinman documents were expected to be released.

- June 5, 2023: The SEC removed Hinman's biography from its website.

- May 19, 2023: Reports emerged that the SEC and Ripple filed a joint letter requesting an extension to submit the Hinman speech.

- May 16, 2023: Judge Torres rejected the SEC's motion to keep the Hinman speech sealed.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- April 18, 2023: SEC Chair Gary Gensler testified at a congressional hearing without revealing whether ether was considered a security.

- April 16, 2o23: John E. Deaton shared a 2018 video featuring Tim Draper and Gary Gensler discussing potential lawsuits and the influence on financial regulators.

- March 6, 2023: Judge Torres issued an initial ruling excluding expert testimony from the summary judgment process in Ripple's legal battle with the SEC.

Observing moneytech and cryptoObservers

Observing moneytech and cryptoObservers

- March 3, 2023: Ripple filed a Supreme Court letter to Judge Torres.

- January 2023: Multiple organizations, including Coinbase, submitted amicus briefs in support of Ripple.

- November 30, 2022: SEC and Ripple submitted final submissions to the summary judgment motions.

- November 7, 2022: The LBRY blockchain lost a similar case against the SEC, resulting in a decline in XRP's value.

- September 17, 2022: Both the SEC and Ripple filed motions for summary judgment.

- January 24, 2022: Judge Netburn granted the SEC until February 17 to appeal the decision regarding sensitive government documents in the case.

- August 31, 2021: Ripple filed a motion requesting the SEC disclose its internal crypto trading policies.

- June 14, 2021: The SEC's deadline for disclosing internal crypto trading policies was extended.

- April 13, 2021: SEC Commissioner Hester M. Peirce published the Token Safe Harbor Proposal 2.0.

- March 22, 2021: Judge Netburn distinguished XRP from BTC and ETH in terms of currency value and utility.

- March 8, 2021: The SEC requested an immediate hearing in response to Ripple's arguments.

- March 3, 2021: XRP holders led by John E. Deaton contested the SEC's lawsuit, arguing that XRP is not a security.

- December 21, 2020: The SEC filed a lawsuit against Ripple Labs, Garlinghouse, and Larsen.