This week, Ripple Labs fired back at the U.S. Securities and Exchange Commission's (SEC) exorbitant fine proposal, calling it "more evidence of the administrative overreach that has beset this case," according to the company's remedies opposition filing. Last month, the SEC requested a staggering $2 billion in penalties, including disgorgement, pre-judgment interest, and a civil penalty, related to Ripple's sales of XRP, its native token.

The regulator's fine request came amidst a long-running battle regarding the classification of XRP. The SEC maintains that XRP functions as a security that the blockchain firm failed to register. Ripple adamantly disagrees, arguing that XRP is a utility token used to facilitate fast and cheap cross-border payments. Utility tokens, unlike securities, are not considered investment contracts and, therefore, not subject to securities regulations.

In its filing, Ripple called the SEC's proposed fine "ungrounded in law or principle" and "wholly out of proportion to any violation that Ripple may have committed," even if the court were to lean in the SEC's favor on the security classification. According to Ripple, the penalty should not exceed $10 million.

Ripple argues that most XRP sales were conducted outside the United States and did not involve U.S. investors. Ripple also says that, since the court's ruling last year, it has "changed the way it sells XRP and changed its contracts to avoid the problems identified by this Court" and that the company has "ensured that its counterparties qualify as accredited investors."

"The SEC’s draconian remedial requests are ungrounded in law or principle. This Court should reject them in their entirety."

The company also argues that the SEC's request for disgorgement is unlawful because it seeks to recover funds that were not obtained due to any wrongdoing. Furthermore, Ripple states that its actions were not egregious. The firm sold XRP to 41 "sophisticated individuals and entities" over eight years.

"Those entities were fully informed about the transactions into which they were entering and chose to do so in their own financial interests. There is no allegation that Ripple deceived or misled them."

Ripple's Chief Legal Officer, Stuart Alderoty, said on X that the SEC's fine request proves "its ongoing intimidation against all of crypto in the U.S." Alderoty has been a vocal critic of the regulator and Chair Gary Gensler's witchhunt on crypto firms.

"Sandbagging" by the SEC?

Ripple also filed a motion to strike new expert witness materials submitted by the SEC on April 22. According to the filing, Ripple argues the court should disregard the SEC's recently submitted materials supporting its request for final judgment and penalties. Ripple's legal team specifically focuses on the timing of the SEC's submission:

"The parties engaged in more than three months of remedies discovery. During that time, Ripple served a supplemental expert report on disgorgement and the SEC deposed Ripple’s disgorgement expert. The SEC waited until the filing of its remedies motion to submit the Fox Declaration setting forth its remedies theories and calculations."

Ripple says the SEC's "Fox Declaration," referencing expert witness Andrea Fox, should have been disclosed during the discovery phase. The document contains expert testimony from Fox, an SEC enforcement division accountant, regarding Ripple's financial records and appropriate penalties for XRP sales.

The firm argues that this late disclosure violates the Federal Rule of Civil Procedure and constitutes "sandbagging," a tactic in which a party withholds information until a strategic moment to gain an advantage.

"The Fox Declaration contains accounting analysis and substantive conclusions about remedies that the Federal Rule of Civil Procedure and this Court’s orders required the SEC to disclose during discovery. The SEC’s untimely submission is precisely the type of sandbagging that Rule 37 is designed to prevent."

Ripple further argues that the SEC initially classified Fox as a "summary witness," suggesting she would not introduce new information. The agency and Ripple have until May 20 to provide their final revisions and submissions.

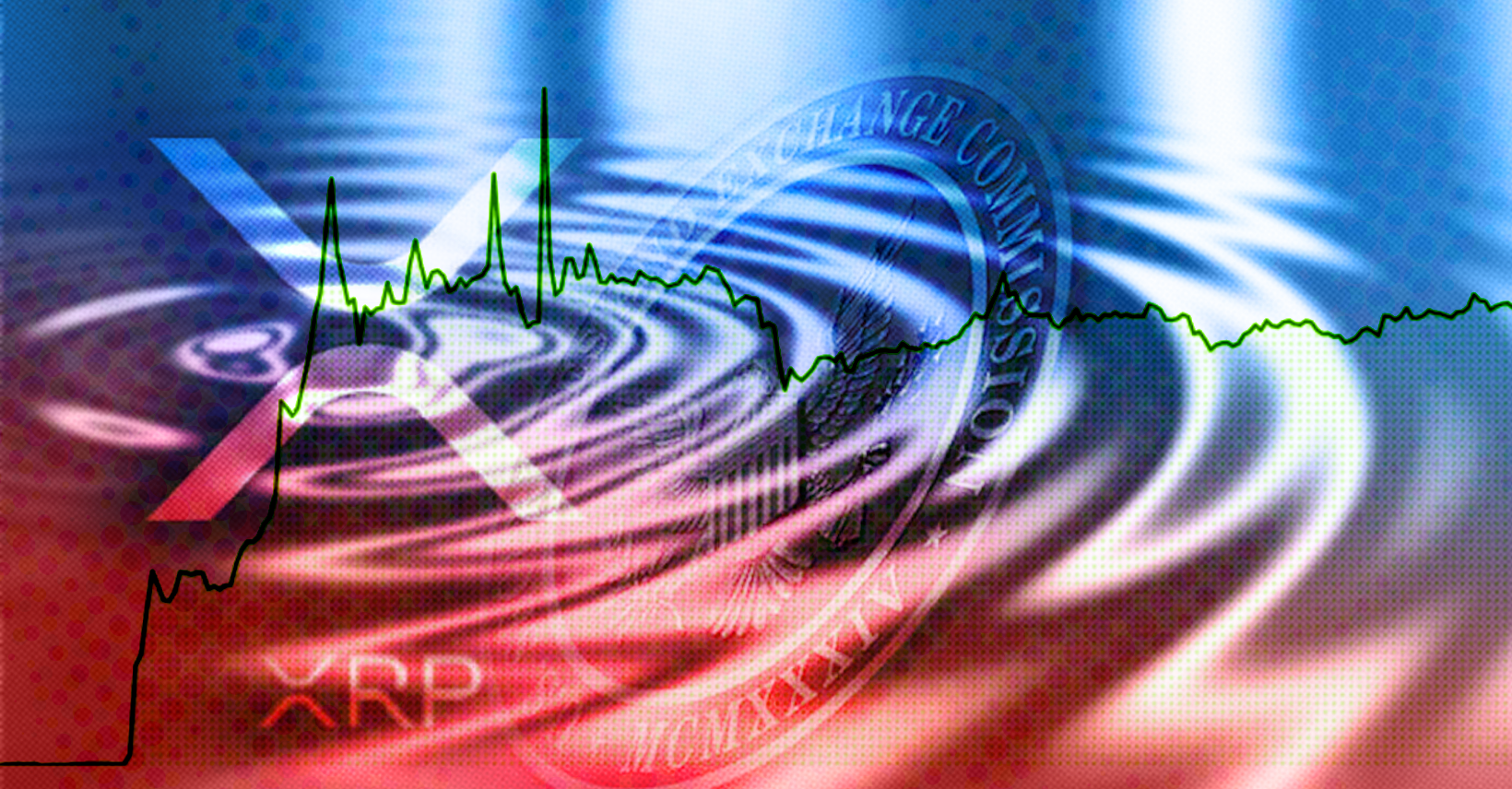

XRP Goes Up

According to CoinGecko data, XRP saw a steady increase in the days before Ripple's expected filing, rising over $0.56 on April 22 (6% rally) from an average of $0.50 in the past weeks. Some analysts predict that XRP could experience even more growth following the upcoming Bitcoin halving, with reports of "whales," large investors with significant holdings, investing in Ripple's token, based on Messari data.

$XRP is currently at a level that initiates an explosive rally. pic.twitter.com/eyKOb1tlZ5

— Mikybull 🐂Crypto (@MikybullCrypto) April 23, 2024

The Timeline

- March 22 to May 20, 2024: Proposed timeframe for submissions and redactions for the SEC and Ripple.

- April 22, 2024: Ripple filed its opposition against the SEC's fine request and a motion to strike expert testimonies due to "sandbagging."

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- March 25, 2024: The SEC filed a proposal for judgment, demanding nearly $2 billion in penalties against Ripple.

- October 23, 2023: The SEC voluntarily dismissed charges against the individual defendants (Garlinghouse & Larsen) with Judge Torres' approval.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- October 4, 2023: Ripple's Singapore subsidiary obtained its license to operate in the country. The trading volume of XRP nearly doubled.

- October 3, 2023: Judge Torres dismissed the SEC's request for an interlocutory appeal, as it does not meet the exceptional circumstances necessary.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- September 8, 2023: The SEC's deadline to file its response.

- September 1, 2023: Ripple filed its response to the appeal and stated that the SEC lacked any legal grounds for the appeal's success or relevance.

- August 18, 2023: Court deadline for the SEC to file its appeal.

- August 15, 2023: Judge Torres granted the SEC's request to file an interlocutory appeal. She also filed a notice of appearance for an investment banker declarant.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- July 13, 2023: Judge Torres ruled that XRP is not a security in the case of programmatic sales but that the token does meet the definition of security for sales made to institutional investors.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- June 13, 2023: The Hinman documents were expected to be released.

- June 5, 2023: The SEC removed Hinman's biography from its website.

- May 19, 2023: Reports emerged that the SEC and Ripple filed a joint letter requesting an extension to submit the Hinman speech.

- May 16, 2023: Judge Torres rejected the SEC's motion to keep the Hinman speech sealed.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- April 18, 2023: SEC Chair Gary Gensler testified at a congressional hearing without revealing whether ether was considered a security.

- April 16, 2o23: John E. Deaton shared a 2018 video featuring Tim Draper and Gary Gensler discussing potential lawsuits and the influence on financial regulators.

- March 6, 2023: Judge Torres issued an initial ruling excluding expert testimony from the summary judgment process in Ripple's legal battle with the SEC.

Observing moneytech and cryptoObservers

Observing moneytech and cryptoObservers

- March 3, 2023: Ripple filed a Supreme Court letter to Judge Torres.

- January 2023: Multiple organizations, including Coinbase, submitted amicus briefs in support of Ripple.

- November 30, 2022: SEC and Ripple submitted final submissions to the summary judgment motions.

- November 7, 2022: The LBRY blockchain lost a similar case against the SEC, resulting in a decline in XRP's value.

- September 17, 2022: Both the SEC and Ripple filed motions for summary judgment.

- January 24, 2022: Judge Netburn granted the SEC until February 17 to appeal the decision regarding sensitive government documents in the case.

- August 31, 2021: Ripple filed a motion requesting the SEC disclose its internal crypto trading policies.

- June 14, 2021: The SEC's deadline for disclosing internal crypto trading policies was extended.

- April 13, 2021: SEC Commissioner Hester M. Peirce published the Token Safe Harbor Proposal 2.0.

- March 22, 2021: Judge Netburn distinguished XRP from BTC and ETH in terms of currency value and utility.

- March 8, 2021: The SEC requested an immediate hearing in response to Ripple's arguments.

- March 3, 2021: XRP holders led by John E. Deaton contested the SEC's lawsuit, arguing that XRP is not a security.

- December 21, 2020: The SEC filed a lawsuit against Ripple Labs, Garlinghouse, and Larsen.