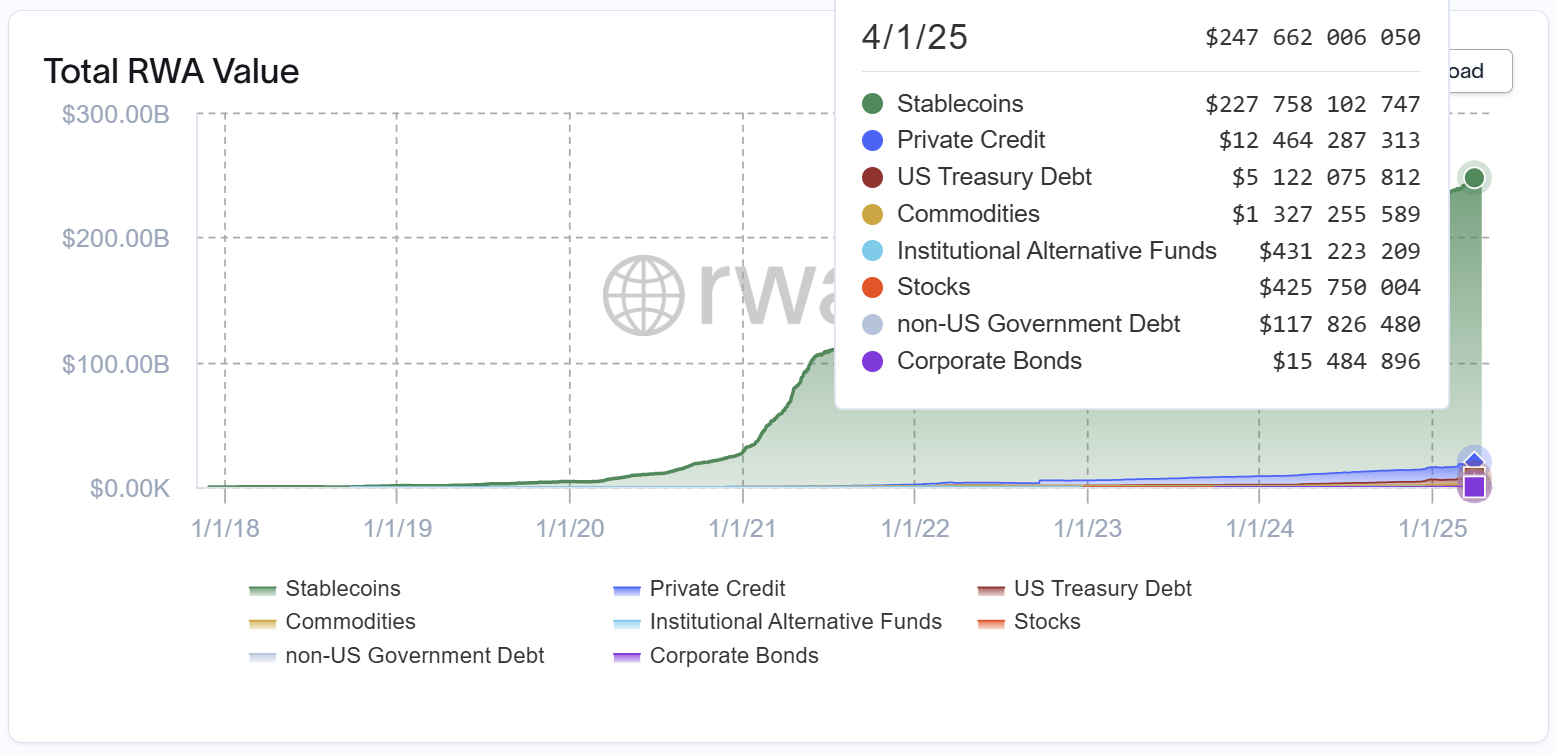

Real-world assets (RWAs) have quietly become one of the fastest-growing areas in crypto. In 2024, the sector grew by over 80%, reaching $247 billion. So far in 2025, monthly RWA issuance—including stablecoins—has averaged around $100 million, with 20% of that coming from non-stablecoin RWAs. However, according to industry research, this number could increase significantly by 2030. Several reports estimate the RWA market size in 2030, with projections ranging from $2 trillion all the way up to $30 trillion.

RWAs basically refer to bringing real-world assets—like real estate, government bonds, private loans, or gold—onto the blockchain. These assets are turned into digital tokens, so they can be traded, lent, or used as collateral within crypto ecosystems, just like any other on-chain asset.

Tokenization gives these assets new capabilities they didn’t have before:

- Fractional ownership lets regular investors access assets that were once only available to the wealthy or institutions.

- Transparency improves because blockchain records are permanent and verifiable.

- Fees can drop thanks to fewer middlemen and more efficient processes.

- Liquidity increases because tokenized assets can be traded more easily than their traditional forms.

Tokenized Real World Assets By Category

Right now, stablecoins—basically tokenized versions of fiat currencies—make up the biggest chunk of the RWA market, with about $227 billion in market cap. But other types of tokenized assets are catching on too, including private credit, treasuries, commodities (like gold), public equities, real estate, and even carbon credits.

The current market size of non-stablecoin tokenized RWA is around $21 billion, more than tripled since the start of 2024.

Tokenized private credit is leading that group, with $12.8 billion in active loans, up more than 90% year-to-date. This kind of credit usually comes from non-bank lenders financing smaller companies that don’t qualify for traditional loans.

The next largest category is tokenized U.S. Treasury debt, which holds some similarities to stablecoins since those are also mostly backed by U.S. Treasuries. However, unlike stablecoins, this product passes the yield from its collateral to the token holders. Since some stablecoins are also experimenting with yield sharing, we will likely see a convergence of these two categories.

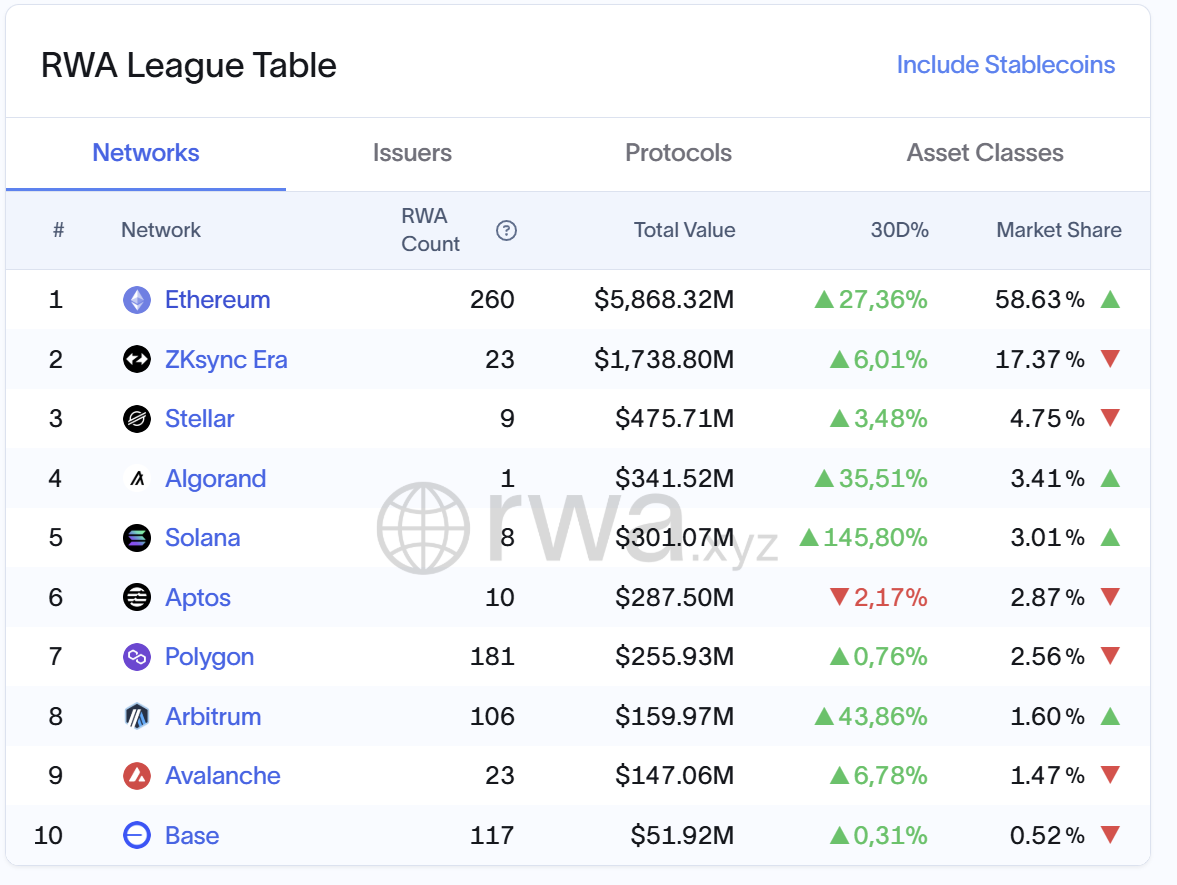

Tokenized Real World Assets By Blockchain

Most RWAs today live on Ethereum and its Layer 2 networks, which together make up over 78% of the total market. In particular, zkSync Era, an Ethereum Layer-2 that utilizes Zero-Knowledge Rollups emerged as the second-largest blockchain platform for tokenized RWA. It holds approximately 26% of the RWA market share, with over $1.74 billion in tokenized assets across 23 projects.

Other blockchains, including Stellar, Algorand, Solana, and Apto, are starting to gain ground. Each hosts hundreds of millions in tokenized assets.

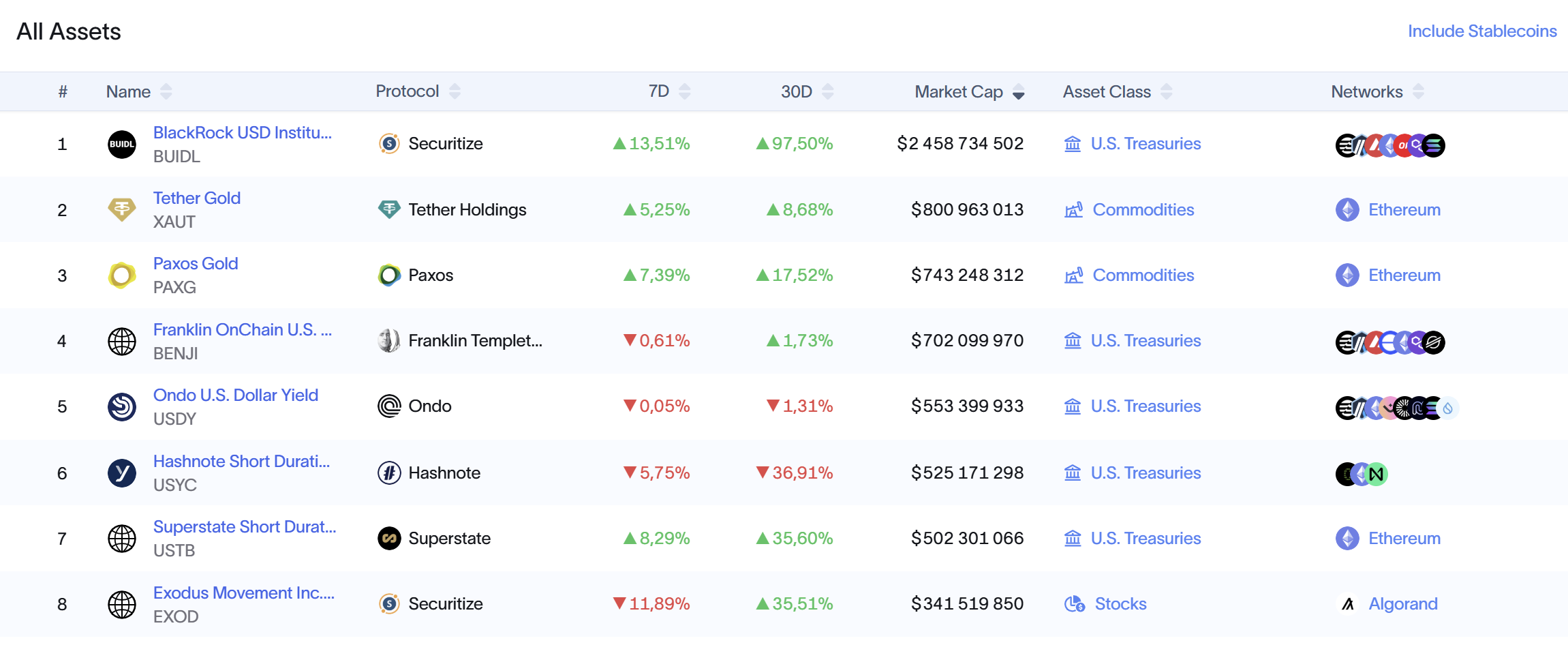

Tokenized Real World Assets By Issuers

In terms of issuers, BlackRock’s BUIDL fund (which holds U.S. Treasuries) is currently the biggest in the space. It is followed by gold-backed tokens from Tether Gold and Paxos Gold.

Franklin Templeton's BENJI Token, which represents the Franklin OnChain U.S. Government tokenized money market fund, accounts for the majority of Stellar's RWA value. The total value of assets under management across all blockchains exceeds $700 million.

Altogether, there are already over 800 RWA tokens floating around, covering a wide mix of real asset types.

Natively Digital Assets

Natively issued digital assets, such as bonds created and managed entirely on blockchain platforms without traditional off-chain counterparts, represent a smaller portion of the RWA market. Over the past 18 months, approximately $1.6 billion in digital bonds have been issued by various entities, including sovereigns, corporations, and financial institutions. These bonds are predominantly issued on private blockchains, with payments often settled off-chain through traditional systems. These classes of assets are emerging as key innovative financial instruments within the blockchain ecosystem.

The asset tokenization market, which includes both tokenized traditional assets and natively issued digital assets, is projected to experience significant growth, reaching trillions of U.S. dollars in value.

These bullish forecasts aren’t just hype—there is real substance behind them. In theory, almost every traditional financial asset can be brought on-chain or replaced by a natively digital asset. And over time, we will likely see more of that happen. We are talking trillions in public stocks, trillions more in private companies, massive real estate markets worth hundreds of trillions, and huge commodity markets—all of it could eventually be brought on distributed ledgers.