What has happened this week?

This Monday began with the testimony of the third key witness. Former FTX engineering chief Nishad Singh had earlier pleaded guilty and admitted making changes to FTX’s code that gave Alameda special privileges (although he now hopes to avoid prison time).

Singh told the jury about two meetings he had with Sam Bankman-Fried last year concerning the companies’ financial statements. According to his testimony, Singh learned from FTX co-founder Gary Wang that Alameda was borrowing $13 billion from the exchange. He then discussed this privately with the FTX CEO, asking him to curb unnecessary spending. Singh testified that Bankman-Fried said he wasn’t too worried and claimed that Alameda could deliver $5 billion relatively quickly and “substantially more” in the next few weeks to months. Singh said he agreed to stay on at FTX as Bankman-Fried persuaded him that his departure might lead to the fall of the company.

“How much are we short? … The wrong question. The right question? How much can we deliver?” - Singh recalls his conversation with SBF.

Singh also testified about the political campaign finance scheme, despite the fact that Bankman-Fried isn’t facing charges related to that in this trial.

The defence made Singh acknowledge that he had lived in a luxury penthouse, made political donations and backdated transactions to mislead the world about FTX’s revenues. It also questioned his credibility by showing some minor discrepancies between what he told the jury during the trial and what he'd supposedly told prosecutors earlier. The defence also tried to show that some of the spending was not that excessive taking into account that all the people involved considered themselves at least millionaires.

This week prosecutors also started calling some (let’s say) less intriguing witnesses. They have started with FTX user Tareq Morad who spoke about his understanding and expectations of how FTX would use his deposits. Among other “minor” witnesses was an FBI forensic accountant, whose testimony fell flat as defence lawyers highlighted mistakes in her analysis of the flow of funds, and FTX’s former general counsel Can Sun, who disclosed a spreadsheet he used to trace loans equal to $2.1 billion made by Alameda to Bankman-Fried, Gary Wang, Ryan Salame and Nishad Singh.

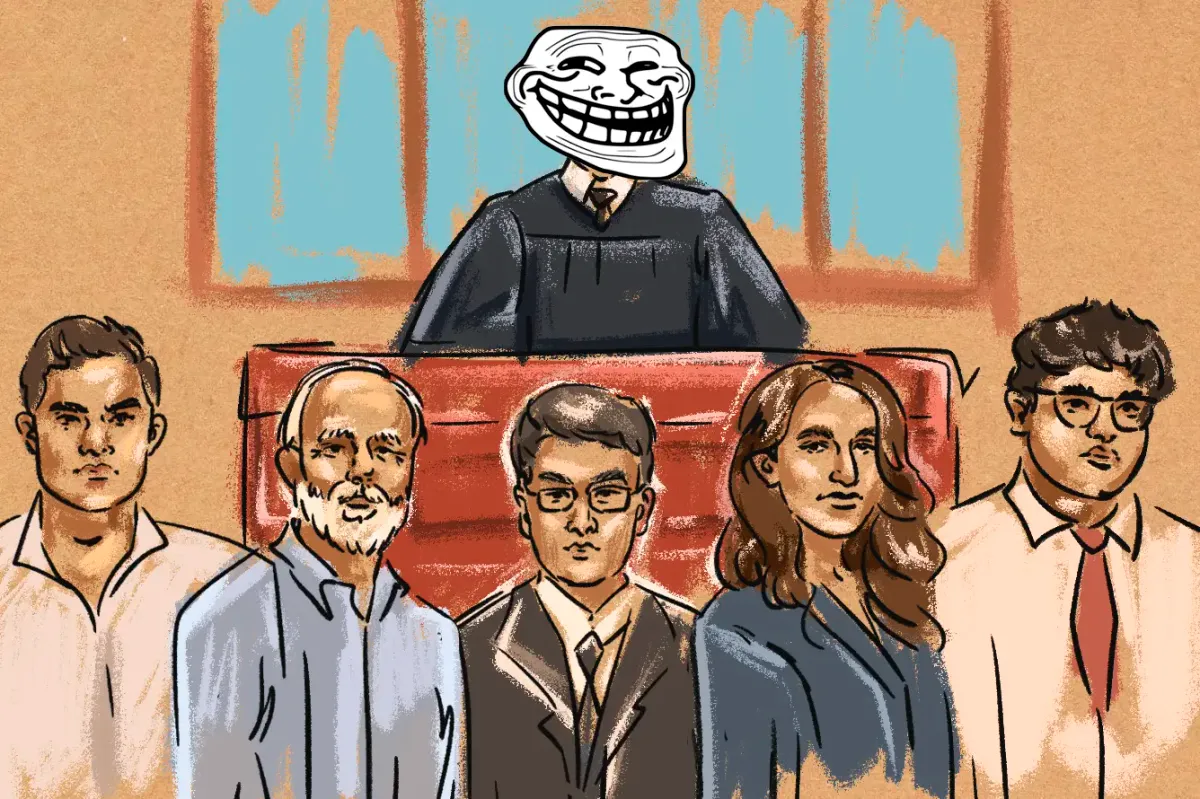

Later on Wednesday, prosecutors called ex-FTX lobbyist Eliora Katz, whose testimony was deemed useless, and Google bureaucrat Cory Gaddis, who testified about metadata while not being a metadata expert. Directly after this Kaplan scolded both the prosecution and the defence lawyers for wasting time and added that calling this witness was “a joke.”

"Lawyers are supposed to do a little better than this – and I’m talking to both sides," - Kaplan said.

Another witness called this week was Australian accounting professor Peter Easton, who teaches at Notre Dame and looks a little bit like Santa Claus. He was hired by the DOJ to trace Alameda and FTX funds. According to his analysis, Alameda had 57 accounts with FTX that could have negative balances, and used users’ funds to pay back its debts, invest in various ventures and donate to charity.

“Oh, yes,” - replied Easton when asked if FTX ever spent user deposits.

What comes next?

A filing last week suggests that the defence might use the argument that Bankman-Fried did not technically commit fraud thanks to the wording of FTX’s terms of service. His attorneys earlier proposed a British lawyer as a witness to explain the English laws governing FTX’s terms to the jury, but Judge Kaplan rejected this.

The defence is allegedly also trying to make the claim that clients still had credit to the deposited funds even if the money wasn’t there. The prosecution compared this argument to a scene in the movie 'Dumb and Dumber', in which Jim Carrey says IOUs (hastily scribbled notes that acknowledge the existence of a debt) are “as good as money.”

The trial will resume on October 26. Prosecutors told Judge Kaplan that they expect to finalize their case on that day, letting the defence begin its own case if it plans to do so.