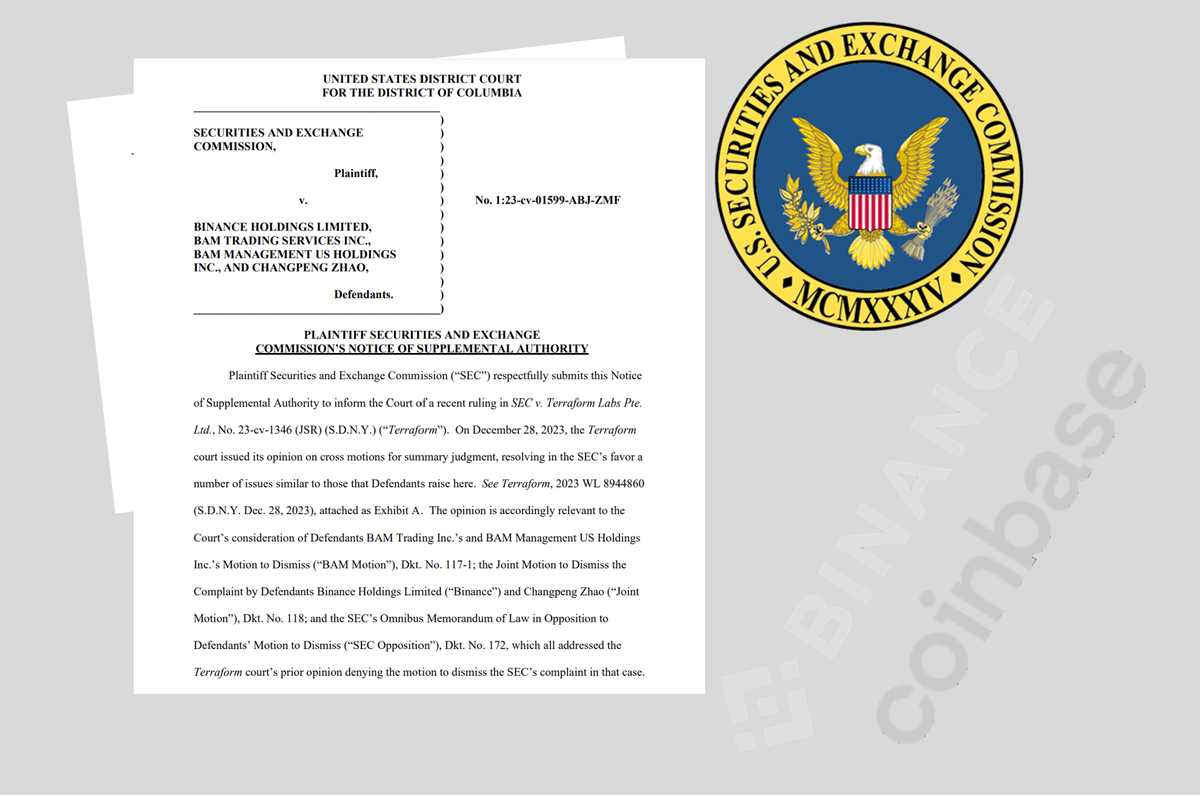

According to two new motions from the U.S. Securities and Exchange Commission (SEC), the authority wants to use its recent partial win in the Terraform Labs case as a precedent in the ongoing cases against the two largest crypto exchanges, Coinbase and Binance. The regulator has asked the courts to consider a recent ruling involving Terraform Labs to argue that the exchanges have previously traded unregistered securities.

At the end of December, the U.S. District Court for the Southern District of New York granted summary judgment on some of the claims in the ongoing SEC vs Terraform Labs case. The court sided with the SEC in finding that the collapsed company and its co-founder, Do Kwon, had indeed offered and sold unregistered securities. The federal judge ruled that Do Kwon and his company had violated U.S. law by failing to register its digital currencies. However, the court sided with Terraform Labs in dismissing claims concerning unregistered security-based swaps.

Despite both sides’ cross-motions for summary judgment on fraud claims, these will be presented in front of a jury at the trial scheduled for January 29, 2024.

“…genuine disputes of material fact linger that preclude summary judgment for any party on the fraud claims. Much of the SEC's evidence of scienter for its two fraud allegations… comes from third-party whistleblowers whose credibility is critical and whose testimony is subject to numerous challenges that are best resolved at trial.”

The SEC motion filed in the Coinbase case informs the court that the Terraform ruling granted a summary judgment for claims concerning the offer and sale of unregistered crypto asset securities, and that it “resolved in the SEC’s favor issues relevant to the consideration of Defendants’ motion in this case.”

The equivalent motion in the Binance case is more detailed but very similar. The SEC claims that the decision relating to Terraform Labs provides further grounds to deny Binance’s motion to dismiss the case. The authority compares the two companies’ services and tokens, saying that “the court’s analysis of the Terraform defendants’ so-called ‘stablecoin’ UST is particularly relevant to this Court’s consideration of Defendants’ arguments concerning Binance’s so-called ‘stablecoin’ BUSD.”

The SEC also has ongoing lawsuits against other crypto companies, including Kraken and Ripple, and might attempt to use the same ruling in these cases to support its position.

The SEC first charged Binance and Coinbase with various alleged securities law violations last summer. The CFTC had also earlier accused Binance of offering a derivatives trading service to U.S. customers without proper registration.

The two exchanges have been unwilling to go down without a fight and have vigorously defended their positions, with Coinbase also criticising the authorities for a lack of clear regulations. Despite the fact that in November Binance reached a resolution with many U.S. regulators, including the DoJ, CFTC and Treasury Department, the SEC’s lawsuit is still ongoing.

Over the last few months, the two exchanges and the SEC have kept themselves busy swapping court filings, singing the same old songs about the limit of authority and alleged legal violations. It remains to be Observed whether the Terraform Labs ruling is deemed relevant in either of the ongoing legal actions.