Major Ethereum block builders are "cooperating" with U.S. authorities to render Tornado Cash useless.

This conclusion comes as part of a study published by the Federal Reserve Bank of New York on Thursday on the effectiveness of the sanctions imposed by the U.S. Office of Foreign Assets Control (OFAC) on crypto-mixer Tornado Cash two years ago.

The researchers looked at user engagement with the privacy tool before and after the restrictions were imposed to determine the impact of the regulator's legal action in deterring users from using the app.

They concluded that the sanctions "significantly impacted overall interactions with Tornado Cash."

They also examined validators's compliance with the sanctions.

They determined that since the courts ruled the OFAC measures could be applied to smart contracts, "an increasing number of large builders, who are responsible for selecting transactions for settlement, cooperate with the sanctions by excluding Tornado Cash transactions from their blocks."

The change in validators' behavior from non-cooperative to cooperative has left Tornado Cash in a "precarious state" where it depends on a single builder to create competitive blocks that include the apps' transactions.

Changes in user engagement

Cooperation "can mean different things, depending on the type of actor along the Ethereum settlement process."

When it comes to users, it is all about engagement with the protocol.

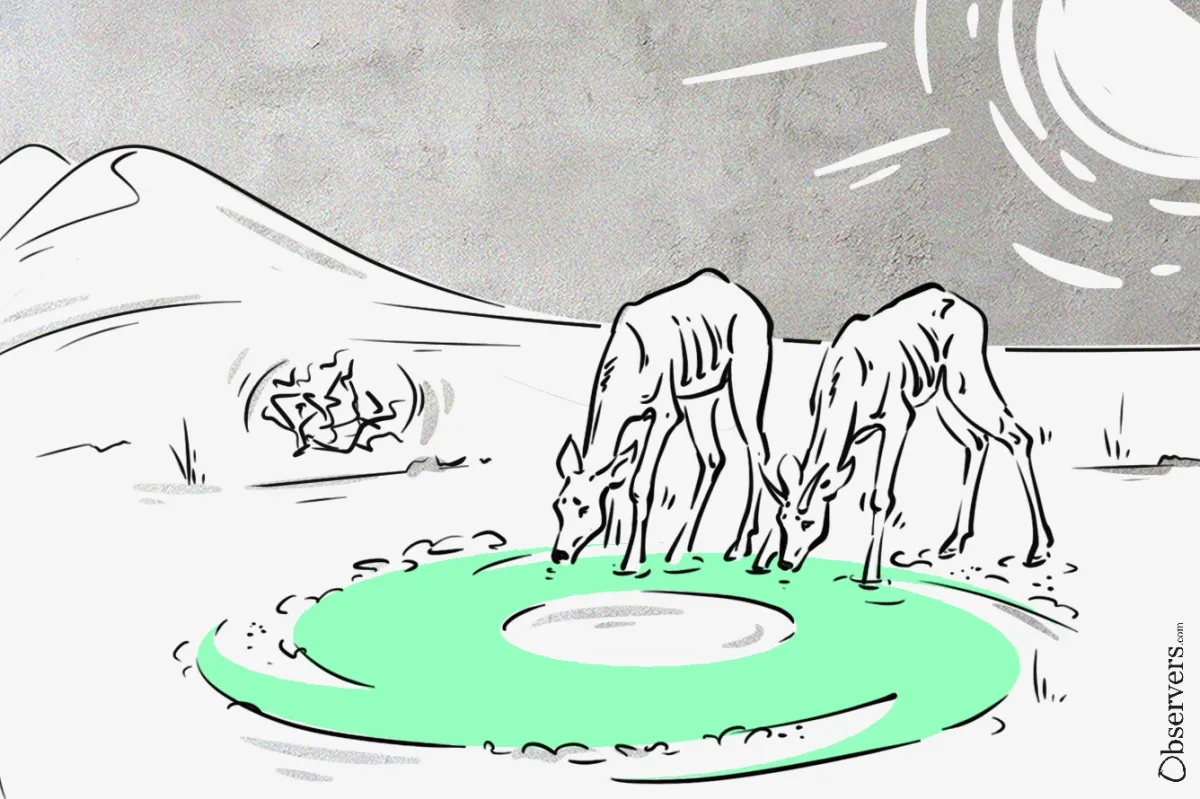

The number of users and their interactions with the app directly impact its effectiveness as a privacy tool: the higher the number of unique addresses depositing funds in the protocol's pools, the harder it is to connect the dots between the deposit and withdraw wallets.

Therefore, not only does interacting with Tornado Cash keep it relevant, but it is also vital for the crypto-mixer to function.

In the days following the agency's ruling, TORN, Tornado Cash's governance token, lost 60% of its market cap. Weekly transactions were down by 72% on average in all pools, with deposits registering a 74% decline and withdrawals falling by 69%.

The decline in user engagement negatively affected the "viability of Tornado Cash to provide its users with strong anonymity guarantees."

Some months after OFAC's mandate, deposits recovered and even surpassed their previous levels, allowing Tornado Cash to maintain its core function of providing privacy.

Unique addresses and transaction volumes remained low, leading to a deterioration in the level of privacy compared with the pre-sanction scenario.

The study indicates that the main reason users "cooperated" with the U.S. agency was that they lost the avenue to access Tornado Cash when OFAC blocked its website, Ethereum addresses, pools, and relayer services.

How Validators Can Censor Transactions

"Actors along the settlement chain can influence the effectiveness of sanctions on Tornado Cash to varying degrees."

To understand why validators are censoring Tornado Cash transactions, it is necessary to get to grips with the Proposer-Builder Separation (PBS).

PBS is a design feature of the Ethereum blockchain that separates the tasks of building blocks that yield maximum extractable value (MEV), performed by the builders, and the task of proposing the block to the network, done by the proposers.

PBS is off-chain and not officially part of the protocol. Nonetheless, since the proposal was introduced in September 2022, validators have been organizing themselves according to its guidelines.

Because maximizing MEV "requires sophisticated technical know-how and custom software" that is easy for institutional investors to obtain but not for smaller ones, separating the two functions guarantees that the blockchain's settlement process is inclusive and fair.

The Ethereum Foundation argues that PBS's first role is to prevent transactions from being censored at the protocol level because "complex inclusion criteria can be added that ensure no censorship has taken place before the block is proposed."

New York Fed, however, found that the practice was clashing with the theory.

While the market of block building is dynamic, with players and market shares changing through time, it is also deeply concentrated.

"12 builders account for about 79% of Ethereum blocks built over our sample period. Given that builders wield complete discretion over the inclusion of transactions in their blocks, a group of builders could float or sink the viability of sanctioned activity in Ethereum."

Validators not validating

Initially, validators defied OFAC.

In the year following the sanctions announcement, the inclusion of Tornado Cash transactions in blocks increased, with researchers pointing to a "perceived ambiguity with respect to the authority for and boundaries of OFAC's sanctions" as the reason why.

The tables turned in August 2023 when the courts ruled that OFAC had the authority to sanction smart contracts.

Immediately after the ruling, there was "a sudden and significant drop in the inclusion of Tornado Cash transactions in blocks built by multiple large builders."

"Towards the end of August 2023, block builders accounting for 89% of blocks validated began to no longer include Tornado Cash transactions in their blocks – a sudden departure from previous activity."

In the final observation period, from August to December 2023, Titan Builder (aided for a short time frame by Fatih Builder) was responsible for over 50% of all crypto-mixer transactions included in blocks sent to the proposers.

The centralization of the block building in a handful of players who have the power to decide which transactions to include in blocks has put Tornado Cash on the verge of being useless.

Users still see the utility in the privacy tool, but most block builders prefer to avoid it.

The situation is alarming, not only for Tornado Cash but also for all Ethereum dApps, as it shows that while smart contracts can't be deleted, they can be censored at the protocol level.