With a chartered banking services license on the line, SoFi has announced that it has thrown in the towel on crypto, as the FinTech company is halting its digital asset services. Users have three weeks to migrate their digital assets to alternative wallets, which they can do commission-free to Blockchain.com, before their accounts are automatically liquidated on December 19, 2023.

The San Francisco FinTech began offering crypto services four years ago, and was granted a banking charter license in 2022 on the condition that, for a 'conformance period' of two years, it would work to make the offering of digital asset services comply with existing or new banking legislation.

The hope that the U.S. market regulators would, in the meantime, adopt clear market guidelines has turned into ashes, as they seem determined to follow the current 'regulation by enforcement' strategy.

Taking precautions against the risk that legal actions taken by the Securities and Exchange Commission as part of its anti-crypto crusade might affect the rest of its $2 billion SoFi business, SoFi has opted to leave the market now.

"Changes in this regulatory environment, including changing interpretations and the implementation of new or varying regulatory requirements by the government or any new legislation, may impose significant costs or restrictions on our ability to conduct business, significantly affect or change the manner in which we currently conduct some aspects of our business or impact our business in unforeseeable ways."

The finance app has been closely monitoring how regulators have dealt with digital asset service providers. According its latest quarterly report, the conclusion is that "although many regulators have provided some guidance, regulation of digital assets based on or incorporating blockchain, such as digital assets and digital asset exchanges, remains uncertain and will continue to evolve."

With a bull market seemingly just around the corner, the company could have used the option to extend its conformance period for another three years.

However, SoFi has decided not to risk paying the financial, reputational and logistical price of complying with "a substantial number of new rules in a short time frame," which could involve obtaining additional regulatory permissions or defending any potential future charges against SoFi for alleged violation of any federal or state securities laws or regulations.

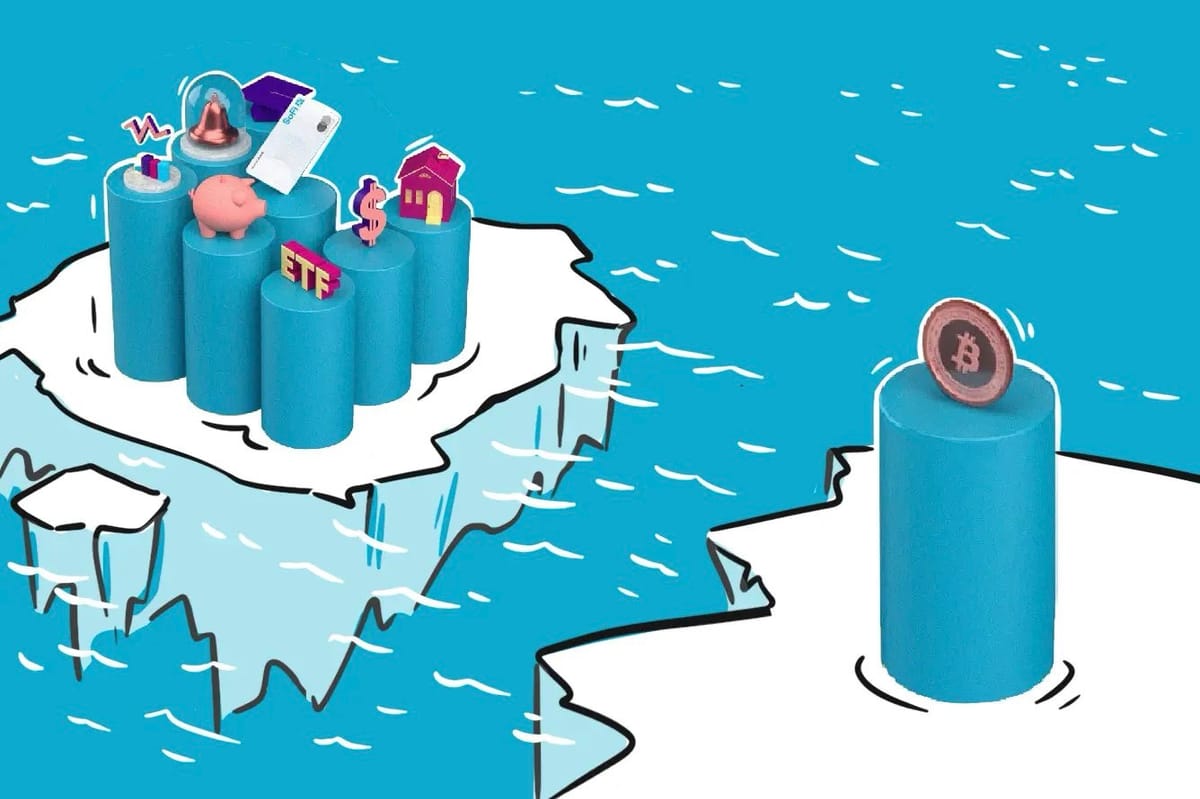

The legal uncertainty brought on by the SEC and other U.S. agencies adds fuel to an intrinsically speculative market. While the war on crypto is often seen as making capital formation unnecessarily difficult, in this case, it touches on an even more visceral issue - investor protection.

SoFi's efforts to abide by the rules and focus on a younger generation of investors made the financial services shop a safe space for inexperienced users to dive into crypto for the first time. That safe space is no more.