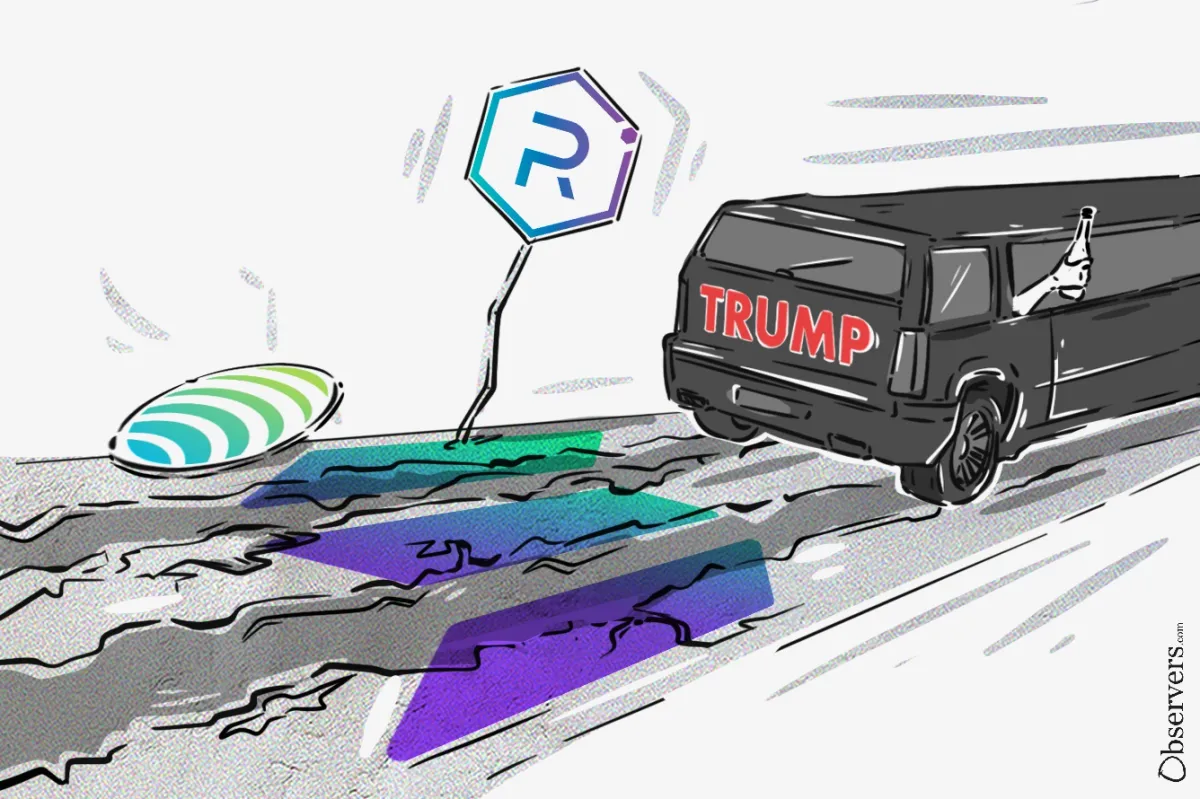

Over the weekend, the Solana network and its decentralized trading infrastructure underwent a real stress test. After Donald Trump and then the rest of his family launched their own memecoins on Solana, traders rushed to the network seeking opportunities.

Solana’s DEX volume skyrocketed to unprecedented levels. While during the week Solana’s average daily DEX volume was around $4 billion, on Saturday it broke records and surpassed a staggering $35 billion.

Weekly volumes on most of Solana’s popular DEXes increased severalfold. For example, on Meteora, the volume increased 15 times over the last 7 days.

Still, January 18th became the largest DEX volume day in the history of decentralized trading. To give some perspective, Binance’s average daily trading volume is around $76 billion, so the time when DEXes finally surpass CEXes might not be that far away.

In terms of network load, the day was also a record for Solana. On January 20, Solana collected a record $30 million in daily network fees. The previous record was set in November of 2024, with $13 million in fees.

Notably, when analyzing daily active addresses, we find that the number remains below the peak set in November 2024. This means most trading activity comes from users who are already familiar with Solana rather than newly joined users.

With the increase in volume and users, Solana’s network experienced a lot of pressure.

Although still quite small, transaction fees increased 15 times from 0.0001 SOL to 0.0015 SOL. Additionally, the increase in traffic affected the average transaction failure rate. It almost doubled, from 20% to around 40%. Currently, if we look at DEXes such as Jupiter and Raydium, the transaction failure rate stays at around 40%.

However, this is not new for Solana. When network activity surges, Solana nodes become overwhelmed and cannot process all submitted transactions, leading to many being dropped. Only a fraction make it through.

To improve their chances, bots start spamming the network with transactions. This spamming harms real users who cannot send transactions as rapidly, making it even less likely that their transactions will be processed. Notably, at the moment, around 50% of Solana's transaction volume is made by trading bots.

In addition, the influx of traffic created infrastructure issues. Users were reporting problems with the main Solana wallet, Phantom. However, Phantom seemed to fix everything quite quickly.

Overall, it seems like Solana has successfully gone through this stress test and is primed to continue growing, as the memecoin craze does not appear to be stopping—especially with the now U.S. president joining the trend.