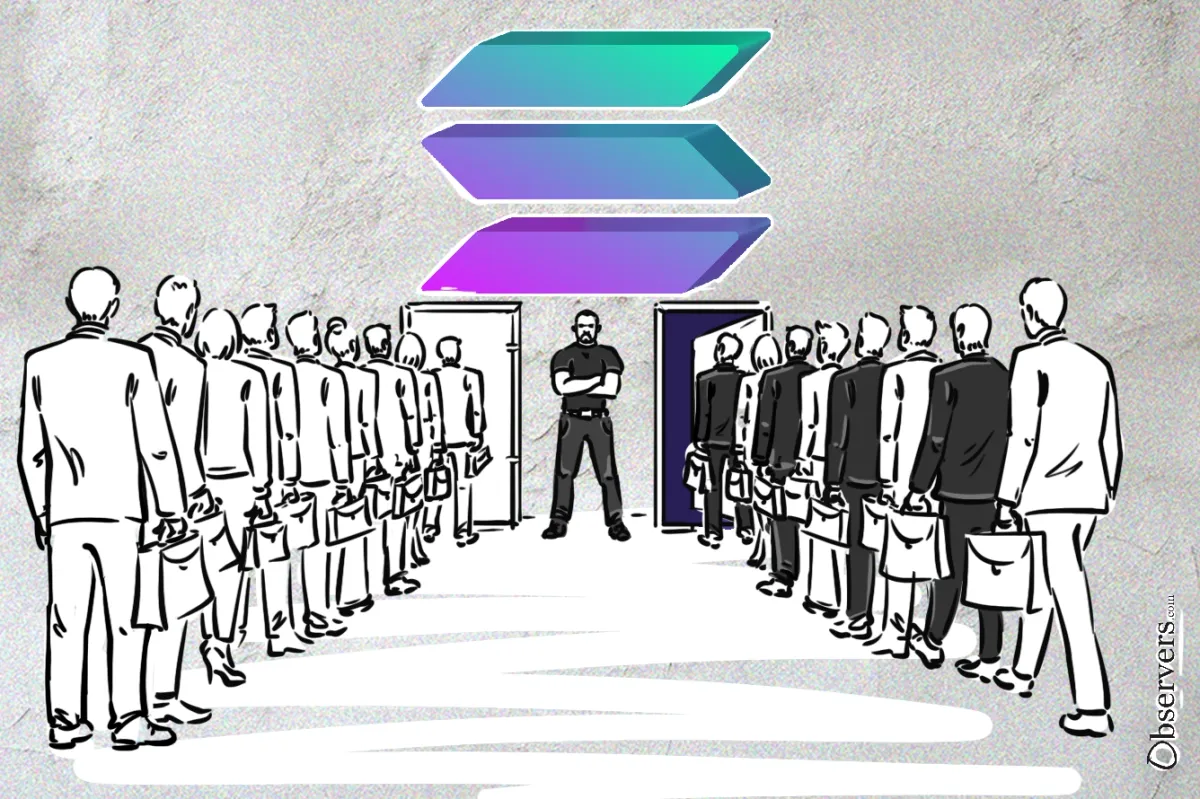

The Solana Foundation recently announced its decision to expel several validators from its delegation program due to their involvement in controversial Maximal Extractable Value (MEV) practices, including sandwich attacks targeting retail users.

The purpose of placing these two orders and surrounding pending transactions is to manipulate asset prices. The transaction placed before the user’s swap transaction inflates the asset price, worsening the exchange rate. Meanwhile, a transaction placed after effectively closes the trade by selling the asset.

Simply put, when you send a buy transaction to purchase a token, someone sees it, quickly buys the same token before you by offering higher fees to the validator, and then sells this token right after you’ve bought it, all within the same block.

This manipulation inflates the asset price just as the user’s transaction goes through, resulting in a poor exchange rate for the user and a profit for the attacker.

Notably, sandwich attacks were not previously possible on Solana. However, to skim extra profits from users, some validators modified their systems to allow such activities. Upon discovering these actions, the Solana Foundation decided to exclude these validators from its Delegation Program.

The news was confirmed by Tim Garcia, the Solana validator relations lead, in a Discord announcement. He made it clear that the decision to remove these validators was final.

Nevertheless, these validators can still operate on the network, but without the financial backing of the Foundation.

This move highlights the Foundation’s commitment to maintaining fair trading practices, distancing itself from validators who compromise user trust for personal gain. The removal led to considerable consequences for the implicated validators, with some losing over 90% of their staked tokens.

MEV remains a contentious issue within the cryptocurrency community, viewed by some as a sophisticated market strategy and others as outright manipulation. The European Securities and Markets Authority (ESMA) has recently highlighted MEV practices, such as sandwich attacks, in its proposed Markets in Crypto-Assets (MiCA) regulation, labeling them as market abuse. Should the MiCA regulations be enacted, utilizing MEV for profit could become illegal within Europe.

However, it is uncertain if this will effectively ban MEV on blockchains like Solana or Ethereum, given that participants might just shift their operations to jurisdictions with looser regulations to continue exploiting market inefficiencies for gain.

If you are concerned about sandwich attacks, a simple preventative measure is to adjust your slippage settings. Keep the slippage tolerance low to limit price changes during your transaction. This will effectively prevent sandwich attacks on your trades.