Solana has recently introduced a new token extensions feature, aiming to enhance compliance controls for businesses that launch tokens on its platform. These tools are tailor-made for businesses that require compliance, reporting, and permissions management. At the same time, they leverage the benefits of Solana’s decentralized environment, offering a balanced solution.

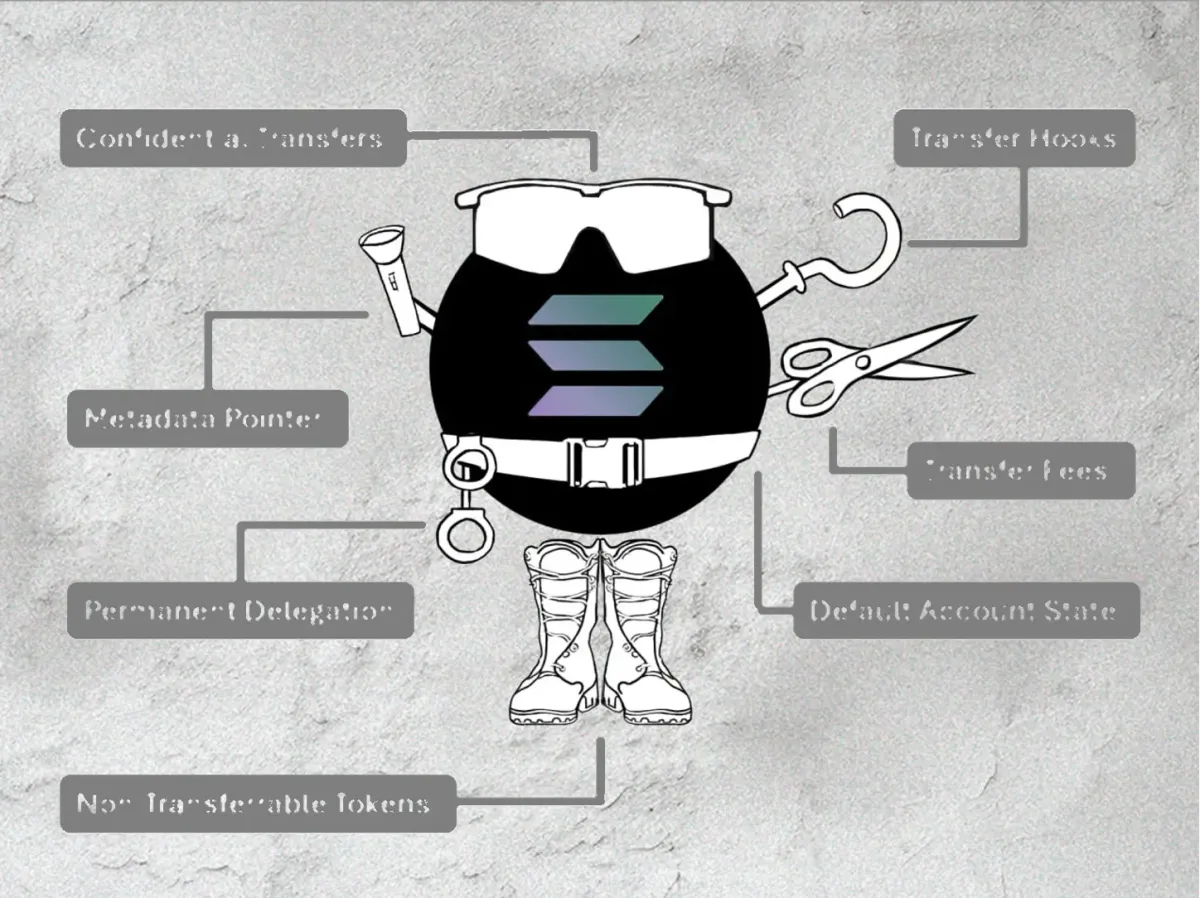

In essence, these extensions provide a range of valuable features for newly issued tokens on the Solana network. Key functionalities include:

Confidential Transfers: Hide user balances and transaction amounts - beneficial for on-chain payroll, B2B payments and treasury management

Transfer Hooks: Allow issuers complete control over wallet interactions and token-user dynamics - useful for KYC verification, token-gated access and royalty enforcement

Transfer Fees: Implement fees at the protocol level - applicable for permanent royalties, publisher fees and transaction costs

Permanent Delegation: Grant issuers irrevocable authority over a token - aiding in automatic subscription services, updating real-world assets and complying with stablecoin regulations like freeze and seize orders

Metadata Pointer: Create verifiable links between tokens and metadata - aiding in token verification and accounts receivable attribution

Default Account State: Set and enforce token account permissions - useful for KYC verification.

Non-Transferrable Tokens: Restrict token ownership reassignment to the issuer - applicable for managing external databases and creating non-transferrable NFTs or other assets.

According to Anatoly Yakovenko, co-founder and CEO of Solana:

“Solana is the first network to offer this level of integrated developer and user experience in a single token program. We’re already seeing the potential to build using token extensions via deployments from some of the most recognizable names in crypto.”

Interestingly, some stablecoin issuers on Solana have already begun implementing these token extensions. For instance, Paxos recently utilized permanent delegation, metadata pointer, transfer hooks and more for their USDP stablecoin launch. GMO Trust also announced the first regulated Japanese yen stablecoin and their U.S. dollar stablecoin on Solana, incorporating permanent delegation, default account state and the metadata pointer.

Unfortunately, projects that have already issued tokens on the Solana blockchain cannot access these new functionalities without migrating to the new standard. This migration process is complex, requiring all tokens of the previous standard to be burned.

Over the past few months, Solana has garnered substantial attention, drawing new users to its protocol and experiencing a significant price rise. Yet, whether Solana’s newly introduced token functionality will attract a significant number of enterprise clients remains to be seen. Historically, enterprises have been quite skeptical of anything related to blockchain.

We will continue to Observe.