Crypto markets have passed a couple of FUD weeks with bitcoin and other cryptocurrencies graphs in nosedive. The dip was instigated by the German authorities selling seized bitcoin and resulted in significant liquidations. However, not everyone panicked.

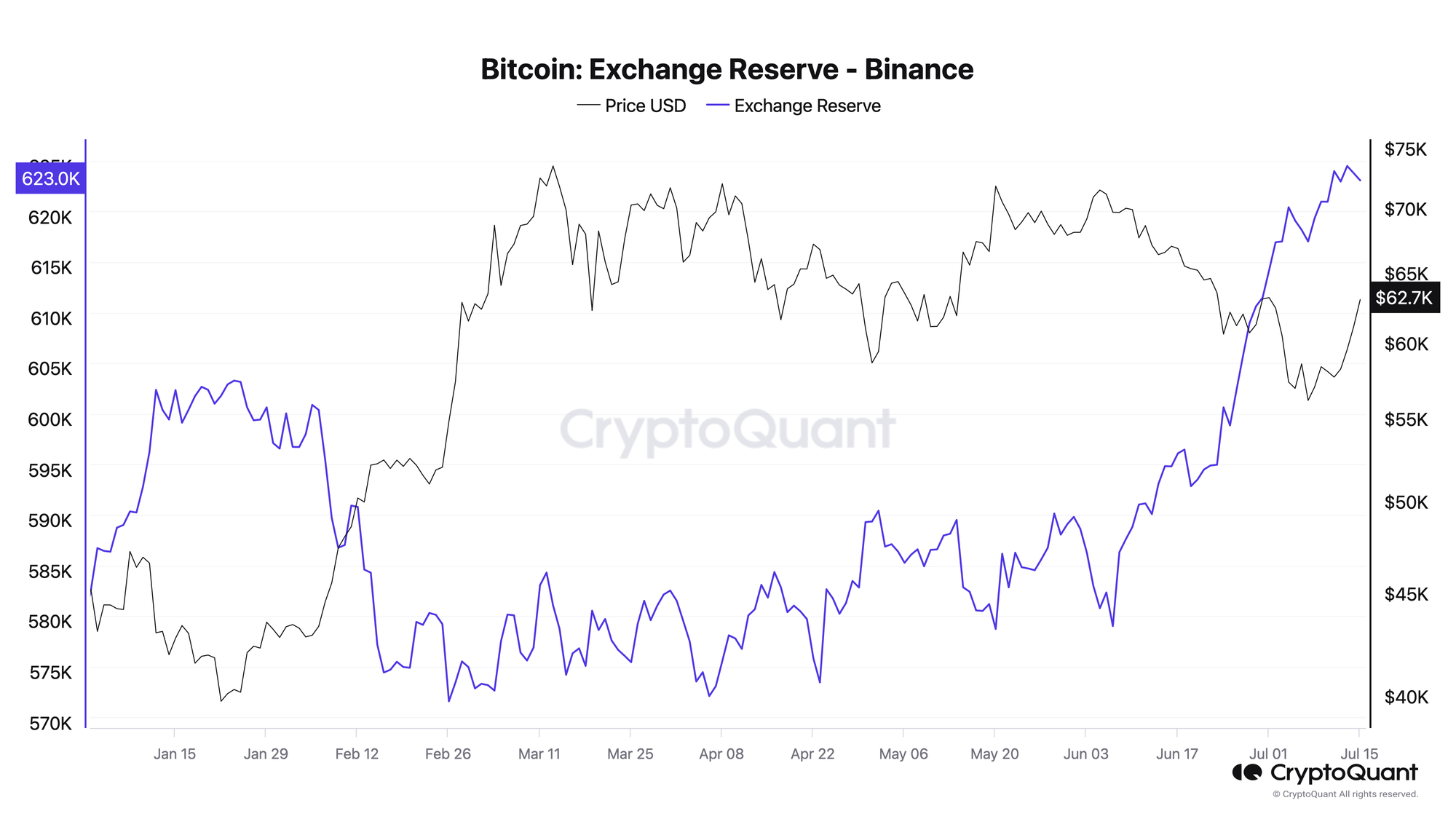

One on-chain researcher recently noticed that Binance increased its Bitcoin reserves by adding 41,000 coins to its existing reserves of 580,000 BTC. The move was made during the Bitcoin price dip when many were panic-sellling. And, Binance did the same earlier in the year.

During the same period, Bitfinex added around 13,000 BTC to its reserves and Upbit—5,000. The data shows that Bitcoin balance across CEXs is growing, which normally means an elevated level of selling pressure in the market.

It is not only institutional players who are bullish on Bitcoin. The whales were accumulating at their fastest rate since April 2023. Ki Young Ju, the founder of CryptoQuant, the major provider of on-chain and market data analytics, added that whales – neither ETFs, exchanges, nor miners – accumulated 85,000 BTC over the last 30 days (or 71,000 BTC within last week by other estimates), partially at the expense of ETF holdings. On July 5, the whales bought over 47,000 BTC at an average price of $57,000. At the same time, smaller traders have been selling during the dip. Ki Young further suggested that most of the selling volume currently available in the market can be digested in the over-the-counter market.

It is also interesting to see how German bitcoin sales were organized. Instead of hiring a specialist broker, the funds were dumped haphazardly on the retail market. After weeks of small transfers, the government rapidly accelerated in sending Bitcoin to market makers and exchanges. The German Government completely emptied its Bitcoin wallets by July 12.

The moment selected for the big sell-off was also questionable. Around the same time as Germany started transactions, Mt.Gox’s was preparing to repay its debtors, causing another down push on the prices.

Some say Binance and other buyers made a smart, profitable, and well-timed move by buying Bitcoin at a price we’ll never see again. Others add that the exchange helped stabilize prices and support the market. Either way, it's clear that despite so much growing support from institutional investors, it's still the retail traders and their volatile trading patterns who drive and shape the market.

Since the dip, BTC has significantly recovered, reaching $63,000 at the time of writing. Some experts even forecast the new ATH for Bitcoin by the end of this month.

"We are about to experience the longest bull run ever," - said another CryptoQuant expert.

The number of wallets that now hold at least 10 BTC has been increasing this month, also indicating the generally bullish sentiment.