This was a good week for Ethereum, with Ether’s price topping $3,500 and Spot Ether ETFs seeing almost $225 million of net inflows in just four trading days.

The bullish moment was expected, as Ethereum has been leading the conversation on innovation and has seen its activity surge in recent weeks.

Even in the competitive stablecoin arena, Ethereum has been able to overcome Tron as the blockchain hosting the most USDT.

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich

The Ethereum community also had great news coming from the courts this week, with the U.S. Fifth Circuit determining that because nobody can change immutable smart contracts, they can’t be sanctioned.

The decision implies that, after more than two years, people can again interact with Tornado Cash without fear of judicial prosecution.

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

One fight was won, but the battle for decentralization is far from over.

The founders of Tornado Cash are still being prosecuted and being repressed as part of the anti-crypto crusade.

One of them, Roman Storm, was debanked on the day after the Fifth Circuit verdict was known.

He shared the experience online, as many crypto founders and users did in the last couple of days.

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

Having a bank account shut down without warning or explanation is something that has been happening quite a lot to people in the U.S. crypto industry.

Marc Andreessen discussing the matter on the Joe Rogan Experience podcast earlier this week has led to many of them finally telling their experience publicly for the first time, in what resembles a #MeToo movement of the debanked.

🔥 Highlights Of The Week

- UK Court rules Craig Wright is not Satoshi Nakamoto;

- Vitalik Buterin donated $1 million to the defense fund of Tornado Cash founders;

- TON launches Teleport bridge for Bitcoin transfers as tgBTC in Telegram.

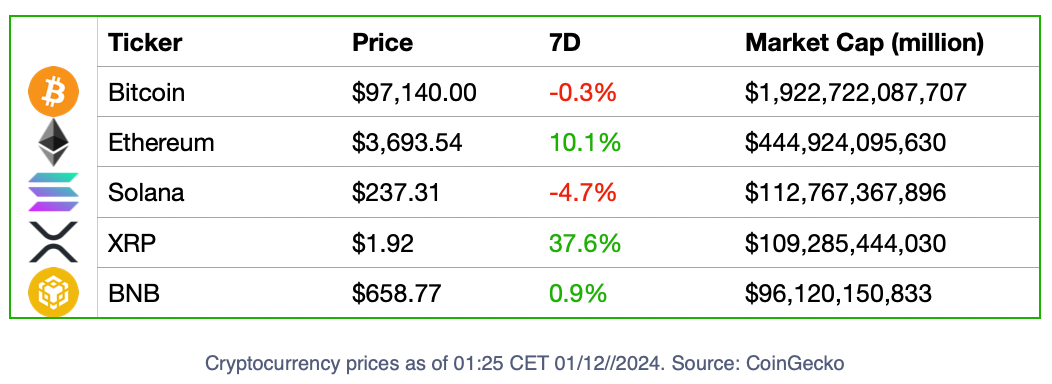

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- Despite most Polymarket users abandoning the platform after the U.S. elections, the prediction market still has the mechanics to power the next generation of information analysis. Volume, however, is essential, and Polymarket needs to find a way to attract users again.

😈 Crypto Naught And Sloppy

- Huobi’s HECO blockchain is closing after four years of trying to provide users with a low-fee ecosystem for small transactions. Launched in December 2020 with the best of intentions, the L1 struggled to create a strong community and Justin Sun’s involvement, rather than bringing in losers, led them to run to more popular alternatives.

📚 Deep Dive: Bittensor

In its quest to dethrone the giants of Silicon Valley in the AI models battlefield, Bittensor launches an EVM layer that will allow it to source help to its cause from decentralized aligned allies.

Bittensor’s platform is a free and equalitarian place for the exploration of machine learning models. Deep dive here to understand more about it:

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

What’s Cooking, Wallet Connect?

Wallet Connect has launched the $WCT token on Tuesday.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

The project is widely known in the decentralized world for its essential role in connecting wallet protocols to dApps.

Its network supports over 600 wallets and has facilitated more than 150 million connections for over 23 million users.

This week’s token launch introduces the next step of its vision: developing a decentralized database managed by nodes: offering web services that need to maintain state and require low latency and high throughput.

Will this be another recipe for success?

⚠️ Warning Centralization ⚠️

Although the Ethereum network might have over one million validators, only two block builders, Beaverbuild and Titan Builder, have 88% of the market share.

MEV-Boost middleware is a system of block auctions that helps independent validators choose the most profitable transactions to include in the block they build.

While it ensures steady reward validators, it requires them to give away control to block builders regarding which transactions are included in blocks, creating room for censorship.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

Solana, too, has a centralisation problem with its validators.

While the situation is widely known and largely considered one of the worst aspects of the blockchain, the consequences of its centralisation are less frequently discussed.

Now, it has come to the public's attention that the largest crypto exchanges are using their vast user bases to make giant profits from Solana.

Coinbase and Binance, currently the third—and fourth-largest validators of the Solana network—use their reliability status to convince users to stake Solana with them at much higher commissions than users would need elsewhere.

While the situation is most striking on Solana, these exchanges also apply similar profit-making strategies to other blockchains.

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich

How To Grow A Stablecoin: Connect With Wallet and Give Interest

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

To generate interest in their products, Coinbase and Circle have partnered to introduce an interest feature in Coinbase Wallet.

In the European Union, the implementation of the scheme was immediately prohibited but on other geographies where it is available users can earn 4.7% APY simply by holding USDC on their wallets.

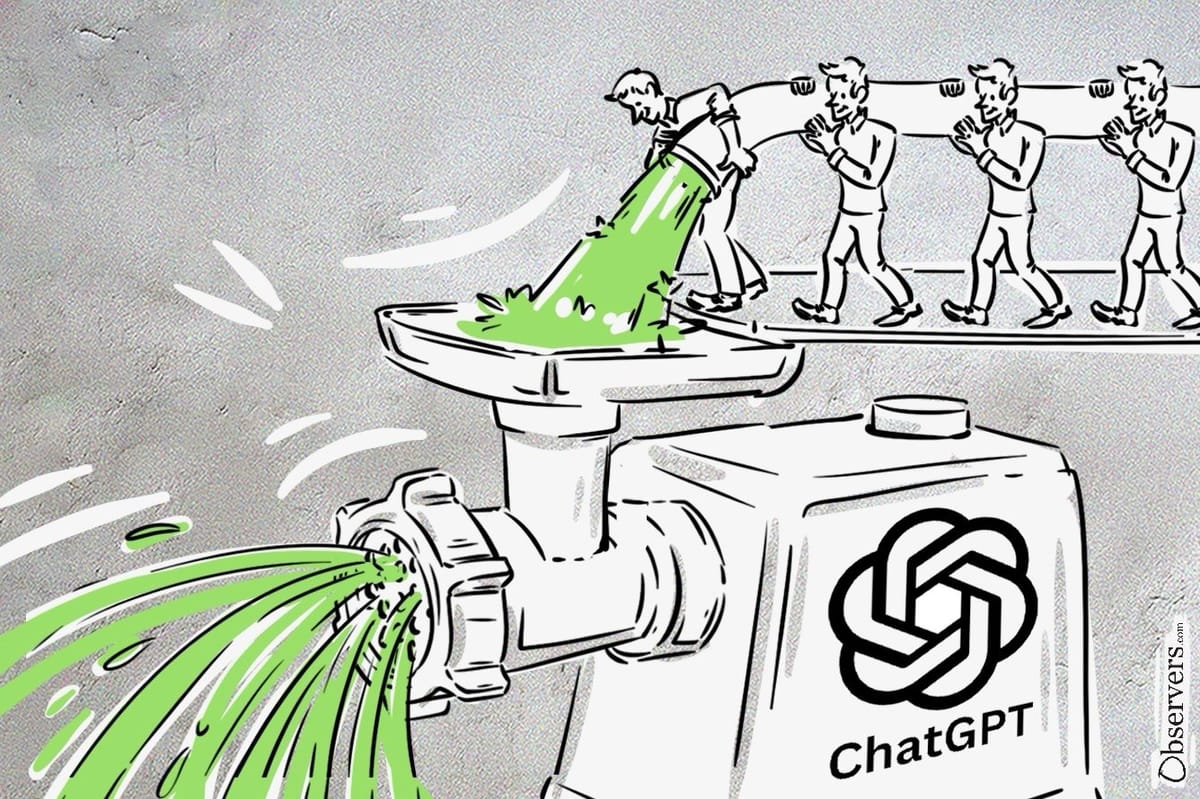

🚨SCAM Detected: AI Poisoning

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

You can never be too careful in a bull market, but at least try to be just a little bit careful when using AI tools and never provide them with sensible information.

A user building a bump bot with ChatGTP had his main wallet drained after adding his personal key to a poisoned AI engine's code.

Hackers spent months building “poisoned” bot repositories on GitHub for Solana meme-coin trading platforms Pump.fun and Moonshot, which ChatGTP then used as its data source.