Happy Monday, Observers!

Silicon Valley was in panic mode last week due to the launch of the cheap-built Chinese large language model DeepSeek.

The threat of Chinese technology disrupting the AI industry wiped off $1 trillion of the US stock market, leading the crypto markets too to start the week in the red.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

With Trump mostly busy imposing tariffs, there was space and time this week to focus on technology, and there were a couple of major launches.

Last Monday, the digital collectibles marketplace OpenSea launched a new platform in beta, and on Friday, the largest decentralized crypto exchange, Uniswap, released its updated version.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

There were also some failed launches this week.

Coinbase saw the price of the newly launched Venice Token (VVV), from Erik Voorhees's privacy-focused AI project Venice, crash a couple of hours after it added support for it.

Venmo’s founder Sam Lessin launched the $JELLY coin associated with his new SoFi project, Jelly Jelly. Traders picked it up as one more meme coin to play with, sending it from 0 to $250 million and nuking it shortly after.

Perception is everything, which is why the decentralized autonomous organization ai16z announced this week that it was changing its name to ElizaOS, avoiding confusion with it and VC firm Andreessen Horowitz (a16z) while also strengthening its connection with Solana’s Eliza agent framework.

🔥 Highlights Of The Week

- YZi labs invests $16 million in on-chain token distribution platform Sign;

- Czech National Bank approves study for a Bitcoin reserve;

- Thorchain has stopped BTC and ETH withdrawals amid insolvency risks;

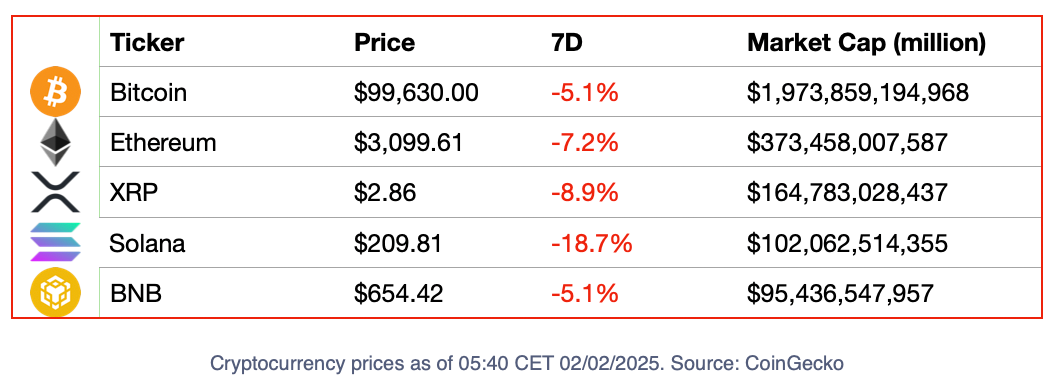

📈 Crypto Markets

Digital Share or Governance Tokens?

Crypto projects call their tokens "governance tokens" to avoid the legal consequences of issuing unregistered securities. There is no contractual promise to share any profits or offer redemption. Yet, holders still get excited when their project signs a major partnership or unveils a new product.

Protocols such as Uniswap, Aave, Lido, and Ethena have discussed and some already implemented mechanisms to share the revenue from fees generated in the protocol’s activity between the treasury and their loyal token holders. Will tokens and stocks merge into a new form of a digital share?

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

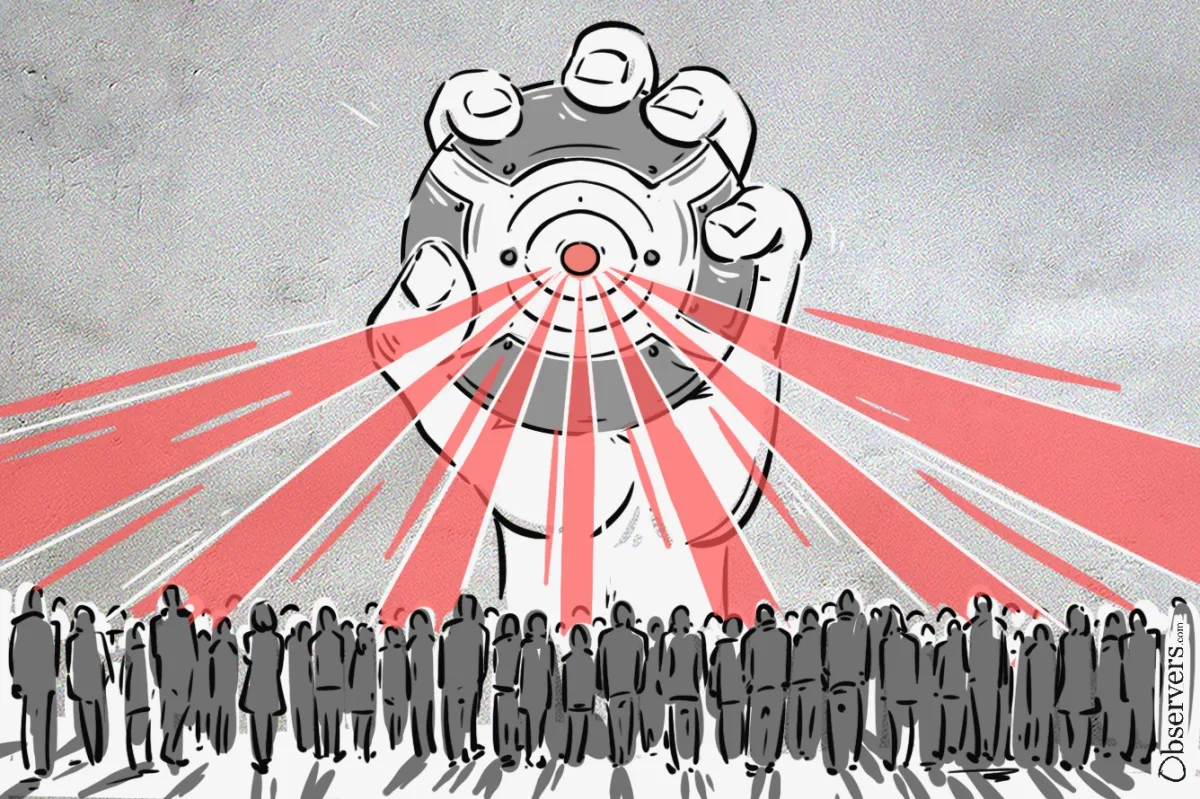

🥸 Identity Matters

The incursion of artificial intelligence into everyday online life begets platforms developing some kind of identity verification mechanism that can distinguish bots from humans.

Blockchain offers the best way of doing so, and Web3 projects dealing with the matter have been proliferating.

Contrary to other market segments, the identity verification business is booming with public initiatives from countries all around the world looking to maintain their monopoly on handling, managing, and protecting their citizens’ identities.

Experts in Digital Assets and Web3Eva Senzaj Pauram

Experts in Digital Assets and Web3Eva Senzaj Pauram

Despite the interest of public institutions, there are significant private initiatives that have already gained some ground.

World (former Worldcoin) has launched in several countries across four different continents. While it has mostly met with problems on its journey to become a global identity network, it continues to launch new features to its blockchain and establish essential partnerships.

Humanity Protocol reached $1 billion valuation this week, despite being still in beta phase.

Centralized Exchanges Under Fire

DeFi mindshare is growing by the week now that the improvements in tech and new products and platforms made decentralized apps more accessible and easier to interact with.

With users' options increasing, they are becoming much more ferocious in their criticism of centralized players and less tolerable with their failures.

Coinbase has been constantly under scrutiny since the year started. The exchange, which has most of its users in the United States, has been criticized for poor customer support and for stopping customers’ withdraws without due reason.

This week, the failure of the VVV launch prompted Justin Sun to join the chorus of criticism by pointing out that the exchange hasn’t listed TRON (TRX), which has been under review for the past seven years despite being one of the most relevant tokens in the industry.

Sun said that Coinbase lost “the most basic fairness and industry judgment in new listings.”

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

Binance, in its turn, continues to face regulatory scrutiny. To the long list of legal problems the exchange has had since its inception France added this week an investigation into how the company implemented KYC and AML protocols. Allegations, which, as per usual, Binance denied.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

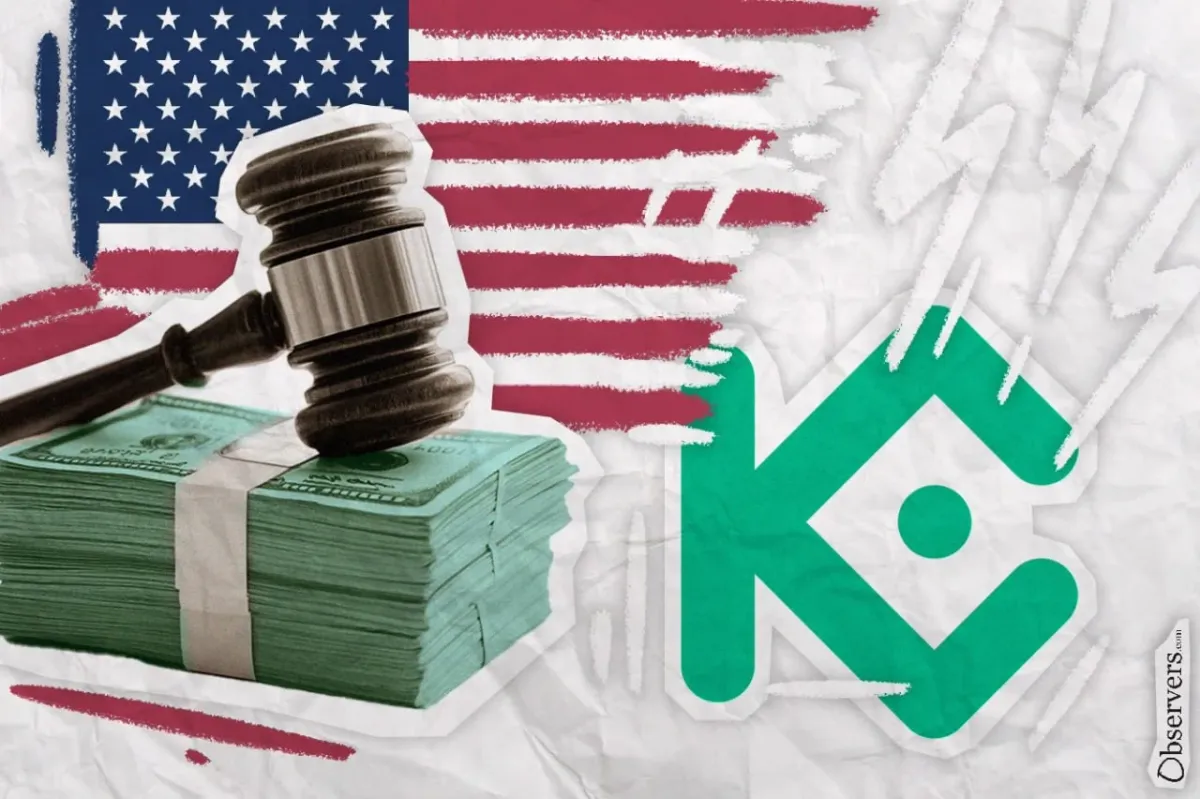

KuCoin is exiting the United States market after its founders signed an almost $300 million settlement in which they pled guilty to operating an unlicensed money-transmitting business.

Under new management, the exchange will continue operations as usual outside U.S. borders.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

🔫 Tweet Of The Week

"Everything I say leaks," Zuckerberg says in leaked meeting audio. "It sucks"https://t.co/4i8d2CczYS

— Jason Koebler (@jason_koebler) January 30, 2025