There is a nascent trend in the crypto ecosystem, and it has nothing to do with artificial intelligence, meme coins, or stablecoins. Much like the normal world has gender reveal parties, crypto is getting into the soapy habit of Satoshi Nakamoto's identity reveals.

In October alone, there were two.

First, the HBO documentary that “revealed” Canadian software developer Peter Todd to be the creator of Bitcoin. The claims were denied by the software developer, who is currently hiding from the public eye due to safety concerns.

This week in London, a PR firm announced out of the blue that it would reveal the legal identity of the father of the world's leading cryptocurrency.

A man called Stephen Mollah, who had previously claimed to be Satoshi, came to the stage to provide proof of his identity. However, he wasn’t able to connect his computer to the Wi-Fi and ended up showing only unconvincing screenshots.

Who will be next, and will there be cake?

🔥 Highlights Of The Week

- Hong Kong launches virtual asset index to guide Asian DeFi market;

- Former Binance CEO CZ makes first public appearance since getting out of jail;

- Visa partners with Coinbase to make instant crypto purchases.

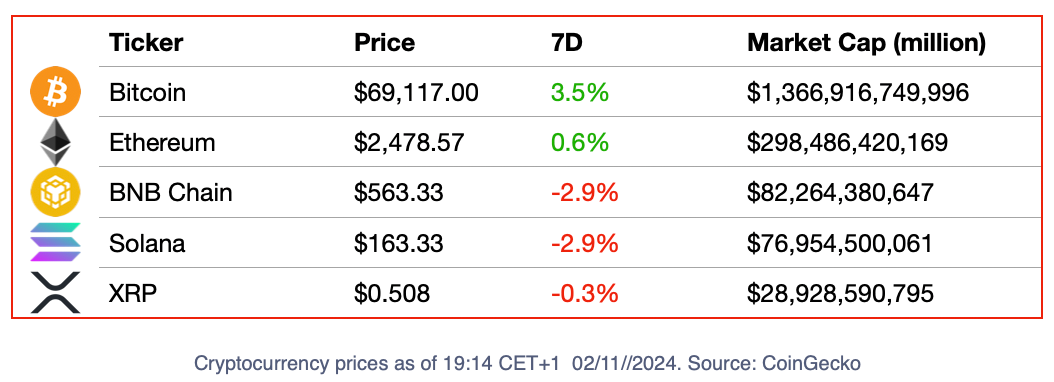

📈 Crypto Markets

On the week it celebrated its 16th anniversary, Bitcoin went on a rollercoaster.

Starting at around $68,000 on Monday, by Tuesday, its price had climbed to $73,295—only $500 less than the all-time high it reached back in March.

It spent the next two days navigating on the $70k high lands before its price dropped to $69,000 on Thursday.

As the U.S. elections approached in October, Bitcoin became increasingly seen as the quintessential Trump Trade. This, together with other macro and financial factors, helped confirm the “Uptober” narrative for one more year.

🍭 Crypto Highs And Fun Times

- Following seven months of development, decentralized perpetual exchange GMX is launching on Solana, adopting Chainlink Data Streams as an Oracle solution. Tapping into Solana’s large community of traders might help GMX, one of the first exchanges in the space, regain the user base numbers it lost to new market entrants in recent times. Solana is a complicated market for Chainlink as well, where the oracle giant holds a market share of just 15.5%, whereas Pyth dominates with over 84%.

😈 Crypto Naught And Sloppy

- Enterprise blockchain R3 is rethinking its future, which might mean selling its business. While its product offering was very appealing when it came out in 2014 it has lost its hedge as the early concerns about privacy and control that drove interest in private blockchains dissipate and public infrastructure gains ground.

EU Crypto Scene: One Directive, 27 Ways To Implement It

The DAC8 directive integrates crypto assets into the EU's Common Reporting Standard (CRS) to prevent tax evasion and streamline data sharing across member states.

It was adopted by the Council of the European Union one year ago, and now, each country is finding the best way to incorporate it into national law. Overall, there will be 27 different versions of the directive, showcasing how the EU's bureaucracy makes simplicity a difficult legislative target.

Observing moneytech and Web3Mathilde Adam

Observing moneytech and Web3Mathilde Adam

Project Of The Week: MainMoney

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

MainMoney is a palm-based biometric identity payment system that was launched early in October in the Democratic Republic of Congo - one of the world’s poorest countries.

If a country can leapfrog from a cash-based economy to one of biometric payments, that country will be in Africa, a continent where technology only becomes mainstream when it can be produced at low cost and needs little infrastructure to operate.

If able to deal with the challenges that exist in a country where 90 to 95% of payments are done in cash, and where there is no national identification system, MainMoney has a real opportunity to be a catalyst for economic development.

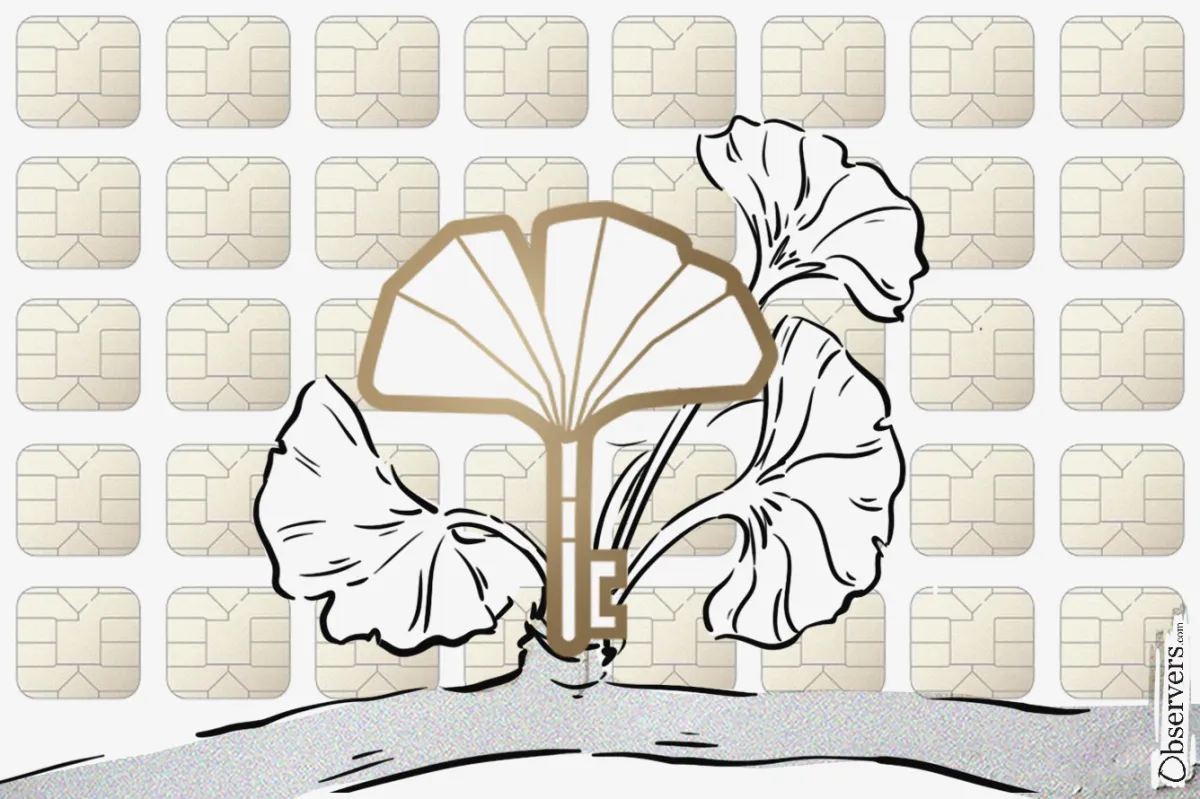

Satochip: Focusing On What Matters

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich

The hardware crypto wallet maker Satochip is focusing on what is important: allowing users the “ability to sign transactions while retaining exclusive control over one's private keys.”

The company has developed three low-cost crypto smart cards that allow users to make transactions while guaranteeing maximum security.

"We firmly believe that the future of the hardware wallet will involve solutions that are more mobile, easy to use, transportable, with few technical constraints and equipped with extensive connectivity options," told Satochip Bastien Taquet in interview to Observers.

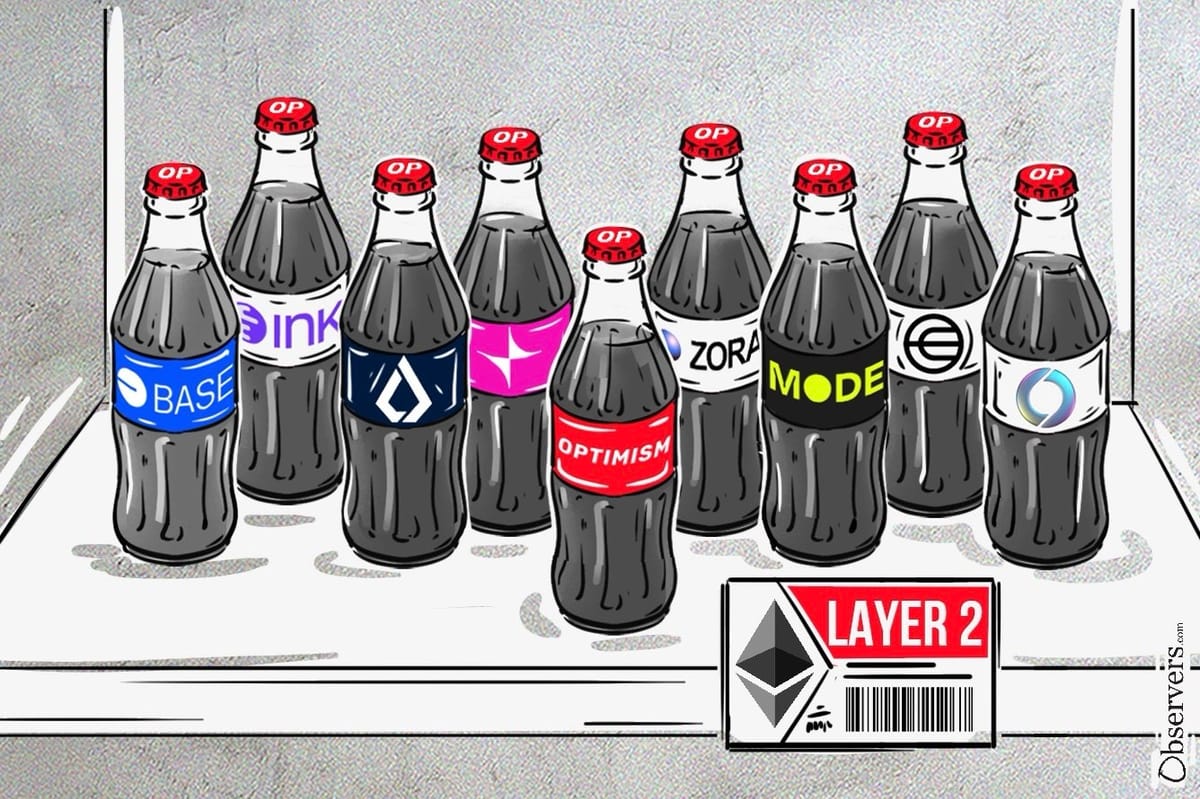

Deep Dive: Optimism Superchain

In recent times, several major crypto projects such as Kraken or Uniswap have launched their layer 2 networks on Ethereum. Instead of developing their own chains, these projects have opted to utilize the OP Stack and the Optimism Superchain. Deep dive into why projects are choosing the Superchain here:

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

💰 The $100 Million Fee

Last week, Stripe’s acquisition of start-up Bridge for $1.1 million - the largest M&A deal in the crypto history - made headlines. Why did the FinTech company pay 5.5x more for the stablecoin payment infrastructure company than what it was worth?

The decision might just boil down to strategic planning and confidence in the future of crypto now that Stripe has re-entered the market following a hiatus of almost a decade.

It is nonetheless worth noting that VC Sequoia Capital, an investor in both companies, is, according to Bloomberg, making $100 million with the acquisition, with other venture capitalist firms also taking home a considerably comfortable sum.

🔫 Quote Of The Week

"The crypto industry is facing an existential threat from an overzealous regulator who is abusing its power by targeting our industry through unending aggressive enforcement actions."

DeFi education fund warned on X in March when it filed a suit against SEC together with Beba, asking the regulatory agency for clarification regarding the free distributions of digital tokens, aka airdrops.

The quote resurfaced this week as several venture capitalist funds, including a16z and Multicoin Capital, filed an amicus brief backing the crypto enterprises in the quest for regulation clarity.