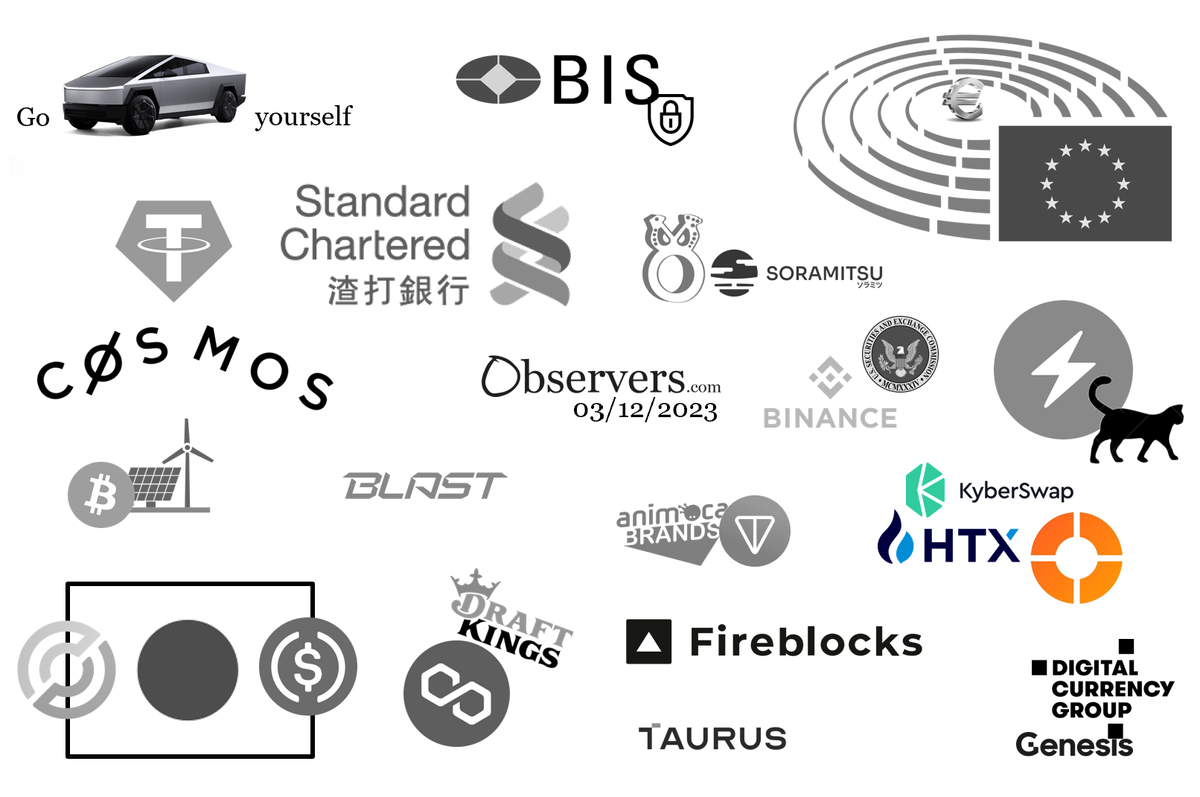

Tesla finally managed to deliver its first Cybertruck pick-ups to customers this week, and at the required glitzy 'launch' event, Elon Musk got his design chief to repeat the infamous stress test on the vehicle's window. This time the window didn't break when a 'rock' was thrown at it, although to be fair it did look like a particularly weak throw.

However, Tesla's celebration was somewhat overshadowed by Musk's advice given to advertisers choosing to leave the X platform. It must be tough being an eccentric billionaire 24/7... but we'd be prepared to give it a try.

But who has been demonstrating their 'strength' and who has just been losing their temper in the crypto world this week? Read on to find out.

With an apparent rise in cyber attacks in recent weeks, we asked what the DeFi industry can do to stem the flow. One such attack on the KyberSwap DEX saw hackers steal $50 million, to which the KyberSwap team offered a 10% bounty for its return. The attacker had other ideas though, and has demanded full control of the company and all of its assets. Is this the blockchain equivalent of a hostile takeover?

The team behind the Aragon DAO creation software has come to blows with its own governance DAO, which has voted to sue the founders over their decision to close down the Aragon Association and redeem ANT tokens for ETH. There are also disagreements between the co-founders of Cosmos, with co-founder Jae Kwon proposing to fork the chain and airdrop ATOM1 tokens to current ATOM holders. Even the successful launch of Layer 2 solution Blast hasn't kept everybody happy. Despite attracting over half a billion dollars in TVL, key investor Polygon Labs has raised questions about the aggressive marketing policy.

Stablecoin issuer Tether and parent company Bitfinex have decided to stop fighting freedom of information requests and continue publishing some semblance of Tether's reserve holdings on a quarterly basis. Meanwhile, fellow stablecoin issuer Circle has teamed up with SBI Holdings to push the usage of USDC in Japan.

Bitcoin's Lightning Network has been facing challenges regarding its security, centralization and censorship resistance. With developers allegedly more interested in providing revenue for investors than fixing the problems, the Layer 2's future looks anything but rosy at the moment. Another Lightning has also been making headlines this week. Lightning Cat is an AI solution to identify vulnerabilities in smart contracts before they are deployed.

Digital Currency Group and Genesis have come to an agreement over loan repayments, which should see Genesis drop an ongoing $620 million lawsuit against its parent company. However, despite Binance capitulating to U.S. authorities and CZ being stuck in Seattle, the SEC hasn't given up hope of finding some major fraud (à la FTX) at the exchange and is continuing its legal action against the company.

To enable institutional investors to avoid the counterparty risks involved in using centralized exchanges (we're still looking at you FTX), Fireblocks has launched its 'Off Exchange' platform. The system uses multi-party computational wallets to allow traders to swap tokens without using an exchange.

Despite the justifiably bad rap that Bitcoin gets for its energy consumption, a recent report has suggested that Bitcoin mining could actually support clean energy projects. By using surplus energy produced before a new project is connected to the grid, developers could earn millions of dollars to support future projects going forward.

The European Parliament hosted several CBDC experts in a discussion on the future direction of its digital euro project. Unfortunately, while they all agreed that the project was not particularly appealing in its current form, they all disagreed on the best way to fix it. The Solomon Islands has had a far more harmonious relationship with its own CBDC, which entered a proof-of-concept trial this week. Our Banking and CBDC roundup also covered four international banks connecting to China's e-CNY platform and the BIS touting its privacy-focused CBDC project.

Animoca Brands has partnered with TON to become the network's biggest validator and bring its extensive experience of Web3 gaming to bear on the blockchain. Sticking with games, a recent report claimed that over 75% of blockchain games released over the past five years have failed. Although if you looked at the current user numbers of most traditional video games released over the past five years then you would conclude that most of those had failed too.

Which brings us nicely round to our final story, which also includes big validators and failing. It emerged this week that Polygon hadn't been fostering a level playing field for its validators, having given an unfair advantage to its big-name mainstream catch, DraftKings. Despite this preferential treatment, which included Polygon delegating 60 million MATIC tokens to DraftKings for staking, the digital sports entertainment company failed as a validator and was kicked off the network for underperformance in September.