Hello Observers!

It was a hot week, almost feverish.

Following Trump’s speech at the 2024 Bitcoin conference in Nashville last Sunday, crypto Twitter and media, from inside and outside the United States, became more political and divided than ever before.

Having a pro-crypto president in the United States, the world’s leading economy, can boost the sector beyond imagination. But while many were quick to show support for Trump in return for his endorsement of Bitcoin, many others questioned the former president’s intentions and worried that his position is all but a stunt to win votes.

While politics divided, sports united. Olympic fever is taking hold of households all around, and athletes such as Brazilian surfer Gabriel Medina and U.S. gymnast Simone Bailes are uniting people in awe regardless of national borders.

🔥 Week Highlights

- Web3 quest platform Layer3 launched its native token $L3

- United States SEC is seeking permission to amend its initial complaint against Binance

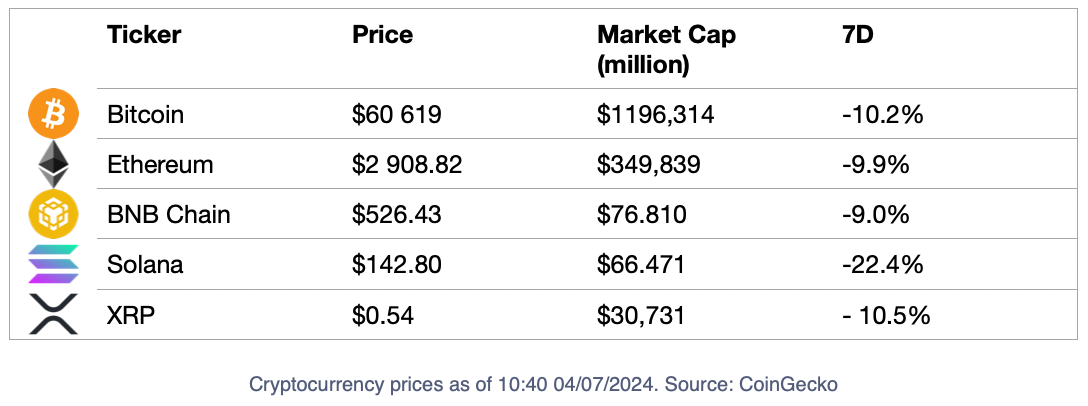

Crypto Markets

AI Problems, Blockchain Solutions: Intellectual Property (IP)

The data lakes from which AI tools source their inputs are a slippery ground for intellectual property rights infringements, but blockchain does offer a solution.

EVM-compatible Layer 1 blockchain Story Protocol has found a way to ensure creators' rights without restricting the dynamic ways in which AI-generated content evolves online.

The platform makes it extremely seamless for creators to register IP, set the terms on how it can be used, and license it to AI companies. The protocol doesn’t make IP law impossible to break but easy to follow.

Observing moneytech and cryptoEva Senzaj Pauram

Observing moneytech and cryptoEva Senzaj Pauram

Naughty & Sloppy

- A group of whales from Compound Finance moved some funds in a technically legal but very sketchy way, which some experts have described as a “governance attack.” The group took advantage of its privileged position to pass a proposal to move $24 million from the Compound DAO to “yield farming” strategies in such a way that the withdrawing actions of those funds can only be performed by themselves and not the DAO.

- Identity protocol Worldcoin has been fined in Argentina, a country considered by the team as a “strategic stronghold” in the region. Despite persistent regulatory controversies in most countries where its iris-scanning “Orbs” are in operation, the global digital identity network continues to blindly push adoption through and has recently improved its strategy of rewarding users for onboarding.

- The viral Telegram mini-game TapSwap has once again put off the idea that a token launch is about to happen. While it remains popular, the constant delays in the token launch date have irritated many users.

Tweet of The Week

In July, @MicroStrategy acquired an additional 169 BTC for $11.4 million and now holds 226,500 BTC. Please join us at 5pm ET as we discuss our Q2 2024 financial results, the outlook for $BTC, and our #Bitcoin development strategy. $MSTRhttps://t.co/cfGPc42jfM

— Michael Saylor⚡️ (@saylor) August 1, 2024

Project Highlight: Blast

Blast's incentive strategy has been a huge success. The automatically applied yield offered to users holding ETH and stablecoins on the network has led its TVL to rise to the fourth highest among all layer-two solutions in five months. Since launching in March, the protocol has attracted over 1.5 million users and handles approximately 800,000 transactions daily.

Observing moneytech and cryptoAlexander Mardar

Observing moneytech and cryptoAlexander Mardar

How to grow a stablecoin? Tether plays high school

The CEO of Cantor Fitzgerald and long-time supporter of Tether, billionaire Howard Lutnick, trashed USDT’s competition at the 2024 BTC conference in Nashville.

On stage, the U.S. billionaire recalled how the relationship between the stablecoin issuer and his company started in 2020. He praised Tether's transparency and security and vouched for its assets. And if that was not enough, he did find time to discredit USDC, USDT’s largest rival.

"We hold their money. USDT is fundamentally different than USDC because USDT holds treasuries and primary dealer Cantor Fitzgerald can liquidate those treasuries and meet your redemptions without fail."

CBDC and Tokenization News

European Central Bank is inviting experts to discuss possible use of eSIM smartphones to make digital euro available offline. There is little traction in digital rupee pilot and new use cases for much larger China's e-CNY project. Brazil is building its DREX CDBC upon Pix payment system's success. Ripple is bringing tokenized U.S. T-bills on its XRPL blockchain in collaboration with Open Eden.

The world is entering this week with reds and nosedives on all charts. Observing the global panic and selloff spreading on the markets we one more time turn our heads to the fundamental sectors in the industry, where the real value is created. And, of course, hope for the peace.