Happy New Year, Observers!

We hope you are well rested because 2025 is probably going to be an even bigger rollercoaster than last year—and didn’t we have quite a wild ride?

If you are within European Union borders, you were probably concerned by the uncertainty surrounding Tether’s USDT stablecoin. The largest stablecoin became non-compliant with the region’s MiCA crypto regulations on 31st of December. According to the new rules, stablecoins must keep 60% of the reserves in EU banks, which Tether's CEO Paolo Ardoino called an unacceptable risk for the company.

The stablecoin’s market cap, and Tether in particular, suffered at the end of the year because of the FUD (Fear, Uncertainty & Doubt) generated by this new non-legal status.

Compliance, however, seems secondary for Paolo Ardoino, who, during the holidays, talked about Tether's AI plans. We will be observing the Tether vs. EU drama as it unfolds in the coming months.

All around the world, new regulations regarding crypto are being implemented:

- in Turkey, ID will be required for transactions over $24

- in the U.S., the IRS is working on finding common ground with brokers regarding how to report crypto in financial statements

- Japan’s FSA plans to reclassify cryptocurrencies as financial assets

- Amidst the current civic unrest; Syria is trying to legalise Bitcoin.

Wherever you are in the world, beware of how the game changes, and make sure you play to win!

🔥 Highlights Of The Week

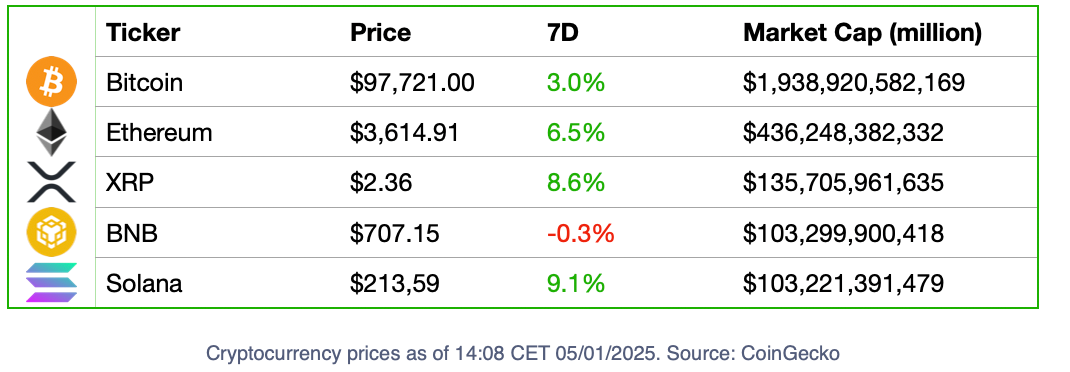

- XRP surpasses USDT as 3rd largest cryptocurrency by market cap;

- Ethena released their 2025 roadmap promising "to disrupt money on a scale far beyond what you have seen so far."

- Do Kwon pleads not guilty to U.S. fraud charges in Manhattan hearing.

📈 Crypto Markets

🔫 A Quote To Start The Year

Financial writer JP Koning has been following Bitcoin since its early days 16 years ago, and he still believes we are early:

“Bitcoin is an incredibly infectious early-bird game, one that after sixteen years continues to find a constant stream of new recruits”

The skepticism around cryptocurrencies finally wore off last year, thanks to the adoption of crypto assets by the largest traditional finance companies in the world and the demonstration of interest by multiple governments.

Observing moneytech and Web3Rebecca Denton

Observing moneytech and Web3Rebecca Denton

There are several ways through which Bitcoin’s price might inflate, with ETFs and strategic reserves being the most in vogue right now.

According to Koning, too much hype and hope around BTC might lead to rush decisions that hinder overall development.

“It begins with a small strategic reserve of a few billion dollars. It ends with the Department of Bitcoin Price Appreciation being allocated 50% of yearly tax revenues to make the number go up, to the detriment of infrastructure like roads, hospitals, and law enforcement.”

Is Elon Musk’s X Poised For A Game Changer Year In 2025?

The big changes Elon Musk made to the social media platform formerly known as Twitter have largely been considered a massive failure due to users deserting the platform by the millions, the lowering of the quality of the content shown, and Musk’s manipulating the algorithms to promote his own political views.

Yet, if there is one thing you can do when you have endless funds, it is to keep trying.

Observing moneytech and Web3Rebecca Denton

Observing moneytech and Web3Rebecca Denton

X’s CEO Linda Yaccarino announced on New Year’s Eve that rather than going back on some of its controversial decisions, it is going forward with an attempt to imitate the Chinese’s "everything app" WeChat.

“2025 X will connect you in ways never thought possible. X TV, X Money, Grok and more,” posted Musk’s highest-ranked X employee.

Even though it will likely mean paying a fee to the richest man on earth for every transaction made on the platform, crypto users are excited about the possibility that X Money will allow users to pay with cryptocurrencies, either an existing one like Dogecoin or one native to X.

A Project For The Passive Investors Out There: Babylon

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

If you want to grow your own wealth rather than spend your hard-earned Bitcoin, making the rich richer this year, Babylon protocol might be worth considering.

This marketplace lets Bitcoin holders securely lock their assets to earn yields by trusting them to Proof-of-Stake (PoS) chains that require BTC so they can secure their networks.

In 2024, Babylon’s TVL surged from $1.4 billion to $5.4 billion, showcasing the growing popularity of Bitcoin restaking.

Overlooked Stablecoins

Stablecoins are the main use case of cryptocurrencies, and the remarkable growth the market witnessed in 2024 is poised to continue in 2025.

The largest stablecoins have several key strengths, such as high adoption levels and vast reserves, but all that comes at the cost of centralization.

Except for Sky's USDS (formerly DAI), truly decentralized stablecoins have smaller market caps and are less known to investors.

These characteristics mean that trading them involves more risk, but where there is more risk, there is generally more opportunity.

Here is a list of 2-tier decentralized stablecoins that might better suit your investor profile than the major ones.

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram