Happy Sunday, Observers!

The escalation of conflicts in the Middle East is shaking up markets, and crypto is no exception. With panic settling amongst investors, the price of all cryptocurrencies has dipped this week.

While it doesn’t curb the blow of the geopolitical tensions unfolding, the news that the unemployment rate in the United States fell from 4.2% to 4.1% in September brings a sense of security to markets.

Always resilient, the U.S. economy has defied fears of a slowdown looming since the Fed cut the benchmark interest rates by half a percentage point on September 18.

🔥 Highlights Of The Week

- Vitalik Buterin urges changes to staking rules to boost solo stakers on Ethereum;

- Tron surpasses Bitcoin and Ethereum in Q3 with $577M revenue;

- BBVA announces 2025 stablecoin launch in partnership with Visa.

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- Covalent has come up with a solution to Ethereum’s “long-term data availability” problem, which puts historical transactional data at risk of being lost forever. They have fixed together an EVM Light Client and The Ethereum Wayback Machine to ensure the network remains verifiable even after the planned “purge” to remove old history takes place.

- Aptos Blockchain is entering the Japanese entertainment market with the acquisition of HashPallete, the developer of the NFT content distribution network Palette Chain. While the NFT mania is long gone, NFTs still have a lot of unexplored potential in building communities, user loyalty, and ramping up event experiences.

😈 Crypto Naught And Sloppy

- First as a farse, now as a joke. The founders of Three Arrows Capital (3AC), the former major crypto fund that went bust when the market crashed in 2022, are attempting a comeback. Predicting that no serious investors would put money in their hands again, they went for the ones who like to have a laugh and created a memecoin fund called “Three Arrowz Capitel.”

- EigenLayer, the protocol that introduced " restacking” to the crypto community, has finally launched its token: $EIGEN. Unfortunately, a lot happens in a year in this ecosystem, with groundbreaking concepts being overtaken at quite a speed. So while $EIGEN is listed on all major exchanges, it has so far been a minor hit.

- Worldcoin is facing another real-world challenge with its Orb eye-scanning devices. Criminals in Germany are exploiting vulnerable groups to cash out the rewards at the scanning stations.

Project Of The Week: Drakula

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich

Social media networks are a source of infinite power and wealth to the small group of techno-capitalists that own them, but turning the balance around hasn’t been easy.

All attempts to create a decentralised social app that excites mainstream users have so far been flops. They have been able to attract only limited attention for a short period of time.

Drakula is a social app on Base that imitates TikTok's interface, might be just one more of those projects that end up dormant somewhere in the chain, but the developer team is trying hard to succeed.

On October 1, it launched an update that allows users to earn fees from referring meme coins. It is also trying to make blockchain invisible so that the UX is as simple as those of Web2 apps.

The big question is: can the new features bring enough users to kick in network effects?

🍊 Tangerines In The Age of CBDCs 🍊

Lack of access to a common currency often creates complications in international trade. Russia and Pakistan have found a solution to their payment challenges by resorting to history books: direct trade of agricultural goods.

And while vitamin C has undoubtedly strong health benefits, wouldn’t vitamin CBDC have simplified this whole business?

Russia agrees to accept payment in Pakistani tangerines amid payment difficulties

— PS01 △ (@PStyle0ne1) October 2, 2024

TASS reports that Russian chickpeas and lentils will be exchanged for tangerines and rice from Pakistan.

The decision to move to an exchange was made because the parties “are experiencing certain… pic.twitter.com/JYr2S45xB7

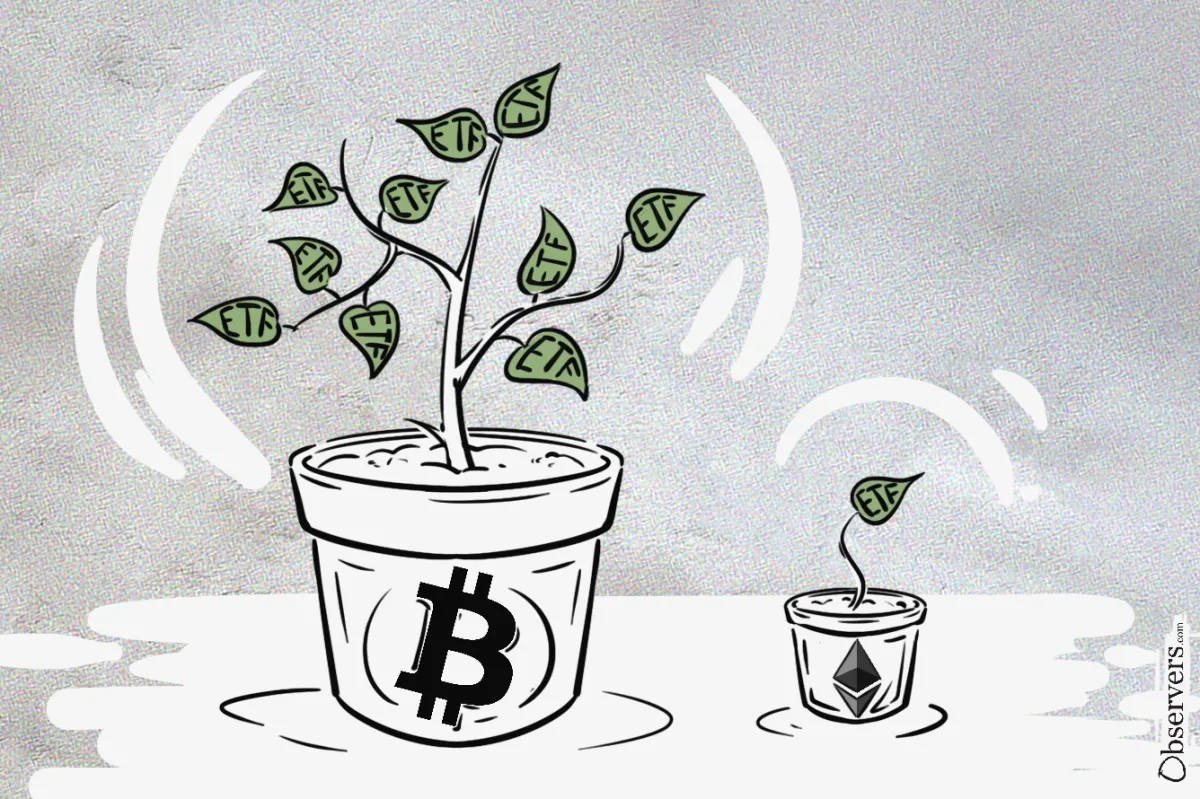

Everyone wants a bite of crypto ETFs growing pie

Wall Street's crypto-related exchange-traded funds hold about $52.8 billion in Bitcoin and $5.5 billion in Ether.

The popularity of BTC ETFs is influencing the price movements of Bitcoin, which is behaving more like a traditional financial asset than a crypto one.

Ether’s supply is different than BTC and the fundamental role it plays on the most dynamic ecosystem in Web3 mean that, despite the high demand for ETH ETFs, their influence on Ether’s price is much more limited than on Bitcoin.

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

At different scales, both BTC and ETH ETFs have huge growth potential and its not only these two majors that attract asset managers. Bitwise has applied to the SEC for the approval of Ripple's XRP spot ETF, despite the ongoing litigation between the U.S. SEC and Ripple.

Traditional banks, too, want to be part of the growing segment. The Bank of New York Mellon has found a way around the SEC’s controversial Staff Accounting Bulletin 121 regarding the accounting of cryptocurrencies in custodians' balance sheets and is set to start providing custody for the crypto assets behind the ETFs, a role that until now has been exclusively in the hands of Coinbase.

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich