Hello Observers!

How is your glass, half full or half empty?

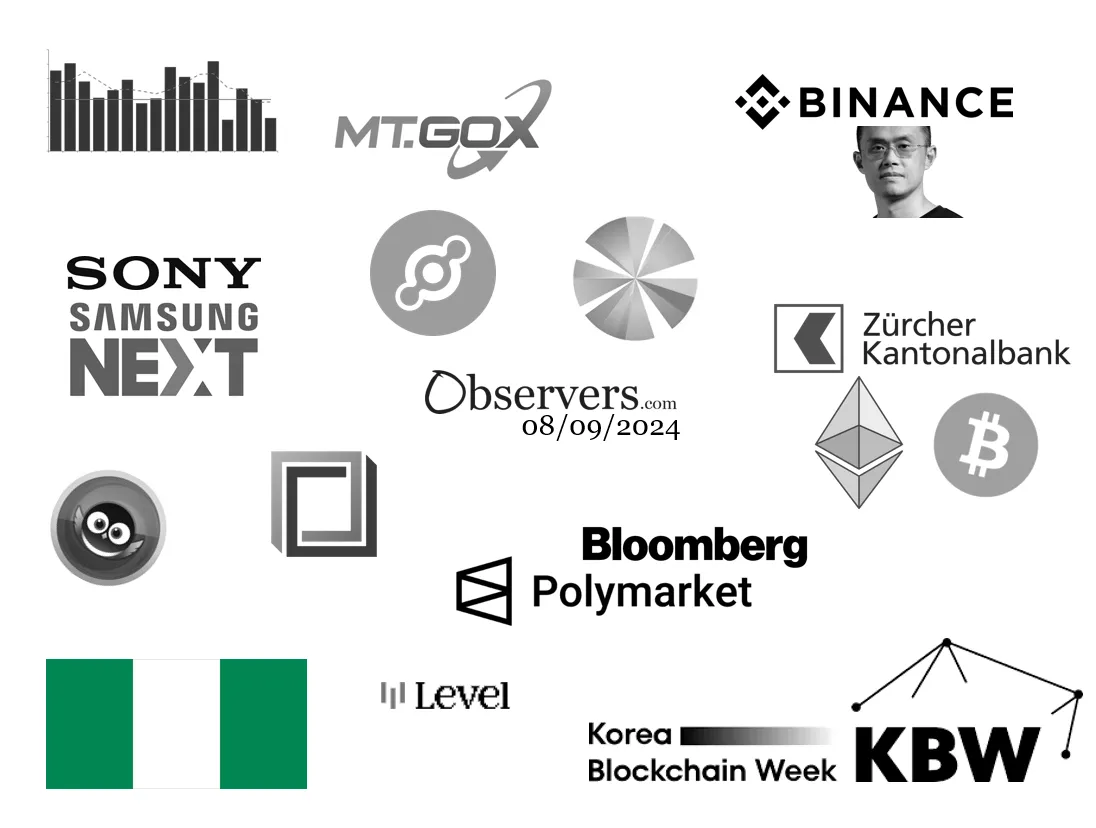

Crypto prices kept falling all through the week, with Bitcoin even tickling the $53K panic level on Saturday following the release of U.S. job data.

Despite this, the progress of the blockchain industry during the past seven days has been notorious.

Thanks to Polymarket's addition to Bloomberg Terminal on August 29, non-Web3 media around the world began using the crypto betting platform's timely and exact information this week. After years of blockchain developers trying to create Dapps with real utility for the masses, Polymarket has finally done it.

In South Korea, the direction of the industry, including decisions on the risks to be taken and financial backing, was shaped at the Korean Blockchain Week -KBW2024. Organized by the dynamic due Factblock and Hashed since 2018, KBW has become one of the most important conferences for Web3 at the institutional level.

🔥 Week Highlights

- CZ has permanently lost the right to manage the platform under a settlement with the US government

- Bitcoin Spot ETFs saw another significant outflow on Sept 6, with a total outflow of $170M across major providers.

- Switzerland's fourth largest bank, Zurich Cantonal Bank, launches Bitcoin & Ethereum trading.

📈Crypto Markets

🍭 Crypto Highs And Fun Times

- Despite being one of the most technologically advanced countries in the world, South Korea has an underdeveloped blockchain industry due to regulatory limitations. The KBW, however, is opening up minds and leading the tables to turn.

- Samsung Next has decided to invest in Web3 infrastructure company Startale Labs. The Singapore-based platform is developing Sony's new blockchain, Soneium. With these three companies joining forces, the “developer-centric” blockchain is set to be a game-changer in the Asian market.

- A whole different way of "owning Friday nights" is becoming possible for crypto investors as they can now literally invest in tequila. Real estate tokenization protocol Blocksquare has partnered with Mexican distillery Rancho Altos to create an RWA marketplace on the protocol.

😈 Crypto Naughty And Sloppy

- The U.S. crypto community is in a head spin, trying to figure out which better presidential candidate can bring the industry forward. Trump has been trying hard to be seen as the “pro-crypto” candidate, while Harris has been mostly silenced on the matter. Nonetheless, there are other things that matter when electing the world's most important head of state.

- Nigeria’s Securities and Exchange Commission (SEC) has licensed two small local crypto exchanges. While the move signals that the country authorities might be changing their stance on the sector, the deja vu is unavoidable: before the whole Binance mess, the government had been enthusiastic about crypto and even launched its own CBDC.

- Penpie Protocol, an independent platform operating above, was hacked of $28 million in assets from different types of staked cryptocurrencies. The naughtiness didn’t go far, as Pendle’s in-house monitoring systems immediately rang the alarm, allowing the team to pause the protocol immediately. Penpie hacker ignored negotiation calls and transfered the stolen funds to Tornado Cash.

Project Highlight: Helium

Observing moneytech and Web3Mathilde Adam

Observing moneytech and Web3Mathilde Adam

Helium's decentralized physical infrastructure network continues to grow impressively, here are some of its recent achievements:

- Helium (HNT) more than doubled in price in less than two months

- Hit 100,000 subscribers in July

- Helium Mobile launched in Puerto Rico

- Helium Mobile now allows crypto payments via a partnership with Sphere Labs.

- Helium community approved HIP 128, paving the way for a major expansion into the energy sector

How To Grow A Stablecoin: Focus on Concept

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

Recent advancements in restaking protocols have prompted Level to launch a stablecoin backed by restaked USDT and USDC. The pioneering concept secured $3.6 million in funding, but the road ahead isn't going to be easy.

Nowadays, the competition among new stablecoins predominantly centres around yields. While it is a popular strategy to attract users, it doesn’t guarantee long-term success. So far, the dominance of major stablecoins like USDT and USDC hasn’t significantly been disrupted.

Quote Of The Week

“I can say very confidently that Mt. Gox hack wouldn't have happened if we had even some of the tools we have today. We could have provided public seed access to an accountant for real-time monitoring of transactions, which would not only have prevented the Mt. Gox hack but also allowed us to detect suspicious activity much earlier.”

The words are those of Mark Karpeles, the former CEO of Mt.Gox, who announced that he is launching a new crypto exchange this month.