Happy Sunday, Observers!

A common response to fear is to freeze.

All financial markets opened in red on Monday as a result of Donald Trump’s announcement of the imposition of tariffs on the United States largest trading partners.

The protectionist trade policy itself was postponed for a month in regards to Mexico and Canada, but the uncertainty it brought continued to loom over the market all through the week.

In the crypto ecosystem, not even the bullish press conference of the White House Crypto Czar David Sachs on Tuesday, where he promised to deliver the regulative clarity the industry has been ardently demanding for the past years, was enough to cheer up prices, which didn’t react at all to it.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

Deepening the crisis for the degens are the pump-to-dump cycle of token launches that is becoming the norm for every new project, legit or not.

The much anticipated launch of the Layer 1 blockchain Berachain finally happened on Thursday. The network pioneers a proof-of-liquidity incentive mechanism and has its roots in the 2021 golden age of NFTs.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

Despite all the hype around it, Berachain’s native token $BERA pumped to $1.1 billion market cap in minutes and began to be dumped shortly after, emulating the price trajectory of all the tokens launched since Trump’s family memecoins came out.

🔥 Highlights Of The Week

- Sony’s recently launched blockchain Soneium has released its first music NFT collection in partnership with Coop Records;

- MicroStrategy has rebranded and is now Strategy the “world’s first and largest Bitcoin Treasury Company”.

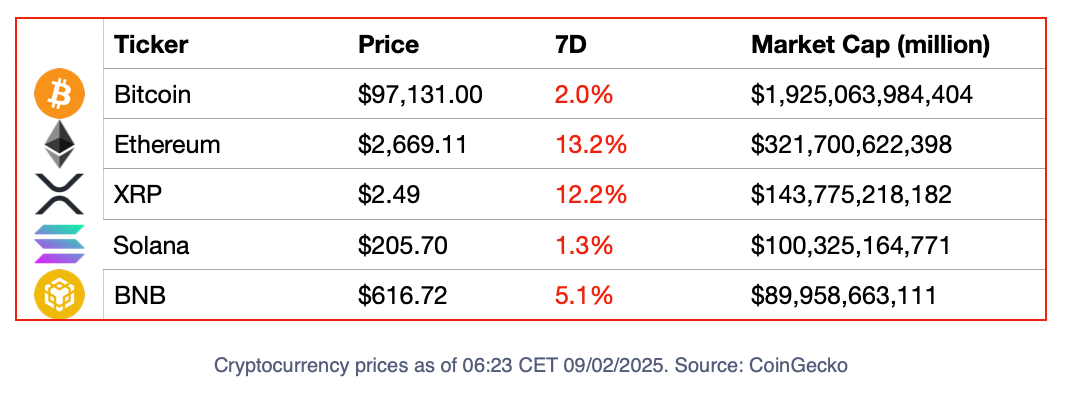

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- In the Netherlands, Tornado Cash co-founder Alexey Pertsev was allowed to leave prison to plan his appeal. The software developer was charged with money laundering for his role in developing and managing the crypto-mixer platform.

😈 Crypto Naught And Sloppy

- An imitation of the highly successful and slightly problematic Pump.fun is now available on the Bitcoin blockchain. Odin.fun challenges the mainstream perception that crypto’s main token is exclusively a financial asset by trying to have users spend their BTC on NFTs and memecoins running on the Runes protocol.

Regulation: Leveraging MiCA EU

Now that the MiCA regulation is already fully entered into force, industry players and European Union governments are trying to leverage it to stay ahead of the game.

Binance Pay is collaborating with payments company xMoney to make crypto payments available to over 20,000 businesses in the region, focusing on the areas of luxury goods, travel, gaming, and public services.

In the Czech Republic, the government announced a tax exemption for investors who held on the assets for over three years.

🔫 Sui Network’s Ambition 🔫

“We’re not just talking about a handful of indie experiments. Over 65 studios are already building for SUI, with around 70 titles queued up for 2025 releases.”

Gaming was always poised to be one of the top blockchain use cases, and while the spotlight has recently been on more shiny and nihilistic trends, behind the curtain, blockchain gaming has been under intense development.

Sui Network is hoping that the sub-sector finally catapults it to the major league in the space. The L1 blockchain fulfils all the technical requirements but in the two years since it has been operational it has failed to capture a level of attention worthy of the crypto Olymp.

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

👁️ Keep An Eye Out For: Cardano 👁️

“February is going to be a very crazy month. We’ve got some stuff going on—I can’t talk about it now, but you’re gonna see, it’s gonna be fun.”

The founder of Cardano, Charles Hoskinson, has said this is going to be a crazy month.

While Cardano’s usage numbers suggest it isn’t no longer competitive, Hoskinson is now an advisor to Trump’s crypto policy team and therefore can push for Cardano’s interests.

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar