Hello Observers!

Borrowing from Gwen Stefani’s 2004 hit “Hollaback girl”, this week was B-A-N-A-N-A-S - bananas.

Crypto prices began to fall last Sunday and went further downhill when markets opened on Monday. In two hours, BTC and ETH plummeted 10% and 18% respectively.

The distress was largely due to the Bank of Japan’s decision to increase interest rates - a move that, due to the high indebtedness of the country and the massive holdings of dollar assets of its national players - had a massive impact on the financial markets worldwide.

The total crypto market cap fell by more than 28% and erased over $670 billion in value when the prices stabilized and began to recover.

Amidst the turbulence, DeFi markets remained resilient, with only two stablecoins losing their peg momentarily and lending protocols processing the over $400 million in on-chain liquidations without a glitch, even turning in a profit due to fees.

As G. Stefani sang back then, “A few times I've been around that track, so it's not just gonna happen like that, 'Cause I ain't no Hollaback Girl.”

🔥 Week Highlights

- Grayscale introduced new crypto investment trusts for SUI and TAO.

- Crypto executives met with White House representatives to discuss policy changes.

- Binance announced it will list Toncoin (TON).

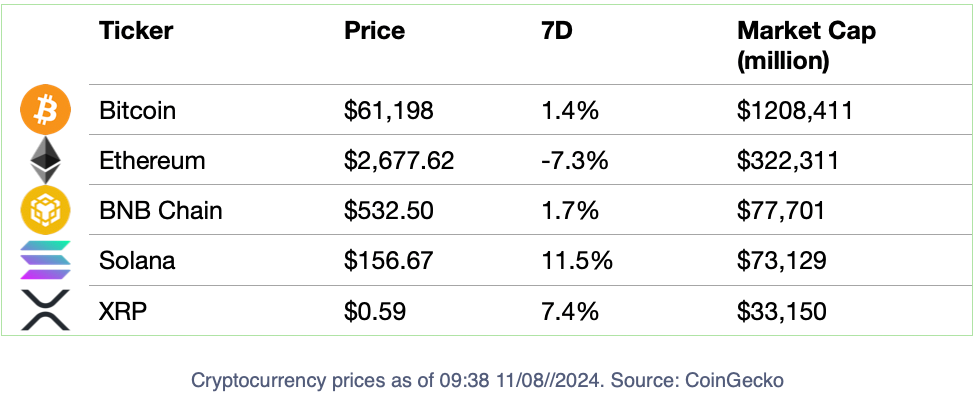

Crypto Markets

How Much Is Too Much?

For quite some time now, Telegram has been targeting the position of “social media of choice” for the crypto world.

This week, the messaging platform launched an in-app browser capable of viewing decentralized websites and a mini-app store that allows users easy access to the tap games that have become so popular in recent times.

Telegram’s Web3 focus has been delivering strong results for the app, its associated TON blockchain, and the decentralized projects that have used it to grow their audiences.

The inebriating smell of success is leading other Web3 ventures to try their luck on the messaging app.

Observing moneytech and cryptoSasha Markevich

Observing moneytech and cryptoSasha Markevich

Gala Music recently announced it would launch Music Miner, a tap game similar to Hamster Kombat, TapSwap, and Notcoin.

This is not the first time the music streaming platform has launched a mini app on Telegram, but the first attempt, a game called “Treasure Tapper,” didn’t achieve the numbers the company was seeking.

The appeal of tap games is their incentive structure, but with so many now on the market, users are getting tired. Last week, TapSwap users began to turn on the app because of the team’s decision to delay the much-anticipated Airdrop.

"Everyone is tired of tapping," one disgruntled user said.

Observing moneytech and cryptoEva Senzaj Pauram

Observing moneytech and cryptoEva Senzaj Pauram

The most popular tap game to date, Notcoin, is trying to diversify its product. This week, it announced the launch of a story-driven Web3 game on the Open Network in an effort to grow beyond tapping.

While old players are being roasted or trying to grow beyond the format that brought them to the spotlight, how many more Web3 projects can grow their user base with a tapping game before the model becomes obsolete?

X Post Of The Week

the timeline today pic.twitter.com/2bjbRkR8yX

— Sanat (@kapursanat) August 5, 2024

Between August 4 and 8, wallets believed to belong to Jump Trading dumped around $247 million. Moving mostly staked Ether. While the price drop in crypto is part of a larger macro trend, Ether's performance was the worst amongst all the major cryptos, and its position is still far from recovered.

Crypto Naughty And Sloppy 😈

- With so many legal battles already fought (and lost), one would expect Binance to have learned to stay off the radar of national regulators. But Binance didn't. The crypto-exchange has now received a $86 million tax show cause notice from the Indian tax intelligence regulator for not paying taxes on user fees between 2017 and 2024.

- It is often considered that the firstborn child has it the hardest, with parents relaxing with the siblings that are born after. The U.S. SEC's fixation with Ripple seems to imitate that kind of relationship, with the agency refusing to let go of the case against the payment network even as it gets too old. Now, the SEC is expected to appeal a court’s decision that finally set a $125 million fine on Ripple for offering unregistered securities.

- On August 7, DeFi protocol Nexera was exploited for a $1.5 million smart contract hack. The NXRA token fell by 43.2%.

- ORE, a cryptocurrency project on Solana trying to mimic the workings (and success) of Bitcoin, has hit a road bump. The project has made accessibility its flag, allowing mining to be done on laptops and phones. Yet, once adoption started to grow, users saw the costs of mining ORE jump through the roof.

Project Highlight: Hyperlane

Observing moneytech and cryptoAlexander Mardar

Observing moneytech and cryptoAlexander Mardar

Hyperlane is a multichain bridge project that functions on a Uniswap-like model, allowing for permissionless bridge creation. By letting any user or project create decentralized bridging pools for any asset across different blockchains, the protocol facilitates seamless asset transfers.

Earlier in the week, the Web3 platform announced the establishment of the Hyperlane Foundation and the introduction of a governance token, $HYPE.

Once these new ideas are rolled out, the protocol's user base of over half a million is expected to grow.