Happy Sunday, Observers!

All eyes were on California this week, where brush fires swept through entire neighborhoods, killing people and destroying billions in property.

The forced stop to normal life in the region, which is home to some of the highest-paid tech talent and to some of the most vibrant tech companies in the world, translated into a slower week in matters of announcements and discussions on several sectors.

Nonetheless, there were still very interesting conversations on crypto. Vitalik Buterin’s remarks on the right way to develop AI going forward gathered a lot of attention, especially as people are becoming increasingly apprehensive about the pace of the technology’s development and concerned about how it will impact people, societies, and markets.

Where some see risk, others see opportunity, and there is no better place to try new ideas and test new technology nowadays than by attributing it to a token and beginning to trade it on crypto markets.

Over the past half-year, AI agents have become the most trendy discussion topic in the blockchain industry. Thanks to automatism, hundreds of new agents pop up every day, mostly on dedicated platforms such as Virtuals Protocol.

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

🔥 Highlights Of The Week

- Vitalik sells 28 meme coins for 1M USDC, donates to Kanro charity;

- Binance reports a 97% rise in institutional users in 2024;

- Sui co-founder seeks OpenAI partnership for AI collaboration.

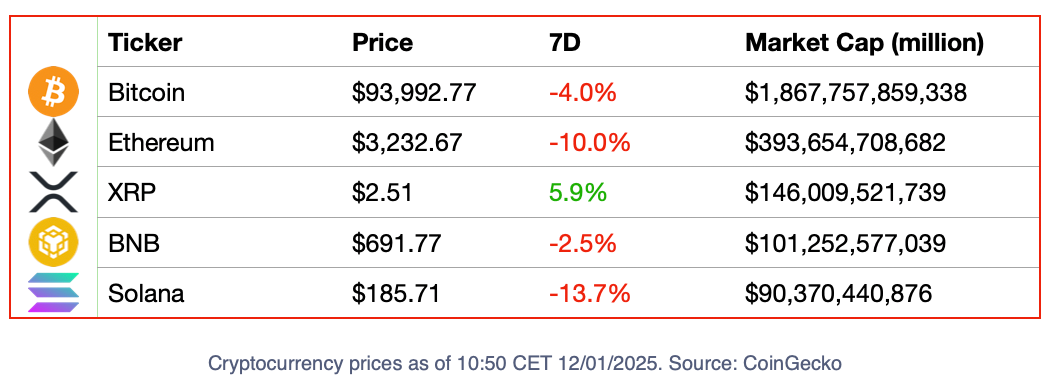

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- Helium network is going to stop mining the IOT and MOBILE governance token on January 15th. This follows a controversial approval of a proposal to abandon the multi-token governance system, which was adopted last year. Network users will now receive rewards only in Helium’s main token, HNT.

- Solana’s decentralized exchange Raydium has established a partnership with the trading infrastructure company Orderly Network to start offering perpetual future trading across over 70 pairs with up to 40x leverage on the industry's second-largest decentralized ecosystem.

😈 Crypto Naught And Sloppy

- Dubai-based crypto-exchange Bybit has halted operations in India due to regulatory challenges. Suggesting that the situation was temporary, the world’s second-largest cryptocurrency exchange said in a public statement that it was striving for “full compliance.”

The Golden Crypto Star This Week Goes To: Aave

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

Net deposits in the lending protocol Aave reached an all-time high of $35 billion in the first days of the year.

At the end of 2023, Aave’s net deposits were $10 billion, up from $5.5 billion one year earlier.

Some of the reasons that contributed to the astounding growth were the increased demand for leverage of crypto investors and Aave’s technological developments - the protocol is currently working on a v4 to be released by mid-2025.

Deep Dive: Ethena's Convergence Thesis

“The most important financial instrument on earth to save and preserve wealth is simply a dollar with a yield.”

According to a recent report published by Ethena, institutional investors are shifting their portfolios to crypto-dollar savings products.

These types of products currently provide high returns compared to the average on DeFi. Ethena is offering 17% APY, while Usual goes as high as 27%.

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

Governmental Adoption

- January 5: The governor of the Czech National Bank has publicly discussed the possibility of adding Bitcoin to the institution's foreign exchange reserves.

- January 6: The Chinese government has announced a plan to spend $273 billion to develop a national data network, incorporating blockchain technology.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

- January 8: In Oklahoma city in the United States, a bill aiming to allow residents to receive salaries in Bitcoin and vendors to accept BTC payments was proposed.

Trump’s Presidency:

- Seeking to improve his relationship with Donald Trump, Marc Zuckerberg announced he would get rid of fact-checkers on Facebook and Instagram. While the President-elect was satisfied, governments around the world expressed deep disapproval of the measure;

- The retirement age is coming early for the Federal Reserve Vice Chair Federal Reserve Vice Chair Michael Barr's retirement age is coming early.