Happy Sunday, Observers!

This was a week marked by several launches, announcements, predictions and rumours about what will happen once Donald Trump is sworn into office on Monday.

A meme coin of the 45th and soon-to-be 47th president of the United States was launched on Friday night on Solana, and within the first 24 hours, the token’s price rose by more than 400%.

During the week, several sources disclosed that the future administration plans to reverse the country’s cryptocurrency policies, including defining when a cryptocurrency is considered a security and creating a new crypto advisory council.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

Prominent figures in the industry, such as Circle’s CEO Jeremy Allaire and MicroStrategy’s Michael Saylor, recently discussed potential roles in Trump’s administration, and a Crypto Ball was held at the president’s Mar-A-Lago residence.

The hype has fuelled rumours that Trump was considering creating a reserve of U.S.-Created cryptocurrencies, but the veracity of this has been hard to verify.

As much as in any other subject in the crypto world, it is becoming increasingly hard to tell the truth apart and understand who can be trusted in White House-related matters.

Bankless, a Web3 native Ethereum-focused media outlet, was under fire this week for heavily promoting the project Aiccelerate DAO the week before its launch and then dumping the tokens it had been allocated as soon as the project hit the market, causing $AICC price to crash and crypto Twitter to go wild with rage.

Experts in Digital Assets and Web3Eva Senzaj Pauram

Experts in Digital Assets and Web3Eva Senzaj Pauram

While neat reputations are being muddied by post-truth era trust issues, reputations that were murky, to begin with seem unperturbed by the clouds of mistrust settling in everywhere.

Ethereum Foundation's leadership, spending, and roadmap goals for 2024 have been criticized too. Discussions arose about whether the leadership changes would result in "feminized wef soy boys" remaining in leadership roles.

In response, Vitalik Buterin announced changes to the Ethereum Foundation's leadership structure, aiming to enhance technical expertise, adding however, that these changes would not include an ideological shift, keeping Ethereum away from aggressive political lobbying or "serving vested interests".

Meanwhile, crypto’s native trouble boy Justin Sun continues to make wild promises with little to back them up.

On Wednesday, he announced the launch of USDD 2.0, featuring a 20% APY fully backed by TRON DAO. When users asked where the yield came from, Sun brushed them off not by simply stating that such yield was possible due to the ecosystem’s robust financial health.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

🔥 Highlights Of The Week

- The U.S. government wants to return $9.3 billion in Bitcoin to Bitfinex;

- Tether has relocated its offices to El Salvador;

- Crypto on/off-ramp MoonPay has acquired Helio for $175 million.

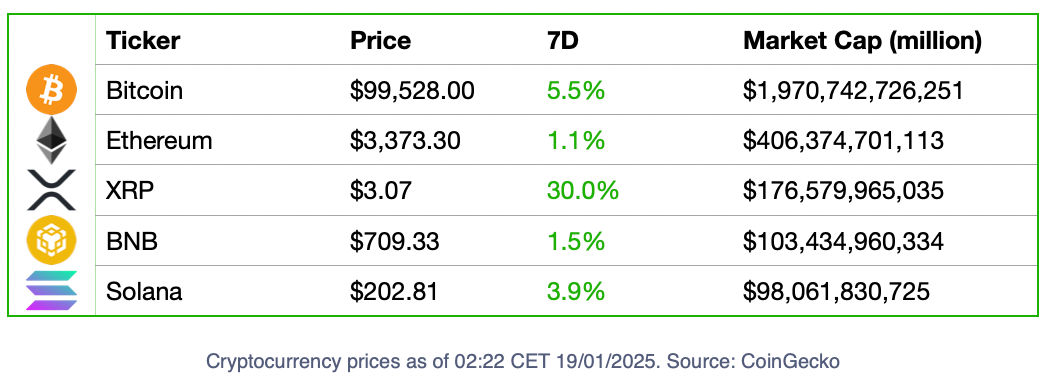

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- Uniswap and Ledger have teamed up to integrate Uniswap’s trading API into Ledger Live, a feature that will allow users to effortlessly swap tokens without having to switch platforms.

😈 Crypto Naught And Sloppy

- Wolf Capital Crypto co-founder Travis Ford has pled guilty to his role in a massive $9.4 million Ponzi scheme in which Ford defrauded 2,800 investors by promising daily returns of 1-2%.

Project Of The Week: Auki Network

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

Auki Network is developing the foundational layer of spatial computing creating a platform that will give devices precise information about their exact physical location, essentially acting as their eyes.

The project aims to integrate physical infrastructure with augmented reality and AI.

For that, it has created the Posemesh protocol, which allows digital devices to exchange spatial data and computing power to form a shared understanding of the physical world.

Keep An Eye On The DeFi Front:

Aggregator project Fluid (former Instadapp) has become increasingly popular in 2024. Now on the top-5 lending protocol on Ethereum, Fluid has grown its TVL from 0 to $1.4 billion in just a few months. Its DEX is also quickly becoming a favorite amongst users, with its trading volume exceeding $720 million last week.

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

The Bitcoin staking Solv Protocol launched its native token SOLV this week on all the major exchanges, with around 1.5 billion circulating tokens. The project’s TVL is currently $2.3 billion, a number poised to grow if its team manages to dispel the allegations of volume manipulations.

Experts in Digital Assets and Web3Observers

Experts in Digital Assets and Web3Observers

Image Of The Week: The Crypto Tower

The building, which is expected to be completed in 2027, will host advanced office spaces, blockchain incubators, venture capital firms, and areas for AI innovation.