Happy Sunday, Observers!

The Bulls are happy and excited for a new run! Jerome Powell’s half-point rate cut announced on Wednesday has cleared the path for some speculation.

The good news must be taken with caution, as unemployment levels put at risk the post-high-rate soft landing that the United States Federal Reserve is looking for.

The difficult balance of the U.S., and therefore, the world’s economy, is concerning. For those who know how to play their cards around option contracts or bets on Polymarket, this period of uncertainty might bring great fortunes…and misfortunes too.

🔥 Highlights Of The Week

- MicroStrategy raises $1B to buy more Bitcoin

- Revolut plans to launch stablecoin

- Phantom Wallet launches custom usernames for sending and receiving crypto with personalized names

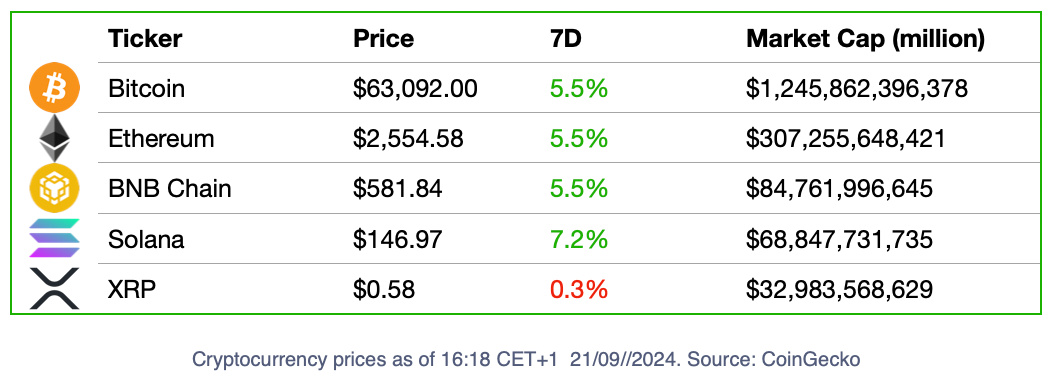

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- The token airdrop of Telegram’s most popular mini-game, Hamster Kombat, is around the corner, and gamers are finally about to get the return of their hard-earned taps of the last months. The first season of the game ended on September 20, and next Thursday, the community will be allocated 60% of the game’s token supply. The Telegram mini-games frenzy shows no signs of slowing, and this week, we observed two more contenders to Hamster's throne.

- The crypto industry is embracing regulation at full speed. This week, the distributed ledger technologies R&D organization DLT Science Foundation announced its support for MiCA crypto alliance - a group of Web3 major players trying to establish industry standards for sustainability disclosures required under the new EU’s digital asset regulation.

😈 Crypto Naught And Sloppy

- Donald Trump is eager (or desperate) to be considered the “crypto candidate” of this year's presidential election. Together with his sons and two prominent crypto executives, he launched World Liberty Financial. While it is great news that such a prominent public figure is endorsing a Web3 project, the whole endeavour is tainted with the quite sounding perspective that all this is a mere political gambit.

- Belarus might be an independent country, but its politics are always aligned with those of its major ally: Russia. That is why the implementation of a new law in a small country barring people from buying and selling crypto on foreign exchanges has the vibe of legislative testing of waters for the approval of a similar law on Russian grounds.

- Legacy brands are joining Telegram’s mega-trend of mini-games and adding a flair of controversy to the field. Flappy Bird's Web3 version came out without the support of its original creators, while Binance’s Moonbix was leaked before the launch date.

Project Of The Week: AO Computer

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

AO computer is a truly innovative protocol built on the Arweave platform that is launching later this year.

The project makes it possible for AI applications to operate directly on the blockchain within smart contracts. According to its founder, Sam Williams, its ultimate goal is to “create a decentralized 'autonomous agent' financial system."

🔫 Quote Of The Week

"Operating payment systems is an unnecessary and harmful distraction for central banks from executing monetary policy, maintaining price stability and avoiding financial crises—missions where their performance has been abysmal."

The quote is from Intrepid Ventures Principal Eric Grover who believes that the Central Banks around the world are getting ahead of themselves and on private enterprise business by developing virtual versions of their national currencies.

Grover is skeptical about the increased competition in the FinTech market now that central banks are developing impressive, innovative, and research-driven solutions for central bank digital currencies (CBDCs).