It was beginning to look a lot like Christmas until Jerome Powell surprised markets on Wednesday with what he said was the last interest rate cut for a while.

The Fed’s chair comments propelled the prices of both traditional stocks and crypto assets to fall, and Bitcoin, which reached a new all-time high of $108,000 on Tuesday, is once again trading beneath the $100,000 mark.

As per usual with downturns, caution reigned in the crypto market, and even in the ever-exaggerating meme-coin segment, traders are taking it slow.

Fartcoin, which recently emerged from obscurity with some hilarious puns, was on the path to becoming one of the greatest meme coins of this cycle when the rate cut announcement clouded its momentum.

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

However, this doesn’t seem to be more than a hiccup in this bull cycle, as signs of market strength are coming from all sides.

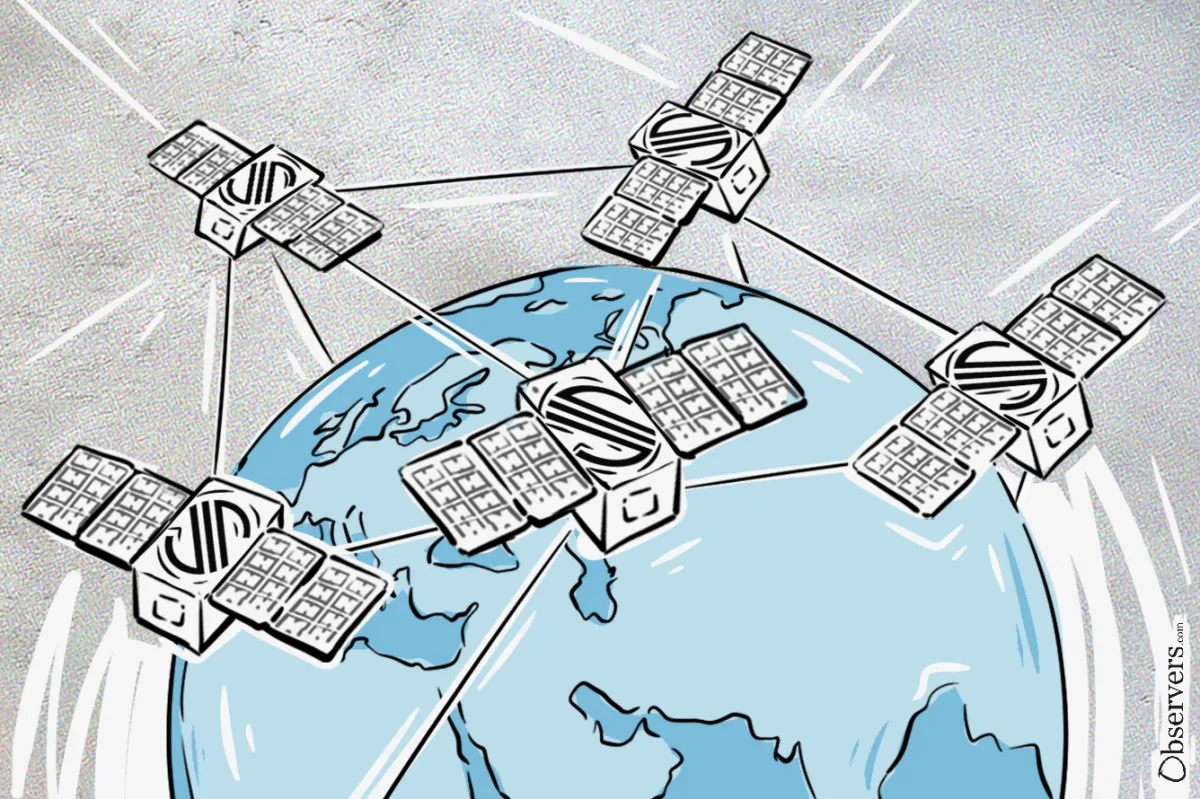

Looking to the skies above, we can now see the first satellite of a crypto protocol in orbit.

CTC-0 flew to outer space on SpaceX's Bandwagon-2 on Saturday, kickstarting the pilot phase of a DePIN project called Spacecoin, which aims to build a 5G internet network that covers the whole surface of the Earth.

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

From a more ground perspective World Liberty Financial, the crypto project closely associated with U.S. President Elect Donald Trump, has continued to make million dollar purchases of crypto tokens - this week, it included Ethena's ENA.

Ethena launched a new dollar-pegged token 90% backed by BlackRock's BUIDL fund, becoming the first major stablecoin to use a regulated money market fund as primary collateral.

While the partnership stirs away from the initial vision for the protocol - a stable currency not reliant on the Western banking system - it does make it a safer investment.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

🔥 Highlights Of The Week

- Deutsche Bank launches its own L2 network using ZKsync;

- Hailey Welch pledges to cooperate with legal reps after HAWK token rug-pull;

- FASB issues new crypto accounting rules for U.S. companies.

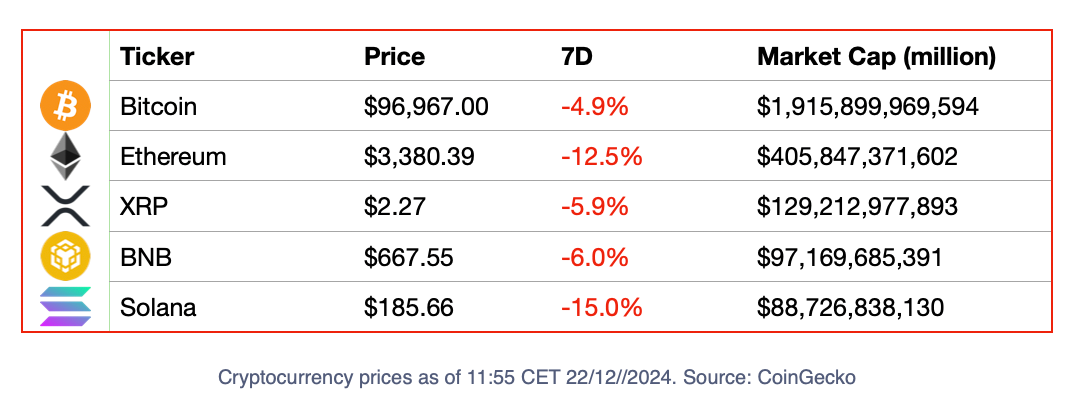

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- Quality over quantity is TON’s way of doing things. The blockchain has attracted loads of attention from newbies this year thanks to several tap-to-earn Telegram games. While most of the users who were drawn in to titles such as Hamster Kombat and Notcoin have since deserted them, that is apparently how developers expect it to be.

😈 Crypto Naught And Sloppy

- Polygon has seen better days: this week, Lido officially exited the platform, while Aave also threatened to say goodbye. The former lending protocol has cited several challenges, such as user adoption and insufficient rewards, while the latter showed concerns about attacks on bridging smart contracts.

Project Of The Week: Stellar

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

Developers’ interest in the Stellar ecosystem has grown considerably since the platform introduced smart contracts with the Soroban Smart Contracts upgrade earlier this year.

The price of the protocol native token, $XLM, has grown over 100% over the last 30 days, and this is not only due to the bullish market sentiment: the rise in daily smart contract calls in November—from 700 to over 10,000—shows a rise in network activity.

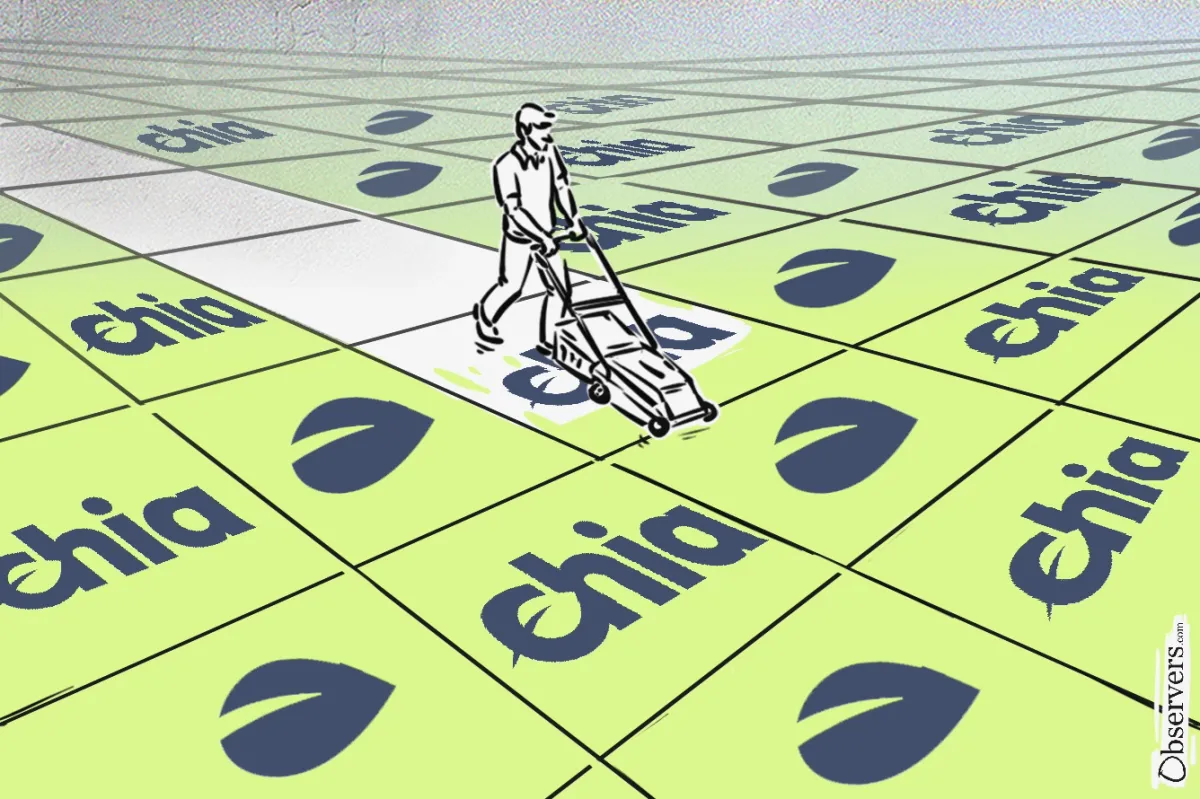

📚Deep Dive: Chia

Layer 1 blockchain Chia has updated its unique Proof of Space and Time (PoST) consensus mechanism with the aim of lowering the technical barriers for farmers and increasing the network’s decentralization.

Deep dive into the concept of PoST and its possibilities here:

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

🔫 Quote Of The Week

Observing moneytech and Web3Mathilde Adam

Observing moneytech and Web3Mathilde Adam

"We cannot be leaving this stuff up to whatever leadership at the SEC happens to think at any given time. We need Congress to step in and decide how are these markets regulated and importantly, by whom."

Chief Legal Officer at Variant Jake Chervinsky believes that Paul Atkins, the next chair of the U.S. SEC is going to tone down the agency’s regulating by enforcement strategy and limit its action scope to make sure companies adhere to existing laws.

Still, he notes that friendly regulators aren’t enough to bring the legal clarity the crypto industry needs and actual laws must be created.