Happy Sunday, Observers!

The pervasiveness of rug pulls might be coming to an end following this week’s events surrounding the $LIBRA token launch, which led to the uncovering of a series of market manipulation schemes at the heart of Solana’s ecosystem.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

As a consequence, SOL was down all week, and the number of meme coins graduating from Pump Dot Fun to Radyum fell sharply, signaling that the market might be ready to end a trend that has become increasingly toxic in recent times.

Argentina’s pro-crypto president Javier Milei, who had promoted the LIBRA token on his socials before the price began to fall sharply, was put in an uncomfortable position that forced him to publicly explain his involvement in the project.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

Milei's “don’t cry in the casino” stance regarding what is now being called the “largest rug pull in history” is similar to that of other media personalities, such as famous pizza reviewer Dave Portnoy, who have also launched meme coins this week whose price crashed as fast as it rose.

As the degen community becomes increasingly suspicious, even projects with serious intentions, such as Hyperliquid, have had disappointing token launches.

🔥 Highlights Of The Week

- ECB explores a blockchain-based payment system;

- SBF claims FTX collapse was a liquidity crisis, not insolvency;

- EigenLayer, UMA, and Polymarket partner to build a next-gen oracle system.

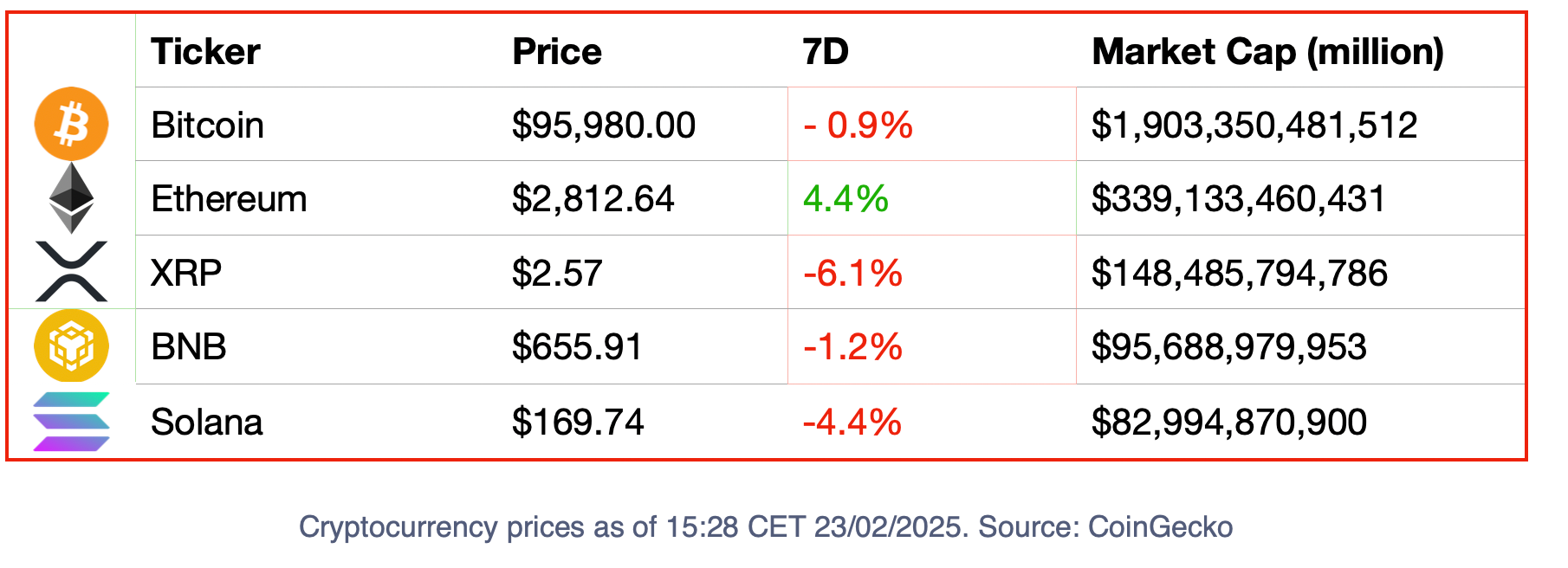

📈 Crypto Markets

😈 Crypto Naught And Sloppy

Cyber hacks in crypto happen every day, but some are much bigger and more impactful than others, such as this week’s Bybit hack, which saw one of the crypto exchange’s Ethereum cold wallets drained of $1.4 billion.

According to the exchange’s CEO, Ben Zhou, the hackers employed a phishing technique to deceive the experienced team.

Bybit is currently the world’s second crypto exchange after Binance. Zhou guaranteed Bybit’s millions of active daily users that the attack was isolated and that no other wallets had been affected.

North Korea's Lazarus group is believed to be behind the attack.

Experts in Digital Assets and Web3Observers

Experts in Digital Assets and Web3Observers

SEC’s Shifting Position On Crypto

The United States Securities and Exchange Commission has decided to abandon its ongoing case against Coinbase despite hearings during 2024 mostly supporting the agency’s case.

The lawsuit accused the country’s largest crypto exchange of acting as an unregistered broker.

A similar lawsuit against OpenSea has also been closed.

Experts in Digital Assets and Web3Observers

Experts in Digital Assets and Web3Observers

The agency also announced this week that it will replace the unit currently fighting fraudulent offerings, which targets the bigger fish, with a smaller one that focuses on “cyber-related misconduct,” which will target smaller everyday mischief.

Elon Musk-led Department of Government Efficiency has asked for help from the public in “finding and fixing waste, fraud and abuse” from the agency.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

Is Everything Well With the Bitcoin Network?

Bitcoin price is at an all-time high, and miners are getting higher returns despite the recent halving. But is this setup sustainable?

Satoshi Nakamoto designed a perfect incentive machine, but he envisaged a peer-to-peer payment system, not a ledger for speculative trading assets. Transaction fees should replace mining incentives for miners in the long term, but with the current low activity levels, Number One Blockchain is doomed.

Is this something Bitcoin miners and investors should worry about?

Experts in Digital Assets and Web3Alexander Mardar

Experts in Digital Assets and Web3Alexander Mardar

The Never-Ending Fuss: Nigerian vs Binance

The government of Nigeria has sued Binance for $81 billion due to economic losses related to the company exchange’s operations.

Earlier in the week, Tigran Gambaryan, the Binance executive who spent months imprisoned in the country, accused the government of orchestrating his detention and alleged that lawmakers had demanded a $150 million bribe from him.

Experts in Digital Assets and Web3Rebecca Denton

Experts in Digital Assets and Web3Rebecca Denton

🍭 Crypto Highs And Fun Times

- Chinese tech giant Tencent has invested in Wintermute, crypto’s most notorious autonomous market maker. The company plans to open offices in New York and introduce over-the-counter trading products tailored for U.S. clients.