Happy Sunday, Observers!

Good things come to those who wait, and we waited.

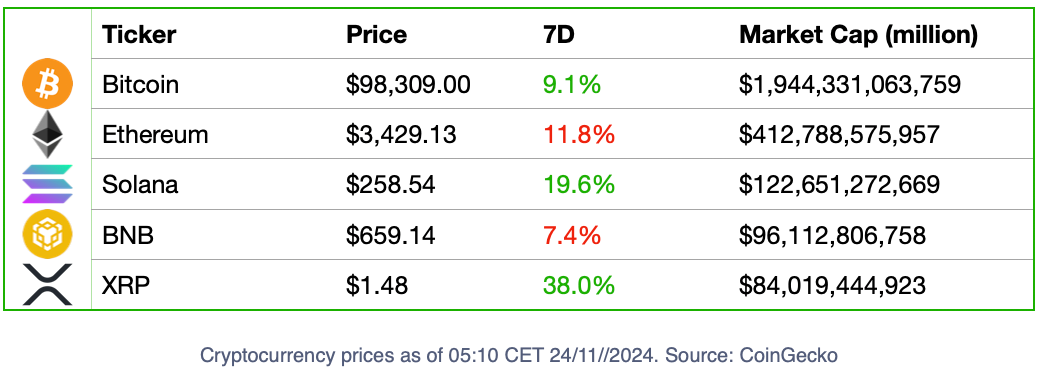

Bitcoin was $500 short from $100,000 after the news that the world’s leading anti-crypto crusader, SEC’s chair Gary Gensler, is leaving its post.

Now that we are throwing precautions out the window, wild things are happening.

The biggest winners are the ones who were losing during Gensler’s mandate: Ripple, which spent the last years fighting the SEC’s legal accusations, is now enjoying the promise of a bright future, with its token XRP hitting three-year highs.

Observing moneytech and Web3Mathilde Adam

Observing moneytech and Web3Mathilde Adam

Tokens barely known to the public can increase in price by 600% if veterans in the space decide to invest in them, and failures, such as the SUI network’s upgrade code, are judged based on what they have achieved so far rather than what they did wrong.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

Despite this blissful portfolio time, several issues remind us that crypto’s fight for legal clarity is far from done.

This week, a California federal court ruled that Lido DAO members were liable as participants in a class-action lawsuit. The notion that members of decentralised networks have the same rights and obligations as anybody else is a blow to the industry, but nonetheless important to understand how to move forward.

Traditional finance is away from all of this: their bets are on what is profitable.

Black Rock’s BUIDL, which gives institutional investors exposure to blockchain-based products, is expanding to five new chains: Aptos, Arbitrum, Avalanche, Optimism and Polygon.

Observing moneytech and Web3Observers

Observing moneytech and Web3Observers

Investors unsatisfied with traditional finance are also finding their way in crypto, but rather than institutional funds and ETFs, they are pouring their money into meme coins

The appeal of these news tokens is stealing retail attention from legacy tokens unless they refuse to go away.

Litecoin, one of the oldest cryptos around, has rebranded itself as a memecoin: “Due to market conditions, I now identify as a memecoin.”

Observing moneytech and Web3Observers

Observing moneytech and Web3Observers

It looks like easy money for investors and scammers alike. As the insanity of high prices takes hold of the market, please be wise.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

🔥 Highlights Of The Week

- Gary Gensler is leaving the Securities and Exchange Commission;

- Trump nominates pro-crypto hedge fund manager Scott Bessent for Treasury Secretary;

- BlackRock’s iShares Bitcoin ETF options launch on Nasdaq.

📈 Crypto Markets

🍭 Crypto Highs And Fun Times

- Immutable has grown 71% during the last year. The blockchain gaming company has secured 181 new game partnerships in 2024 thanks to technological innovations and strategic partnerships.

- Ethiopia's crypto mining sector is booming. Besides high crypto prices, the local mining industry is blossoming thanks to good geopolitical connections with China and cheap energy prices.

😈 Crypto Naught And Sloppy

- Word Network (before Worldcoin) continues its quest to create a “digital passport” for everybody on the planet, despite most of the governments of the countries where it sets its Orbs questioning its data collection processes. After failing to conquer Europe, World Network is now focused on Latin America, but doors keep shutting on Sam Altman’s pet project.

Project Of The Week: Peaq

Observing moneytech and Web3Mathilde Adam

Observing moneytech and Web3Mathilde Adam

Berlin-based blockchain platform Peaq is aiming to be a market leader in the DePIN industry. This Monday, they launched their token $PEAQ across 12 exchanges.

The platform leverages decentralised networks to facilitate autonomous economic activities between machines, such as machine-to-machine transactions, resource management, and DePINs, with minimal human intervention.

Peaq network currently connects 1.75 million devices in 50 projects across several industries and is able to manage 10,000 transactions per second.

How To Grow A Stablecoin: The Enemy of Your Enemy Is Your Friend

If there is something we can all learn by watching Mean Girls (or by reading the Art of War?), it is that the enemy of your enemy is your friend.

Tether is falling behind in Europe because it does not have a license to operate under MiCA, so it has decided to invest in ventures that would challenge its position but which are, under these conditions, allies.

Observing moneytech and Web3Observers

Observing moneytech and Web3Observers

📚 Deep Dive: MANTRA

MANTRA blockchain has emerged as the top performer among layer-1 blockchains over the past week. The network is working towards bridging the gap between traditional finance and decentralized finance by focusing on RWA. Take a deep dive at what is driving investors to Mantra here:

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar