It is with great relief that we report that the crypto community has had so much on its plate these past days that for the first week in a very long time, the politics of the United States were not the main topic of discussion in the space.

It was a riveting week full of development announcements, breakthroughs in the interception between AI and crypto, insider feuds, and key discussions on the industry's most pressing topics: interoperability, the role of stablecoins, and the cultural significance of meme coins.

Michael Saylor’s disparaging remarks on self-custody shook his crypto cult to the core. Bitcoin Jesus’ despise for one of the founding principles of the space has hindered his popularity and got him tones of criticism, including from Ethereum’s co-founder Vitalik Buterin.

Most importantly, however, it opened a debate on who is and who should be calling the shots in Web3: VCs and TradiFi vs. users and developers.

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

This week, the AI bot Truth Terminal captured almost as much attention as Saylor and Buterin due to its social activity's connection to the surge in the price of meme coins $GOAT and $RUSSELL.

Traders, copycats, and investors are now trying to understand what role AI can play in the meme coins arena, which continues to be a magnet for activity, creation and community.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

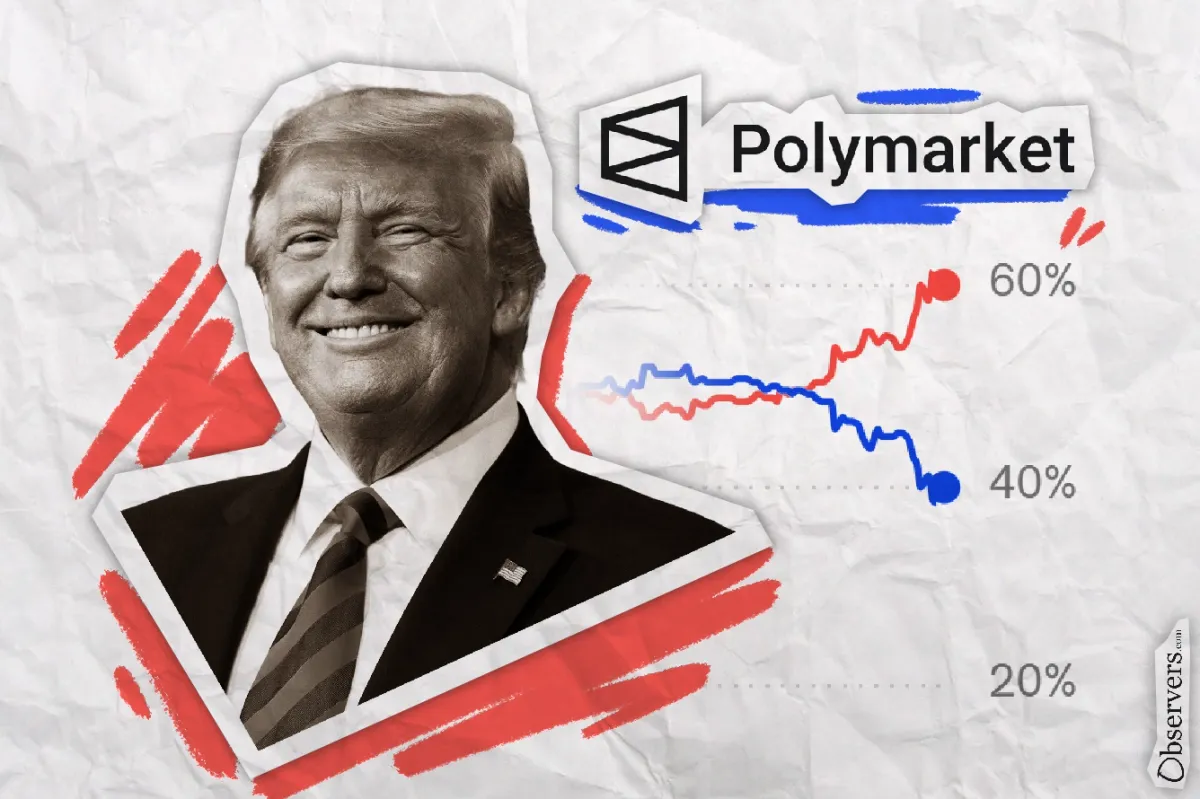

The upcoming presidential elections of the world’s leading economy were not entirely forgotten as they are the main driver of volume in the blockchain-based prediction market Polymarket.

Yet, rather than who’s beating the odds, the conversation is now about who is cheating the odds.

Polymarket has quickly changed from a tool for measuring the pulse of a situation to a tool used by those with enough capital to force the perception that their size is winning.

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich

🔥 Highlights Of The Week

- Forte's secret acquisitions of gaming studios revealed;

- Nigerian government drops charges against Binance executive;

- Microsoft shareholders to vote on Bitcoin investment proposal.

- Kraken launched its own blockchain

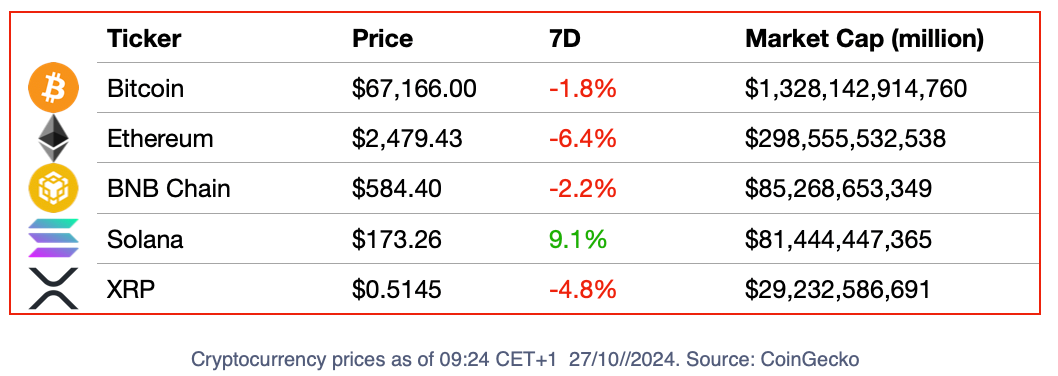

📈 Crypto Markets

Project Of The Week: dGEN1

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

It took a couple of days until people began to grasp what the ingenious dGEN1 was. Freedom Factory’s decision to call it an "everyday carry device" was dull and confusing but quite understandable: how would you name a whole new category of hardware?

It is not a phone, but it does many of the things a phone does. It is not a Start Trek communicator, but it looks like one and comes with a laser. It isn’t meant to be used by everybody (not just yet), but it has got everybody in crypto excited about it.

Yuga Labs: A Fantastic Comeback!

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

The launch of ApeChain this week might be a turning point for Yuga Labs, the creator studio of the BAYC and MAYC collections, which has been struggling for attention following the abysmal decline of NFT’s popularity.

The new chain, built on Arbitrium Orbit, was launched with a set of notable trading, launchpad, and gaming dApps that immediately excited the community.

In the days after its introduction, Apechain onboarded over 120,000 new users and processed approximately 500,000 transactions. The $APE tokens nearly doubled in value.

Deep Dive: Solutions For Blobs

Vitalik Buterin has expressed concerns over how the blob transaction types introduced at the Ethereum Dencun upgrade in January are already reaching their cheap processing targets.

What would the Ethereum community choose? Earn money or allow for more sidechains? Learn here.

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

🍰 Bankers, regulators, and politicians want in on it too

The integration of blockchain and tokenization with traditional finance took the main stage at Sibos 2024, the world's biggest financial conference, held this year in Beijing, China.

Observing moneytech and Web3Mathilde Adam

Observing moneytech and Web3Mathilde Adam

Bankers, regulators, and politicians are past heating up to the idea of decentralised technology in finance and are now seeking implementation.

At the BRICS Summit in Kazan, Russia, President Vladimir Putin proposed that the member countries of the intergovernmental organization use digital currencies in investment processes.

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich

On the other side of the Atlantic, one of the Fed's most vocal members on crypto issues, Governor Christopher Waller, showed his support for stablecoins in a speech where he discussed how USD-pegged stables could help consolidate the dollar's dominance in global transactions

Observing moneytech and Web3Sasha Markevich

Observing moneytech and Web3Sasha Markevich