Hello observers!

This was a week of firsts for the crypto community and the world.

Monday was the world’s hottest day on record, with the global average surface air temperature rising for the first time to 17.15 degrees Celsius.

On Friday, the opening ceremony of the 2024 Paris Olympic Games took place - the first time in a hundred years that the number one international sports competition is held in the French capital.

In our ever-expanding ecosystem, we saw a record number of U.S. politicians showing support for Bitcoin solutions and the first spot Ether ETFs being traded at the U.S. stock exchange.

🔥 Week Highlights:

- U.S. Spot Ether ETFs' first day of trading

- data availability project Avail launched on the mainnet

- Snowden, Trump, Kennedy, Michael Saylor speak at Bitcoin 2024 Conference in Nashville

Video of The Week

Crypto.com commemorated its 8th birthday by showcasing the Bitcoin logo onto the Las Vegas Sphere, U.S.

Naughty & Sloppy

- A Coinbase subsidiary in the United Kingdom, CB Payments Limited, was fined by the FCA for onboarding high-risk customers. The case marks the first penalty the Financial Conduct Authority imposed on a crypto-related company, and the inexperience was noted in figuring out the penalty’s value: it started at $480, went to $6.4 million after an 'adjustment for deterrence', and then was given a discount that finally settled it at $4.5 million.

- Cryptoexchange Gate.io announced its decision to leave the Japanese market for not meeting compliance standards. The company has publicly stated that it strives to be compliant with the legislation of all countries where it operates, which is an affirmation difficult to verify: Gate.io officially has licenses in eight countries, yet the traffic on its website comes from totally different locations.

- $7.5 million mysteriously disappeared from lending protocol Rho markets last Friday. The incident was a white hat hack, but not really. Once an on-chain sleuth discovered the hacker’s links to several CEX, the pseudo-bandit struck a deal: give back all money in return for the protocol to blame it on a misconfiguration. All ended well, sort of.

Real World Problems, Blockchain Solutions: Philanthropy

The future of philanthropy happens on-chain. Quadratic Funding (QF) and Retroactive Funding (RF) have emerged as efficient mechanisms to support public goods and community-driven initiatives in the crypto space, which broaden participation and democratize the allocation of resources.

Their deployment has led to the funding of hundreds of projects that would have been left out by traditional mechanisms. As the world moves on-chain, the impact of their deployment is bound to grow.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

How to grow a stablecoin? Aave Overcollateralizes, Tether builds relationships, nobody Airdrops

It has been a slow but steady growth for Aave’s decentralized and overcollaterized GHO stablecoin. After losing its peg to the dollar right after launch one year ago, GHO was re-engineered and, with a collateralization that is currently almost triple its circulating supply, has become a success story. Since May, GHO supply has almost doubled, now hovering around 100 million.

Tether is betting on building relationships. Last month, the stablecoin issuer announced a partnership with The Open Network to put the newly created USDT-TON pair “in every pocket”.

The joint effort seems to be making good progress on its promise of completing over 100 integrations with other Web3 protocols in the coming months. Major players like Binance, Gate.io, OKX, and Bybit have already recognized the trading pair, and Tether’s social media is being updated frequently with reports of new minor and major partnerships.

According to crypto textbooks, an airdrop has always been a good way to grow a stablecoin or any crypto project.

However, the marketing strategy has been leading to poor results lately, with airdropped results registering poor performances. Simon Kim, the CEO of Hashed, says:

“Even multi-billion dollar airdrop events are riddled with rudimentary problems that lead to dumping, and there are even hedge funds that specialize in airdrops, not just airdrop hunters.”

Project Highlight: Alkimiya

Observing moneytech and cryptoAlexander Mardar

Observing moneytech and cryptoAlexander Mardar

Alkimiya is a platform that lets users trade blockchain transaction fees. Its goal is to make blockchain interactions smoother by offering stable transaction fees for daily blockchain users. The Bitcoin-focused protocol is built on Ethereum and uses Wrapped Bitcoin to settle trades.

Banking and CBDC Arena

The U.S. will probably shift its focus from CBDC to stablecoins in case Donald Trump is elected. European central bankers are trying hard to comfort commercial bankers' concerns but this may damage the usability of the digital euro. This story and the weekly digest of CBDC news are covered in our Banking and CBDC newsletter.

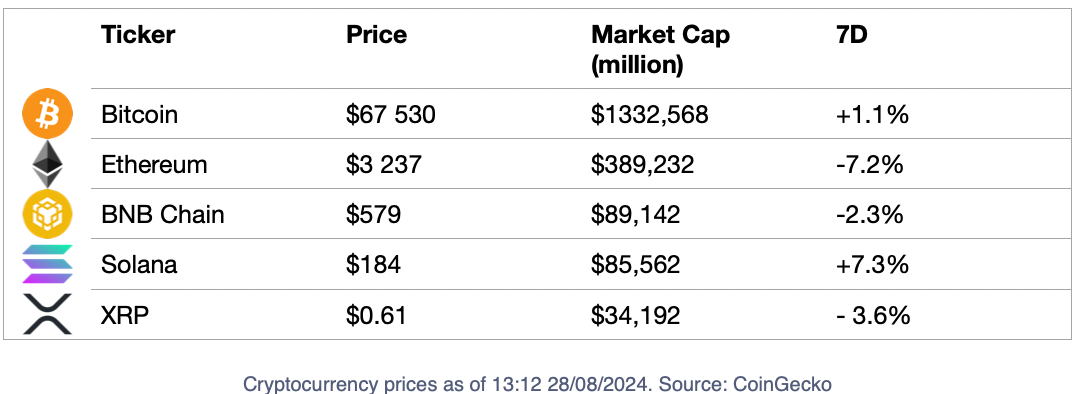

Crypto Markets