Happy Sunday Observers!

Hamster Kombat’s “largest crypto airdrop ever” turned out to be one of the worst airdrops in crypto history. Users were disappointed, as everything that could fail failed, and the rewards of months of tapping turned out much smaller than users anticipated.

Things started going south when around 2.3 million users were banned from the airdrop at the eleventh hour. Then, the rewards were smaller than expected. To top it all off, the excessive traffic led to performance issues on the TON network that delayed access of many users to their $HMSTR tokens.

One more crypto big promise that turned out to be a big disappointment. How many lives has the industry left to prove itself to outsiders?

🔥 Highlights Of The Week

- Binance founder CZ released from prison;

- VISA launches Ethereum platform for banks to test tokenized assets;

- SEC declares crypto mining devices as securities.

🍭 Crypto Highs And Fun Times

- Ethereum.org, one of the most visited websites of Web3, was updated to simplify the onboarding experience of new users from all corners of the world into the ecosystem. While there is still much work to do, the changes already show the adaptability of its community to the new priorities of the space.

- The digital asset arm of the French bank Société Generale is expanding its euro-backed stablecoin, the EUR CoinVertible (EURCV), to the Solana blockchain, in an effort to increase adoption and tap into decentralised finance markets. SG-FORGE recently restructured the stablecoin as an Electronic-Money Token to align with the EU MiCA regulation.

What Is Cooking? Magic Accounts

Observing moneytech and Web3Alexander Mardar

Observing moneytech and Web3Alexander Mardar

In a talk earlier this month, Vitalik Buterin explained his vision: “Using the greater Ethereum-verse should not feel like you’re jumping between 34 blockchains. It should feel like you’re using Ethereum.”

Two weeks later, Socket and ZeroDev have developed a solution: a smart wallet that lets users maintain a single balance across Ethereum and its various Layer 2 networks.

With a “Magic Accounts” users have only one single balance for each crypto that is instantly accessible for spending on any chain of the ecosystem.

😈 Crypto Naught And Sloppy

- Former CEO of Alameda Research and ex-girlfriend of Sam Bankman-Fried, Caroline Ellison, has been sentenced to two years in jail for her role in the collapse of the FTX crypto exchange. SBF, currently sharing a jail cell with P. Diddy, was sentenced to 25 years. His close allies, Nishad Singh and Gary Wang, are awaiting trial. FTX executive Ryan Salame pleaded guilty and struck a plea deal that he is now regretful of.

- A SEC investigation revealed that TrueCoin and TrustToken made false claims regarding TUSD's backing. They told investors the token was fully backed by U.S. dollars or liquid equivalents, but it wasn't. Instead, most of its reserves have been invested in a "speculative and risky offshore investment fund.”

Project Of The Week: Seeker, The Solana Phone

Observing moneytech and Web3Mathilde Adam

Observing moneytech and Web3Mathilde Adam

Set to launch in mid-2025, the Solana “Seeker” is the second iteration of the first Web3-powered phone “Saga,” which came out in 2023.

At $500 for pre-orders, Seeker's price tag is more than 50% cheaper than its previous version. “We've priced it very aggressively because we want it to be accessible for growth, not necessarily because we see this in any way of a step-down."

It will include the next version of the Seed Vault and an improved version of the Solana dApp store, among other specs.

🔫 Threat Of The Week 🔫

“THIS WAS YOUR FINAL EXCHANGE!

This is for you, ransomware affiliates, botnet operators and darknet vendors: For years, the operators of these criminal exchange services have led you to believe that their hosting cannot be found […]

From our point of view: nothing but empty promises! We have found their servers and seized them […] We have their data – and therefore, we have your data.

Our search for traces begins. See you soon.”

The text is from German authorities, who clearly don’t joke around. After closing down 47 cryptocurrency exchange services for allegedly violating anti-money laundering laws, they redirected their websites to finalexchange.de and very vividly warned users of those services that now, they are coming from them.

How To Grow A Stablecoin: A Convincing Story Backed By Even More Convincing Dollars

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

Circle, USDC's issuer, is going all in its efforts to become a public company.

During this year, the company has been deploying an international expansion strategy that emulates the geopolitical best interests of the United States, while inside the country, it has adopted the best and most patriotic decisions - including changing its legal base from the Republic of Ireland to the U.S. ( a move that will drastically increase the taxes it pays).

If the strategy works, this will be the first time a major stablecoin issuer has become public, and that is quite a phenomenon.

While all types of companies go public all the time, a stablecoin issues digital money, a unique asset that isn’t like any other commodity.

By going public, Circle will distribute seigniorage—the difference between the value of money and the cost to produce and distribute it—to the public.

Seignorage has always been a privilege of banks—the only "MoneyTechs" that existed until the advent of stablecoins.

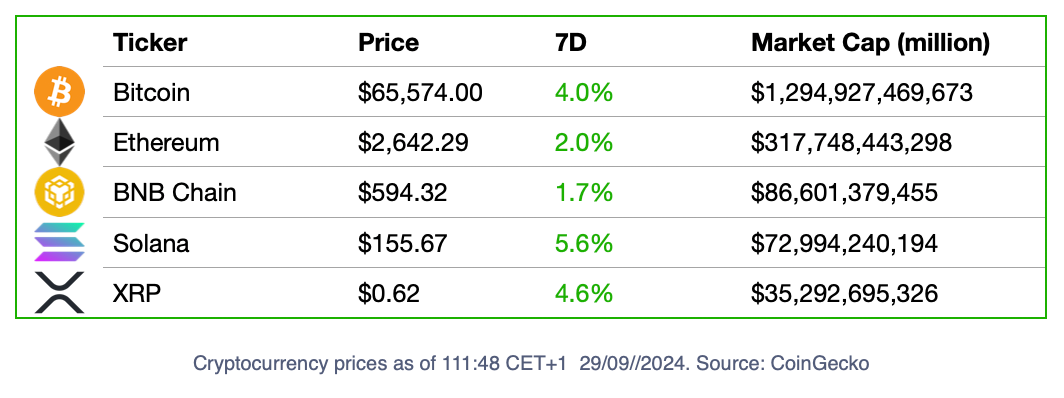

📈 Crypto Markets

The Durov Saga: Capitulation

Observing moneytech and Web3Eva Senzaj Pauram

Observing moneytech and Web3Eva Senzaj Pauram

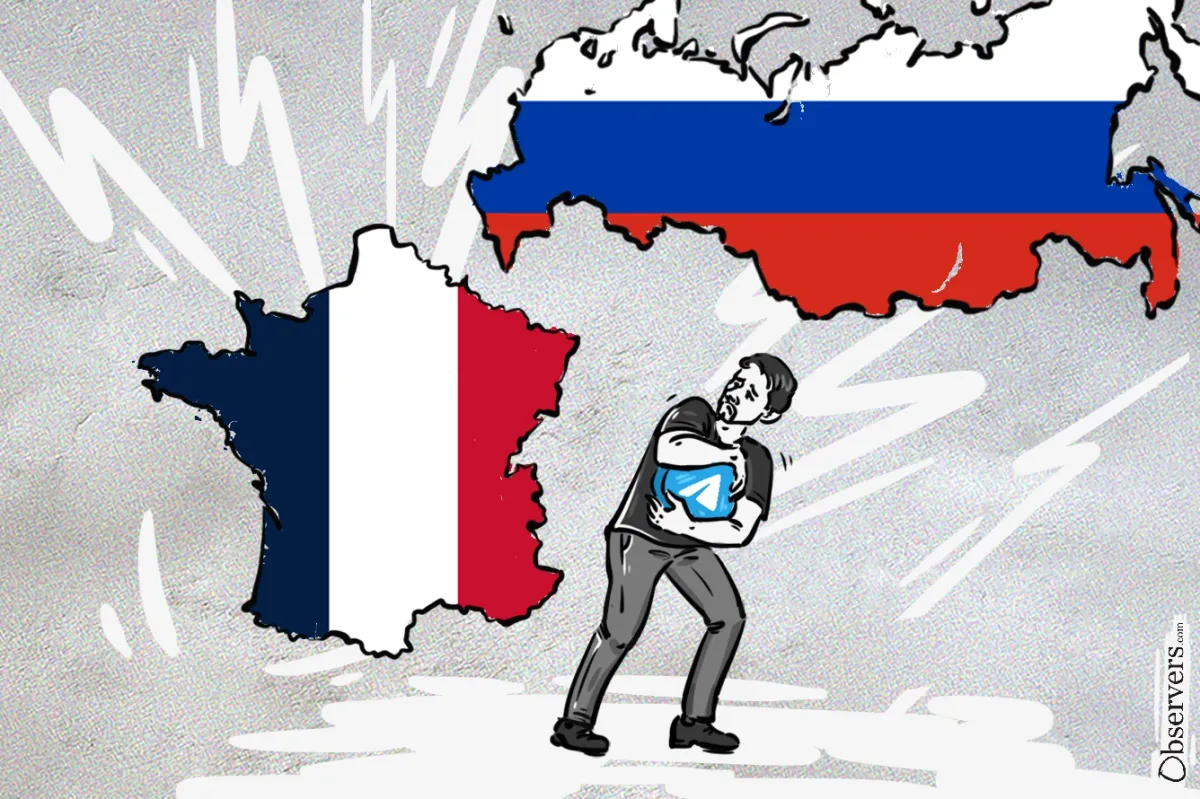

Earlier this week, CEO Pavel Durov announced changes to the privacy policy and terms of use of Telegram that make it easier for the messaging app to share users' information with governmental entities.

Durov’s popularity is partly due to his resistance to the Russian government in 2013. The Kremlin asked the CEO for access to the conversations of his then-app, VKontakte, and he refused.

At the time, the tech entrepreneur lost his company and his country in defense of users' privacy. Eleven years later, something seems to have changed.

In less than a month following his arrest, Durov bowed to Paris authorities demands, exchanging his users privacy for his personal freedom.