A meme coin super-cycle refers to the rapid rise and fall of event-driven tokens, which are typically created in response to major events such as celebrity deaths, political scandals, or viral internet moments.

These coins experience a sharp increase in value as they attract attention from emotionally driven or speculative investors, only to plummet in price once the initial buzz fades. This pattern was clear in the aftermath of the death of 1 Direction star Liam Payne when developers flooded the market with over 150 "tribute" tokens, many of which crashed shortly after launch.

Traditionally, meme coins have been shunned by old-school crypto investors, regularly dismissed as scams, grifts, and money grabs. Sure, meme coins frequently capitalize on public emotions while seemingly offering little long-term value or utility. And, of course, the sheer volume of coins should give enough reason to be cautious: Solana-based Pump.Fun currently has over two million listed. But despite these risks, meme coins are still insanely popular.

Let's dig into the why.

Meme Coins & Community

There is a growing movement reframing meme coins as more than just volatile pump-and-dump opportunism from dodgy developers. Some pundits now suggest that buying into a new coin in a flurry of excitement and camaraderie gives retail investors, bludgeoned by inflation, loneliness, real-world wars, and politics, a sense of community. They say that meme coins, like all subcultures, fill an emotional gap for people online and that, they argue, can hold real long-term value.

Traditionally, online subcultures interact through social media, such as Reddit, X, and other more niche online spaces. This new position creates a fascinating link between social media and finance. "Do you know what can compete with trad social media? The fusion of social and finance, merging two of the most addictive loops together," said one punter on X, just hours after Pump.Fun added videos to its site, invoking comparisons with TikTok. "Tokens and the ability to instantly build a community will be what competes against the algorithm."

Meme coins, then, are as much about the gamble as the community you're a part of. In typical degen fashion, these communities become an us-against-the-world team, still fighting the big bad wolf institutions.

I’ve come to realize that meme coins are more than just a trend—they’re all about building decentralized communities.

— Akshay Agrawal (@Akshay8212) October 12, 2024

It’s wild how, when I meet someone who holds the same meme coin, it’s like we already have something in common. It makes conversations way easier…..

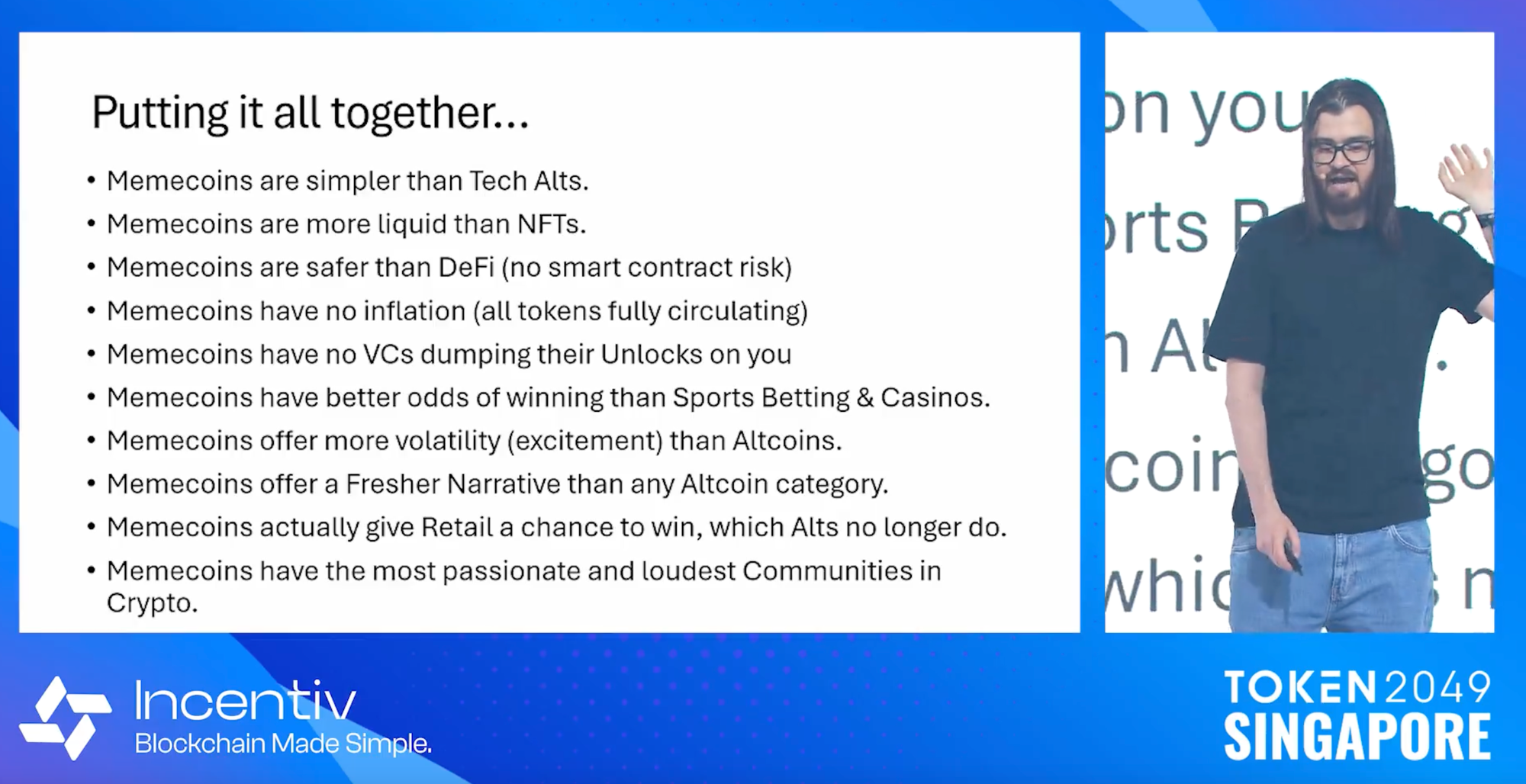

A viral talk by former Bitcoin Fund Manager Murad Mahmudov went much further. He argued that meme coins are popular also because VC-backed altcoin alternatives are awful. In his 20-minute talk, which is well worth your time, he argues that meme coins are due to go "parabolic" in 2025.

It's true that many VC-backed tokens go down not long after listing. They're often pushed hard via paid-for celebrity endorsements or reek of political motivation (WLFI, for one), and many non-transferable tokens become worthless once their products fold.

But like all coins and tokens, the key is spotting the ones with value, and Mahmudov says that is far easier with a meme coin where you can analyze its potential for a critical cult-like following. His position is that most retail investors don't simply want to gamble, they want to believe in or be part of something.

He also argues that meme coins still offer retail investors a chance to "win" where the bigger altcoins do not.

AI Bots: A Reason To Be Wary

One of the most interesting recent developments in the meme-coin space involves the rise of AI-driven bots that capitalize on these trends faster than human traders.

According to one report, an anonymous developer used AI bots to mint meme coins within seconds of high-profile events. Essentially, this developer became the first meme coin millionaire by automating their participation in the super cycle.

These AI bots scour news and social media for trending topics and create meme coins before most traders even become aware of the event. While this automation allows developers to profit from the hype, it raises concerns about the future of meme coins and its enthusiastic "human" community.

Where The Truth Lies

Mahmudov has skin in the game. With an alleged holding of $24 million in meme coins, he is personally invested in the sector's success.

“Some folks will happily delude themselves that they’re going to magically get rich for one reason or another,” Jameson Lopp, co-founder of crypto custodian Casa, told Cointelegraph last week. “Often, it’s because someone who has an actual plan to get rich needs them to believe a narrative.”

Still, the power of community cannot be ignored. Meme coins continue to be created, sector stalwarts like DOGE continue to rise, celebrities continue to launch coins and do endorsement deals, and communities continue to rally, push, and buy into their favorites.

At some point, legacy crypto holders might have to admit there is something in this beyond the grift and that the true spirit of decentralization might just lie somewhere among the memes.