Latest Articles

14 Articles

Explore Apple's contributions to technology and finance, including its impact on digital currencies and the future of financial services.

Explore Apple's contributions to technology and finance, including its impact on digital currencies and the future of financial services.

"Even if CBDC is not used, we still need it for interlinking", conclude Canadian researchers. Meanwhile, the digital euro overcomes a key technical hurdle, as Israel and Taiwan say they won't launch CBDC until someone else does first.

Despite speculation, JasmyCoin did not form a partnership with Apple. The confusion arose after Apple announced its plan to integrate Japan’s ID system into its iPhones, leading investors to mistakenly believe that JasmyCoin was involved in this collaboration.

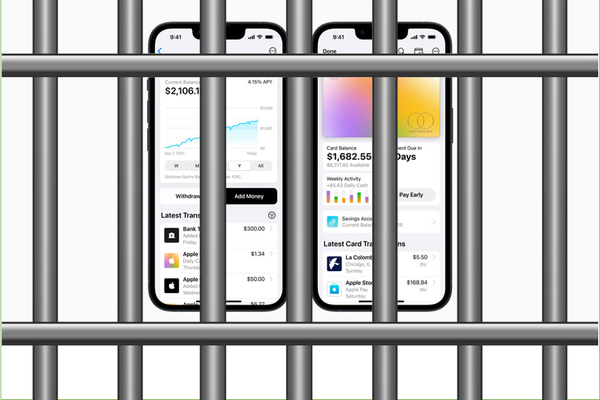

Apple opens NFC and SE. An association of German banks questions the value of the digital euro, while the only financial institution offering a wallet for Jamaica's CBDC claims it adds friction to the user experience.

Observers

Apple opens NFC and SE. An association of German banks questions the value of the digital euro, while the only financial institution offering a wallet for Jamaica's CBDC claims it adds friction to the user experience.

Observers

"Even if CBDC is not used, we still need it for interlinking", conclude Canadian researchers. Meanwhile, the digital euro overcomes a key technical hurdle, as Israel and Taiwan say they won't launch CBDC until someone else does first.

Observers

Despite speculation, JasmyCoin did not form a partnership with Apple. The confusion arose after Apple announced its plan to integrate Japan’s ID system into its iPhones, leading investors to mistakenly believe that JasmyCoin was involved in this collaboration.

Alexander Mardar

The rise of Apple Pay and embedded finance in popular consumer products had long been a looming threat to legacy banks. Now, central banks were feeling the squeeze

Observers

The tech giant faces a class-action lawsuit filed by Venmo and Cash App users, questioning its control over iOS peer-to-peer payment services and the resulting impact on fees and market competition.

Mathilde Adam

Apple Card’s high-yield savings account has seen over $10 billion in customer deposits since its launch in April, but banking partner Goldman Sachs allegedly wants to walk away from the arrangement, as it reduces the consumer-facing side of its business.

Jack Martin

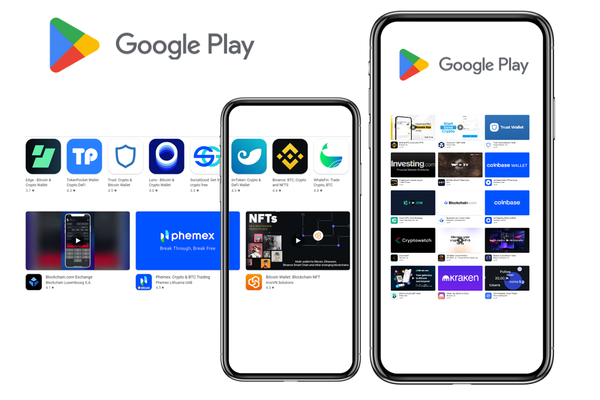

Google will start trialling a new mobile marketplace policy update this summer to give users increased transparency and protection when transacting with blockchain-based content.

Eva Senzaj Pauram

Apple’s Goldman Sachs-run savings account attracted 240,000 new customers in its first week of launch, but many have complained of problems withdrawing their money. Experts have suggested that this may be down to the over-zealous application of anti-money laundering measures.

Jack Martin