Latest Articles

16 Articles

Learn about BlackRock's strategies regarding cryptocurrency investments and their implications for institutional investors.

Learn about BlackRock's strategies regarding cryptocurrency investments and their implications for institutional investors.

The regulator has significantly increased its enforcement actions in the crypto sector under Gary Gensler's leadership, with many crackdowns on major crypto entities and influencers.

As the SEC moves closer to approving spot bitcoin ETFs, Blackrock joins the queue for an Ethereum-based product.

The SEC, asset firms and the big U.S. banks have spent the week putting the final touches to the long-awaited approval of spot bitcoin ETFs.

Eva Senzaj Pauram

The SEC, asset firms and the big U.S. banks have spent the week putting the final touches to the long-awaited approval of spot bitcoin ETFs.

Eva Senzaj Pauram

The regulator has significantly increased its enforcement actions in the crypto sector under Gary Gensler's leadership, with many crackdowns on major crypto entities and influencers.

Mathilde Adam

As the SEC moves closer to approving spot bitcoin ETFs, Blackrock joins the queue for an Ethereum-based product.

Eva Senzaj Pauram

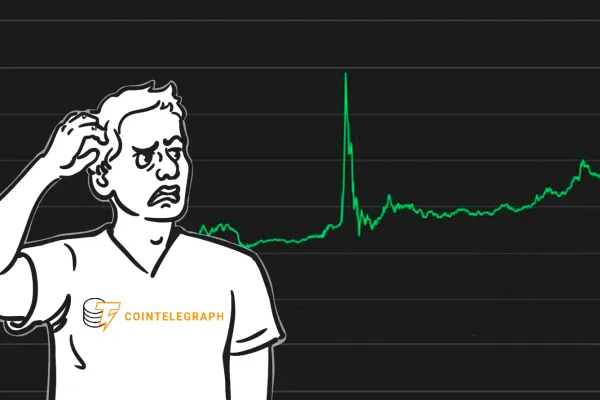

After Cointelegraph posted on X to say that the BlackRock spot bitcoin ETF had been approved by the SEC, BTC price jumped by 7% before falling back to its original level. BlackRock’s CEO said this demonstrated the “pent-up interest in crypto.”

Jack Martin

Optimism must be in the air, as investment firms WisdomTree and Invesco have both filed spot bitcoin ETF applications with the SEC, within a week of that by BlackRock.

Jack Martin

The investment giant submitted the paperwork late last week through its iShares unit, with custody to be provided by Coinbase and price data coming from CF Benchmarks.

Jack MartinAt the end of May, when everyone was watching the U.S. debt ceiling drama, Blackrock, the manager of Circle stablecoin reserves, precautiously moved the holdings from T-bills to commercial banks. Now that the storm alert has passed, T-bills have started to appear on the balance sheets again.

Alex Harutunian

BlackRock, the world's largest asset manager based in the US, launched an exchange traded fund iShares Blockchain Technology UCITS for EU customers. BlackRock was founded in 1988 and has grown to $82 billion market capitalization. The company was widely criticized for its close relations with the Fed during

Observers