Latest Articles

119 Articles

Understand the significance of central bank digital currencies (CBDCs) and their impact on the global financial system. Explore various national initiatives.

Understand the significance of central bank digital currencies (CBDCs) and their impact on the global financial system. Explore various national initiatives.

The Governor of the Bank of England told an audience that an inability to specify a precise detailed use case today was no reason to put off investigating the future potential of ‘enhanced digital money’.

The Bank for International Settlements’ Annual Economic Report 2023 dedicates a significant portion to a ‘Blueprint for the future monetary system’, covering tokenization, CBDCs, smart contracts, and a proposed unified ledger.

China is doubling down on its efforts to increase the use of the digital yuan. The Bank of China has started testing offline no-battery mobile payments.

Eva Senzaj Pauram

China is doubling down on its efforts to increase the use of the digital yuan. The Bank of China has started testing offline no-battery mobile payments.

Eva Senzaj Pauram

The Governor of the Bank of England told an audience that an inability to specify a precise detailed use case today was no reason to put off investigating the future potential of ‘enhanced digital money’.

Jack Martin

The Bank for International Settlements’ Annual Economic Report 2023 dedicates a significant portion to a ‘Blueprint for the future monetary system’, covering tokenization, CBDCs, smart contracts, and a proposed unified ledger.

Jack Martin

The recent fine-tuning amendments to Russia's digital ruble legislation indicate an ever-closer launch of the country's Central Bank Digital Currency (CBDC)

Alex Harutunian

Project Rosalind provides a communication layer between both account-based and token-based ledgers maintained by a central bank and user front-ends developed by ecosystem service and payment interface providers.

Jack Martin

The Bank of Thailand is running a pilot for its retail CBDC with the staff of three payment service providers and merchants situated around their head offices.

Jack Martin

The third round of the e-krona project's practical tests, which were completed in April, focused on the practical implementation of the Riksbank's potential CBDC.

Alex Harutunian

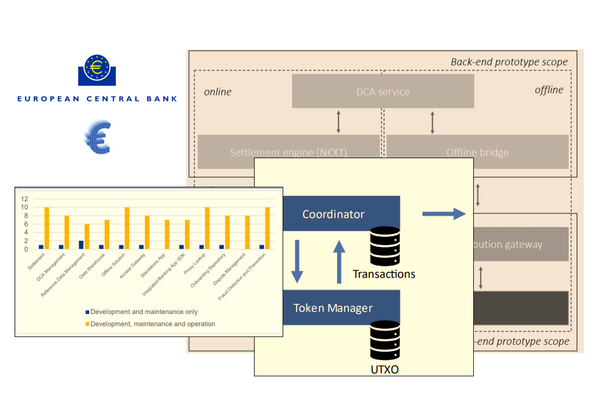

The European Central Bank has published reports on its recent market research and prototyping activities, during which it was both told, and shown, that launching a digital euro CBDC to its currently proposed specification is inherently possible.

Jack Martin