Latest Articles

119 Articles

Understand the significance of central bank digital currencies (CBDCs) and their impact on the global financial system. Explore various national initiatives.

Understand the significance of central bank digital currencies (CBDCs) and their impact on the global financial system. Explore various national initiatives.

China’s Central Bank is taking every possible opportunity to expand the use of the Digital Yuan, both at home and abroad.

Brazil’s Central Bank has announced the official name of its Real Digital platform. DREX will allow the deployment of smart contracts to make financial services more accessible.

The payment processor has brought together a group of leading blockchain technology and payment service providers, including Ripple, Consensys and Fireblocks, to drive innovation and efficiencies in the CBDC space.

Jack Martin

The payment processor has brought together a group of leading blockchain technology and payment service providers, including Ripple, Consensys and Fireblocks, to drive innovation and efficiencies in the CBDC space.

Jack Martin

China’s Central Bank is taking every possible opportunity to expand the use of the Digital Yuan, both at home and abroad.

Eva Senzaj Pauram

Brazil’s Central Bank has announced the official name of its Real Digital platform. DREX will allow the deployment of smart contracts to make financial services more accessible.

Eva Senzaj Pauram

Soramitsu plans to connect its Cambodia-based RTGS system, Bakong, to its cross-chain stablecoin exchange, creating a pan-Asian transfer and payment network.

Alex Harutunian

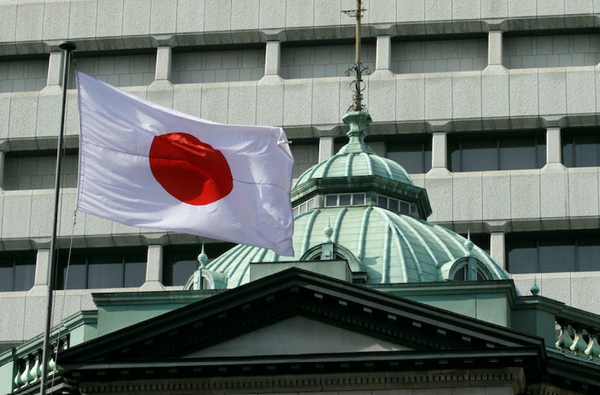

The Japanese central bank has established a working group of 60 companies to gain input into its decision on launching a CBDC from a business perspective.

Jack Martin

Brazilians are concerned after functionality that gives control over CBDC wallets to the government was discovered.

Eva Senzaj Pauram

Transactions using the digital yuan have amounted to $250 billion since the start of the CBDC’s pilot phase. China’s Central Bank Governor looked to the next step to increased adoption - cross-border payments

Eva Senzaj Pauram

This week the U.S. Federal Reserve finally launched its long-awaited instant payments solution. Meanwhile, the South Korean central bank published a report outlining an important upgrade to the country’s longstanding instant payments solution.

Jack Martin